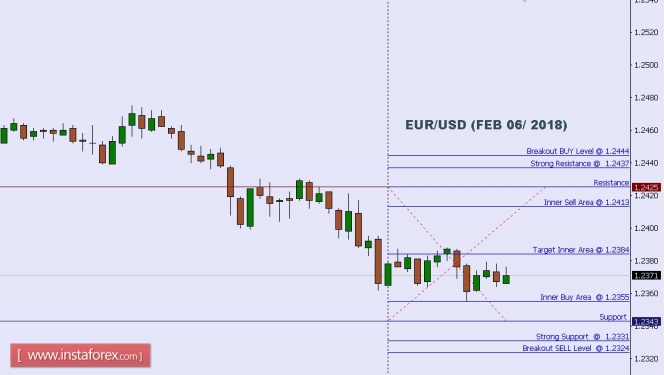

Technical analysis of EUR/USD for Feb 06, 2018

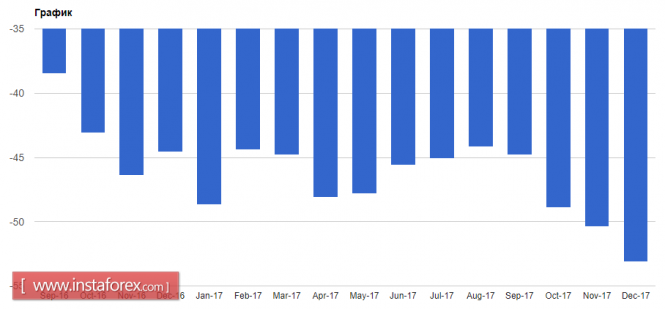

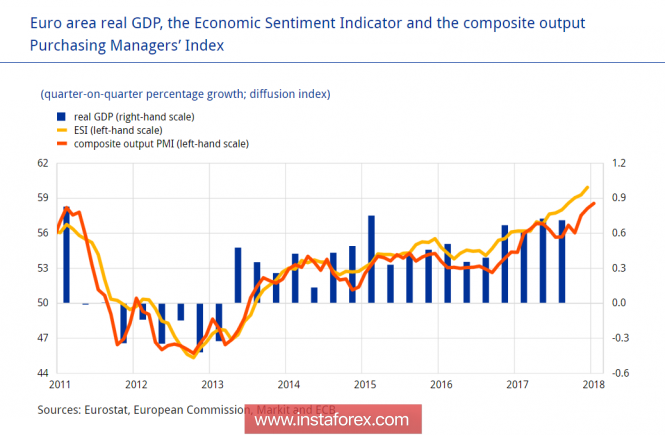

When the European market opens, some Economic Data will be released such as Retail PMI, French Gov Budget Balance, and German Factory Orders m/m. The US will release the Economic Data too, such as IBD/TIPP Economic Optimism, JOLTS Job Openings, and Trade Balance, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2444.

Strong Resistance:1.2437.

Original Resistance: 1.2425.

Inner Sell Area: 1.2413.

Target Inner Area: 1.2384.

Inner Buy Area: 1.2355.

Original Support: 1.2343.

Strong Support: 1.2331.

Breakout SELL Level: 1.2324.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks