EUR/JPY remain bearish for a further drop

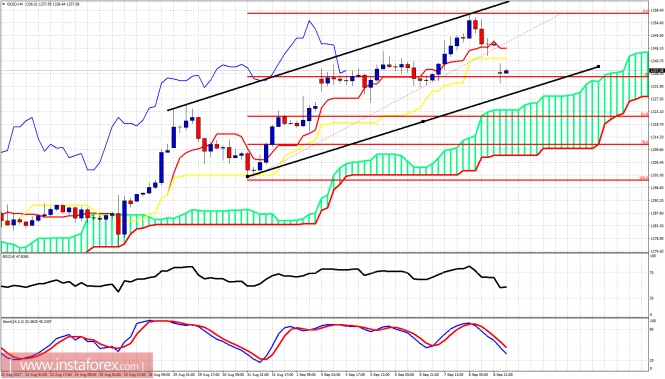

The price continues to rise and we're now seeing major resistance at 129.40 (Fibonacci retracement, horizontal pullback resistance, Fibonacci extension) where we expect a strong reaction from to fuel the drop to at least 127.56 support (Fibonacci extension, horizontal swing low support).

Stochastic (34,5,3) is once against testing our 93% resistance level where we expect a drop from.

Sell below 129.40. Stop loss is at 129.86. Take profit is at 127.56.

Analysis are provided byInstaForex.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks