Elliott wave analysis of EUR/NZD for October 11, 2018

The break above resistance at 1.7847 told us that the corrective decline from 1.7929 had completed prematurely and a new impulsive rally towards 1.8030 and 1.8369 should be unfolding.

Despite our expectation of a new impulsive rally towards 1.8030, we should be aware of the possibility of a more complex correction unfolding, but the minimum upside target should be 1.7929 if a larger flat correction is in the making.

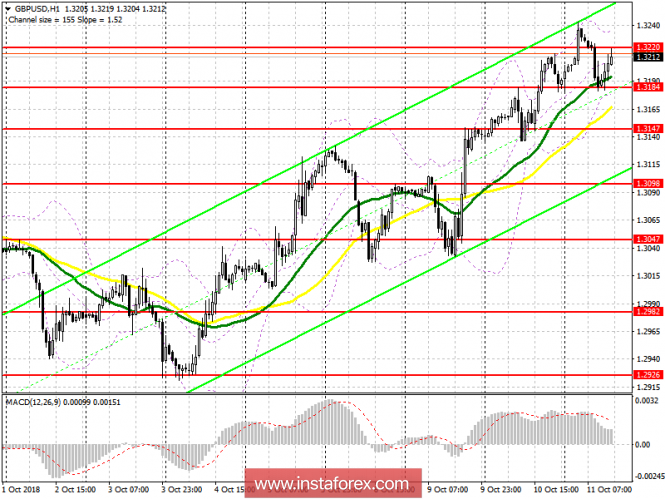

R3: 1.8030

R2: 1.7960

R1: 1.7929

Pivot: 1.7882

S1: 1.7835

S2: 1.7800

S3: 1.7774

Trading recommendation:

We are long EUR from 1.7847 and we will place our stop at 1.7780. Upon a break above 1.7882 will will move our stop to break-even at 1.7847.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks