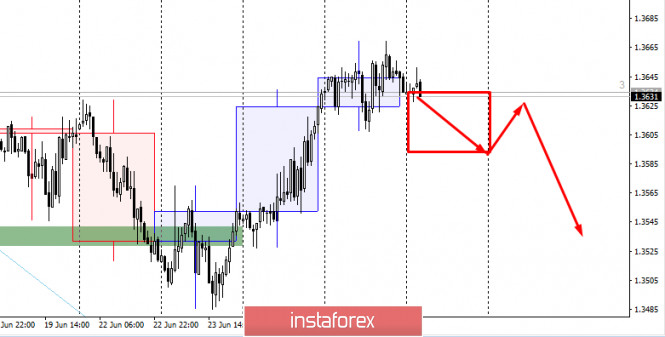

Forecast for EUR/USD on June 22, 2020

EUR/USD

Last Friday, buyers of the dollar managed to restrain the onslaught of the euro bulls and keep the single currency in a downward local trend of the last ten days. The signal line of the Marlin oscillator on the daily chart has penetrated the territory of the bears, now it is easier for the market trend to reach the target along the embedded line of the price channel of 1.1115. Overcoming this support opens the second target of 1.1010.

The four-hour chart shows that the euro's growth in the first half of the day was restrained by the balance indicator line, that is, the growth occurred in the framework of the general decreasing trend, which strengthens this trend itself. Now in the struggle of the local trend with convergence, the Marlin oscillator has a higher chance of winning the trend. We are waiting for the price at 1.1115.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks