Technical analysis: Intraday Level For EUR/USD, April 02, 2018

When the European market opens, the US will release the Economic Data such as ISM Manufacturing Prices, Construction Spending m/m, ISM Manufacturing PMI, and Final Manufacturing PMI, so amid the reports, EUR/USD will move in a low to medium volatility during this day.

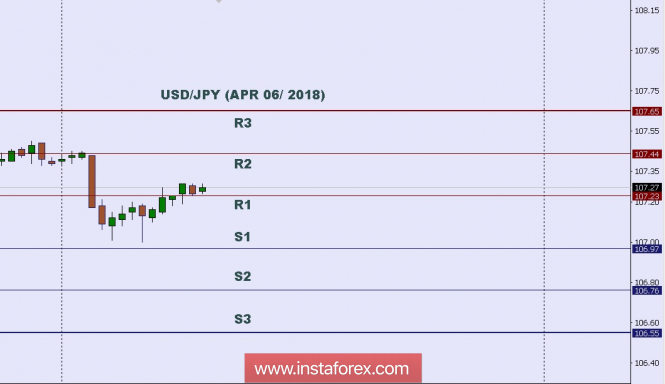

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2372.

Strong Resistance:1.2365.

Original Resistance: 1.2353.

Inner Sell Area: 1.2341.

Target Inner Area: 1.2312.

Inner Buy Area: 1.2283.

Original Support: 1.2271.

Strong Support: 1.2259.

Breakout SELL Level: 1.2252.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks