Forecast for EUR/USD on March 26, 2020

EUR/USD

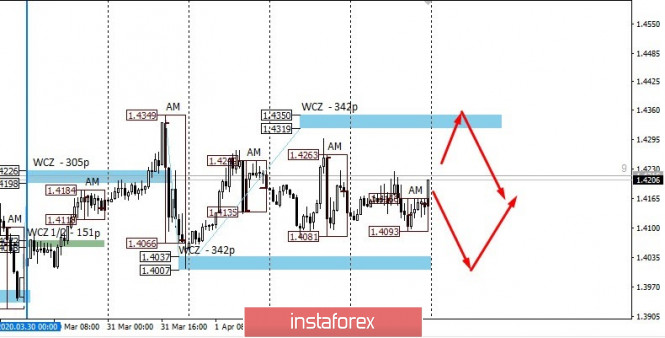

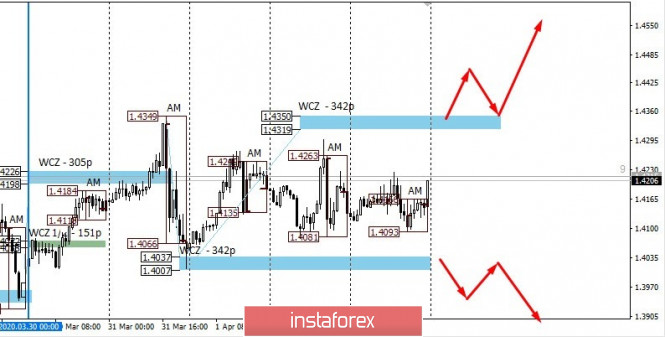

The euro added more than 90 points yesterday and reached the first target level of 1.0879. Today, the euro added another 50 points in the Asian session, clearly slowing down on the resistance of the balance line (red indicator ) of the daily price scale. The next growth target is the point of coincidence of the Fibonacci level of 38.2% with the enclosed line of the price channel in the region of 1.0967. At about the same moment, the signal line of the Marlin oscillator can touch the zero line - the boundary with the growth territory, and turn down.

The price touched the MACD line on the four-hour chart, according to Marlin there is no reversal formation, as a result, the price can make a false exit above the MACD line with working out the target on the daily timeframe, after which we wait for the price to turn down with the target at 1.0636.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

5Likes

5Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks