Brent ignores Trump's calls

When there is no agreement in the comrades, their business will not go smoothly. Contrary to the calls of Donald Trump, OPEC did not increase oil production in order to suspend the growth of prices. Inside the cartel, there is a clear division between those who can do it, but would like to see a corresponding increase in demand, and those who are unable to expand production, and it is satisfied with the current levels of Brent. Futures on the North Sea variety, by the way, updated the four-year high. The market is amplified by rumors that the increase in global demand (according to the International Energy Agency, the figure will grow by 1.4 million b/d in 2018 and 1.5 million b/d in 2019), the reduction of Iranian exports and the reluctance of OPEC to increase production will lead to such a deficit of oil, which has not been seen for several decades.

Oil closes in the positive territory for the fifth consecutive quarter, which has not happened since the beginning of 2007, when six straight quarters of growth inflated the WTI quotes to a historic high of $147.5 per barrel. In the current situation, the expansion of the imbalance allows banks to set "bullish" forecasts for Brent and WTI. In particular, BofA Merrill Lynch and JP Morgan believe that the North Sea variety can jump up to $95 per barrel.

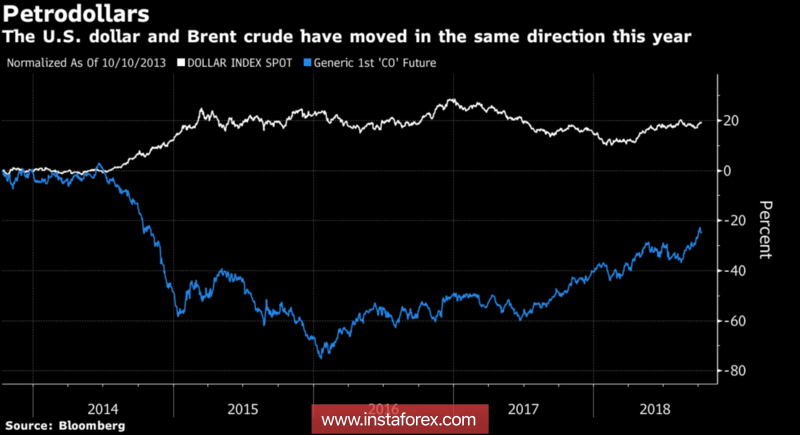

Not the least role in the September oil rally was played by a weak dollar. Despite the strong US economy and labor market, as well as the Fed's desire to continue the cycle of monetary policy normalization, speculators preferred to get rid of the US currency at the end of the quarter, as the escalation of trade disputes between Washington and Beijing could not provide it with the expected support. At the same time, the risks of Donald Trump's impeachment in the event of the Democrats' victory in the midterm elections to Congress in November are growing. Taking into account the existing correlation of the USD and Brent index, the growth of black gold looks quite logical.

Dynamics of Brent and USD index

It can not be said that politics does not even consider the oil market. Rising prices have the potential to increase ordinary Americans' spending on gasoline and reduce the effectiveness of the fiscal stimulus. This is a serious trump card in the hands of opponents of Donald Trump. In this regard, the President's calls for OPEC to increase production look logical.

Despite the fact that sanctions against Iran are a pronounced "bullish" factor for Brent and WTI, there is an opinion in the market that it is unlikely to become a long-term driver of growth in quotations. Moreover, the reduction in global demand under the influence of trade wars (IMF estimates it at 150-200 thousand b/d) may limit the potential for oil growth. In my opinion, much will depend on the buyers' refusals and on the scale of hostilities between the US and China. So far, several countries have expressed their intention to reduce purchases of oil from Tehran, including India, South Korea, Japan and others.

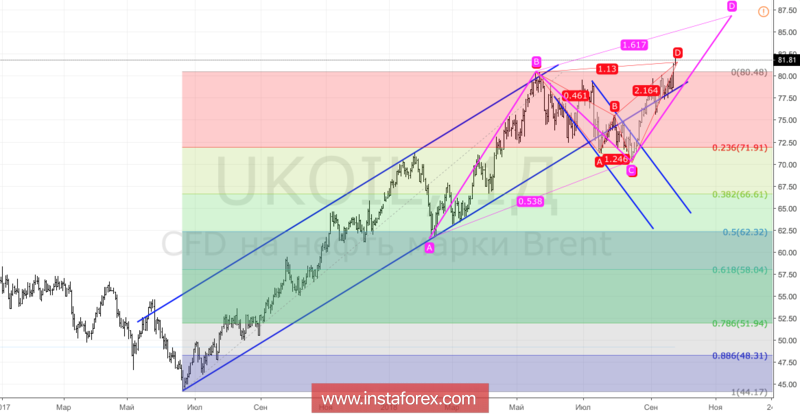

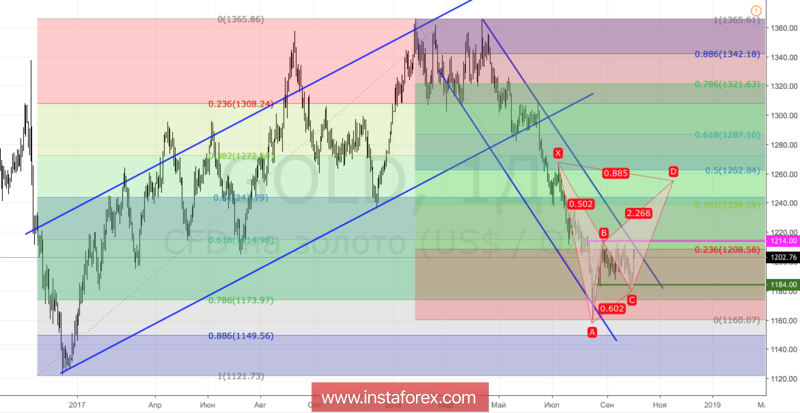

Technically, the implementation of the target by 113% on the "Shark" pattern increases the risks of a rollback. If the bulls do not stop there, the probability of achieving the target by 161.8% for AB=CD will increase.

Brent, daily chart

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks