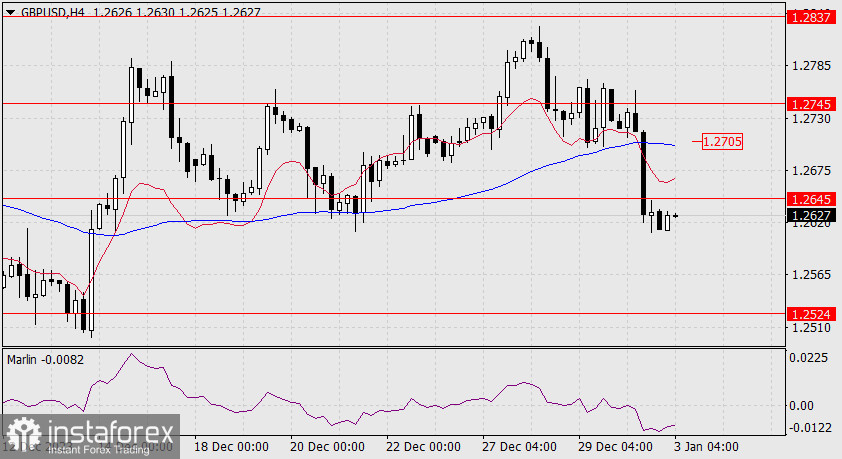

Forex Analysis & Reviews: Forecast for GBP/USD on January 3, 2024

GBP/USD

Amid investors' flight from risk on Tuesday, the British pound lost 111 pips and breached the support of the balance indicator line on the daily chart. This morning, the price quickly returned above the line, but the bulls' main goal for now is to close the day above the nearest resistance at 1.2645, otherwise, we may see a consolidation below this mark, and the bears could gain the upper hand, pushing the quote to 1.2524.

The Marlin oscillator has settled in a downtrend, so sellers have a good chance. If the price consolidates above 1.2645, the price could rise towards 1.2745, and a breakthrough of 1.2745 will provide an optimistic outlook towards 1.2930 - the upper band of a long-term price channel.

On the 4-hour chart, the price has settled below the balance and MACD indicator lines, as well as the level of 1.2645. The Marlin oscillator has also settled in negative territory. Considering the uptrend, we can consider the pound's decline as a short-term effect. The first signal for an upward move will be the price consolidating above the level of 1.2645, further confirmed by the price breaking above the MACD line and the 1.2705 mark. However, if the price fails to exhibit growth, it will fall, with 1.2524 as the target. We await further developments.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks