Gold tests advisor

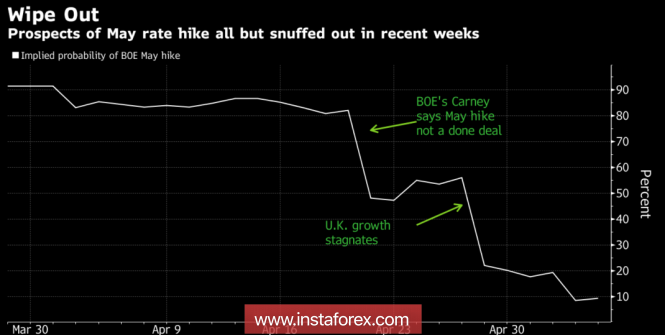

The dollar rose from its knees and the yield of 10-year US Treasuries broke through a psychologically important mark of 3%, which made gold a whipping boy. The precious metal fell to the level of 4-month lows, and the market is discussing the prophetic forecast of Larry Kudlow. When assuming the post of chief economic advisor to the president, he recommended buying the US dollar and selling gold. By that time, and the case was in mid-March, the USD index lost about 8.6%, while the XAU/USD, by contrast, added 8.8%, so Kudlow's advice at best was puzzling. In fact, everything turned out differently. The Economic Adviser proved his professionalism. A great start, Larry!

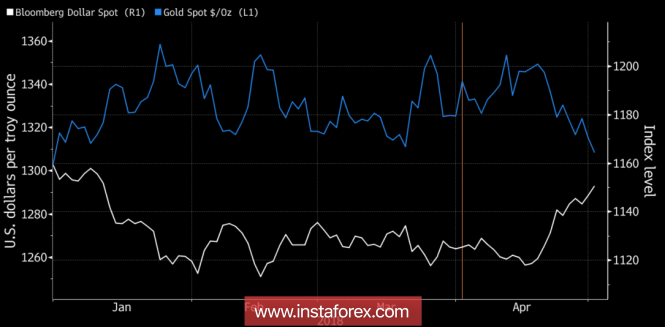

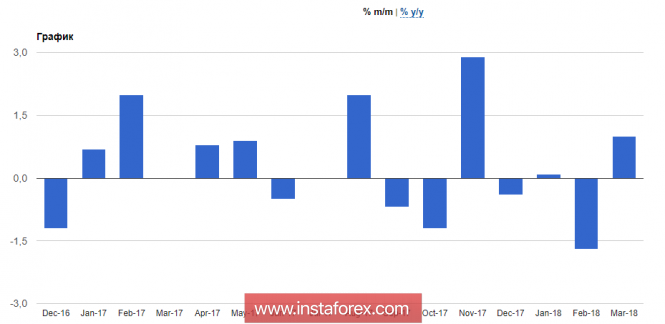

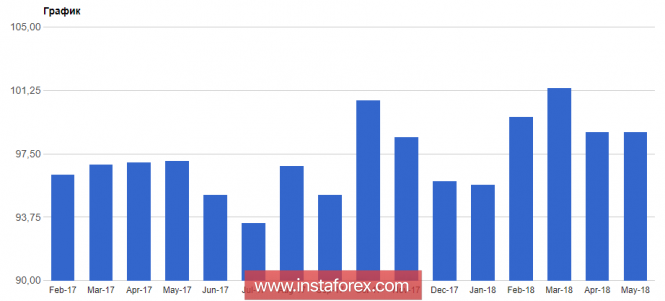

Dynamics of gold and the US dollar

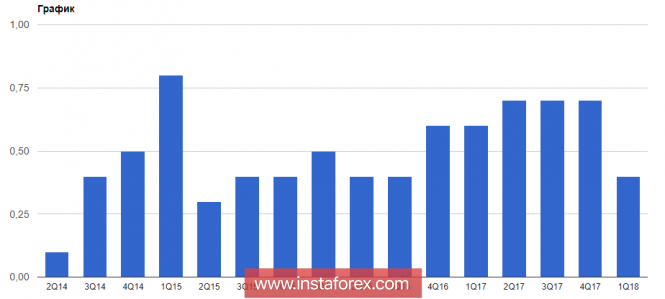

Someone perceived the success of the replacement Gary Cohen as an accident (once a year and a stick shoots), someone - a confirmation of the theory that markets are ruled by people from Washington, whether the Fed or the US administration. Much more important is another - the precious metal and the dollar continue to walk in pairs, although in different directions. The gold is traditionally perceived as a hedge against inflation, but always take into account the dynamics of real rates of the US debt market. The rapid growth in the yield of treasury bonds caused no less a blow to the positions of the "bulls" in the XAU/USD than the "greenback" who rose from the ashes. The precious metal is unable to compete with bonds because of its inability to pay dividends, so it fell into disgrace. Stocks of the world's largest specialized stock exchange fund SPDR Gold Trust fell to 866.77 tons, while XAU/USD prices fell to the lowest level since the end of December.

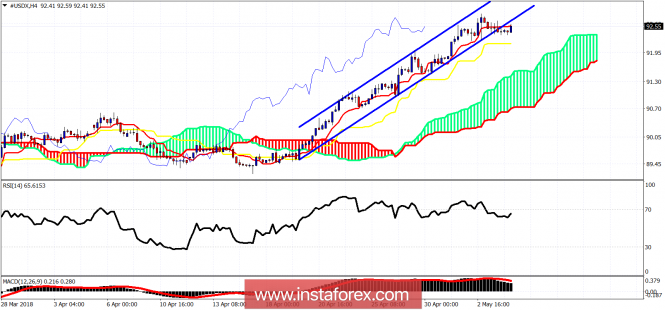

Gold as easily slid into the red zone from the beginning of the year, as it started to kick off. What can save it? Short-term - the absence of signals from the Fed on four hikes in the federal funds rate in 2018 and disappointing statistics on the US labor market for April. Mid-term - the restoration of the global economy after a disastrous first quarter. Do not be surprised that the safe-haven will respond positively to an improvement in the global appetite for risk. In fact, the scheme "overclocking the US economy - increasing the growth rate of global GDP - the normalization of monetary policy by central banks-competitors of the Fed" can cause a re-earn, which will lead to a weakening of the dollar and a return to interest in gold.

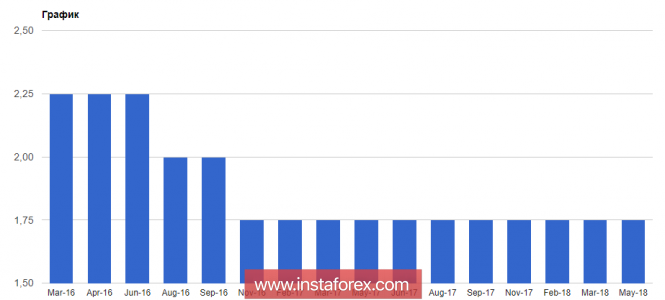

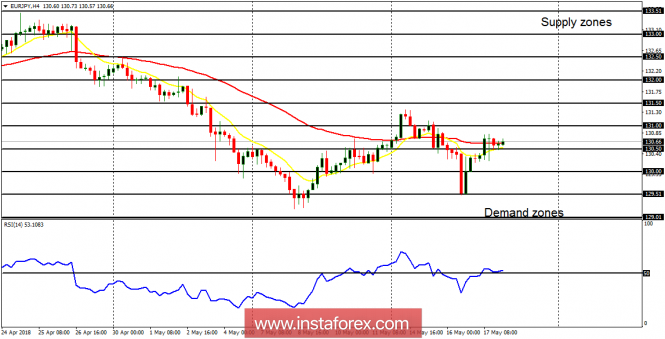

Investors should closely monitor the ability of the yield of 10-year US bonds to break the level of 3%, and gain a foothold above it. It does not work out - large accounts will begin to record profits on long positions in US currency.

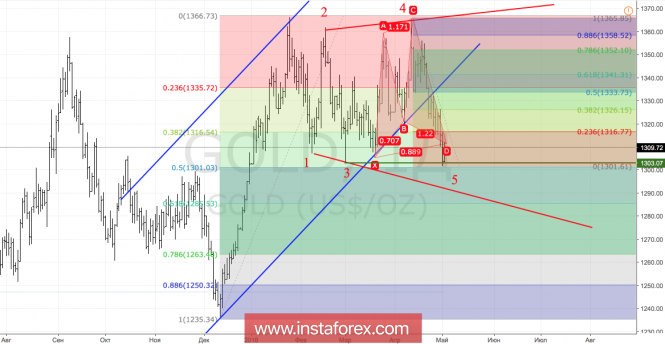

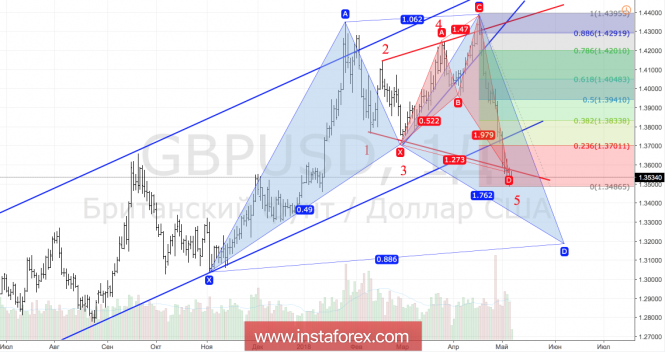

The technically formed pattern of the "Broadening Wedge" pattern and the transformation of the "Shark" pattern into a 5-0 increase the risks of a pullback in the direction of 23.6%, 38.2% and 50% of the CD wave. Correction, as a rule, is used for selling, however, if bulls on gold manage to return quotes to the resistance at $1352 and $1359 per ounce, the risks of recovery of the upward trend will increase.т.

Gold, daily chart

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks