Fundamental Analysis of EUR/USD for April 17, 2018

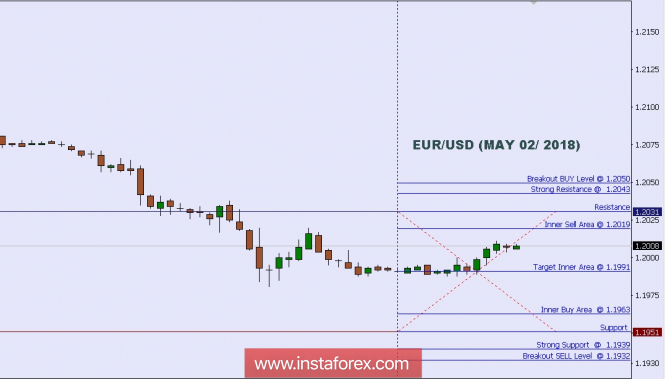

EUR/USD has been quite impulsive with the bullish gains recently which engulfed the recent bearish pressure with a daily candle yesterday. The volatility in the EURUSD is still quite high and expected to have no definite trend momentum until 1.25 is broken above or 1.21 is broken below. Despite having worse economic reports EUR gained good momentum over USD recently which is expected to push higher in the coming days. Today EUR German ZEW Economic Sentiment report is going to be published which is expected to decrease to -0.8 from the previous positive figure of 5.1, Italian Trade Balance report is expected to show an increase to 2.23B which previously was at -0.09B and ZEW Economic Sentiment report is expected to decrease to 7.3 from the previous figure of 13.4. On the other hand, today USD Building Permits report is going to be published which is expected to increase to 1.33M from the previous figure of 1.30M, Housing Starts is also expected to increase to 1.27M from the previous figure of 1.24M, Capacity Utilization Rate is expected to have slight decrease to 77.9% from the previous value of 78.1% and Industrial Production report is expected to decrease to 0.3% from the previous value of 1.1%. Moreover, today FOMC Member Williams and Quarles is going to speak about the nation's interest rate and monetary policy which is expected to be neutral in nature. As of the current scenario, both currencies in the pair is expected to have mixed economic results today and this week there is no further high impact economic reports or events to push the price into a definite trend but as the EUR is quite stronger in comparison to USD with the market sentiment, further bullish momentum is expected after certain retracement along the way in the coming days.

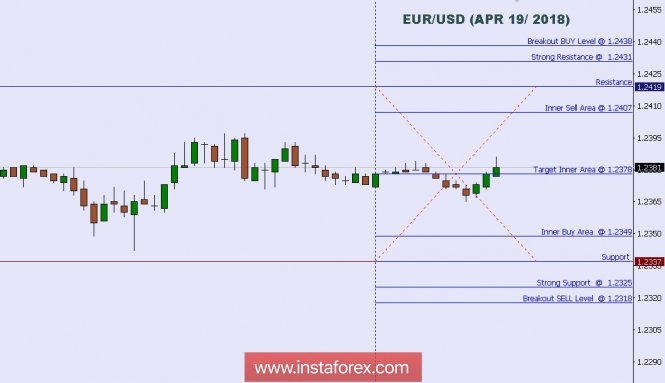

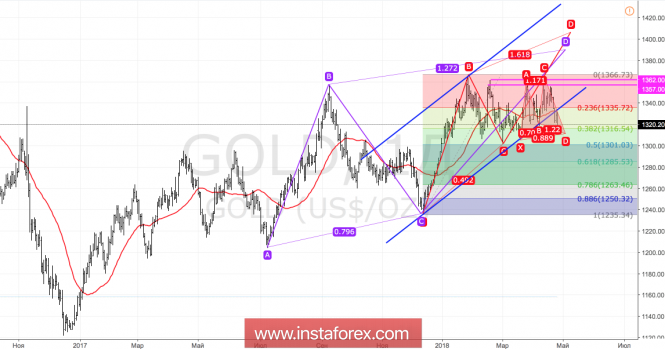

Now let us look at the technical view. The price is currently residing above 1.2350 which was recently broken below with a daily close showing good evidence of price proceeding lower. As of yesterday, after having a daily close above 1.2350 does signify previous bearish move as a false break which is currently expected to push the price much higher in the coming days with the target towards 1.2450-1.25 price area. As the price remains above 1.2350 area, the further bullish pressure is expected in this pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks