GBP / USD. December 18th. The results of the day. Boris Johnson is ready to return to the "tough" Brexit and takes a tough stance in future negotiations with the EU

4 hour time-frame

Amplitude of the last 5 days (high-low): 108p - 179p - 354p - 101p - 234p.

Average volatility over the past 5 days: 196p (high).

The GBP / USD currency pair on Wednesday trades continued a steady downward movement, which, from our point of view, is justified by only one factor. This factor is elections to the Parliament of Great Britain. They were left behind and deprived market participants of the foundation and the reason that allowed them to buy the pound in the last two months. Now that it is clear that the entire power in the country is concentrated in the hands of the Conservative Party, that neither Labor, nor Scottish nationalists, nor, moreover, other political forces, and even all of them combined, can prevent Boris Johnson from doing so, gives an opportunity with high accuracy to predict what will happen in the state in the near future. December 20 will be a vote on a bill of agreement between Britain and the European Union. Certainly it will be adopted by a majority vote and on January 31, 2020 (or even earlier), the so-called "transition period" will begin, during which the Boris Johnson government will need to agree with Brussels on all aspects of the further coexistence of the Alliance and the Kingdom, which has left the jurisdiction of Brussels. However, if earlier Boris Johnson and his cabinet had to agree, because Parliament required it, now he absolutely does not have to do it. Recall that initially Johnson was ready to implement the "hard" Brexit without any agreements with the European Union. Now that there are already agreements, it is possible to continue the dialogue with Michel Barnier and the company, but the British Prime Minister has already made it clear that he will not make any concessions, prolongation of the "transitional period" categorically rejects (now in the UK there is a law that allows extending the "transitional period" once for a period of 2 years, if the parties fail to manage to reach an agreement before the expiration of the initial period). According to Johnson, any negotiations with the EU should be completed by December 31, 2020, and if London and Brussels fail to meet this deadline, then the gap will occur without an agreement at all. That is, in fact, the government of Boris Johnson, having received full power in the country, is absolutely not opposed to returning to the original version with the "hard" Brexit. Or is this a new plan by Boris Johnson aimed at political blackmail of the leaders of the European Union. Approximately Johnson's strategy may be as follows. The Prime Minister threatens a "tough" divorce and requires speedy negotiations and the speedy conclusion of a trade agreement. If the EU drags out the time during which Britain continues to pay contributions to the European treasury, to remain under all EU financial standards, then Johnson is ready to withdraw without a "deal". Since the "tough" Brexit is not beneficial for the EU itself, then, according to the Prime Minister, the Europeans will be much more accommodating. In any case, negotiations will continue for at least the next year, which, according to the vast majority of experts, will be difficult. And at best, a trade agreement will be concluded at the end of the year that will mitigate the negative effect of breaking all ties between London and Brussels. In the worst case, there will be no agreement,

Macroeconomic statistics from the UK continues to leave much to be desired, however, today, when the pound continued to calmly drop in price, the only British report of the day - the consumer price index for November - did not disappoint market participants. According to experts, inflation in the Foggy Albion should have been reduced to 1.4% y / y, but this did not happen and the index remained at the level of the previous month - 1.5% y / y. This is not to say that this is great and now the British economy will begin to recover. This is just the absence of deterioration in one month. If we recall the rest of the macroeconomic statistics, it becomes clear that there are no reasons for joy and the British pound is likely to continue to fall against the US currency. Moreover, the most important topics for the US dollar (the impeachment of Donald Trump, trade wars and negotiations with China) have no effect on the movement of the GBP / USD pair. And macroeconomic statistics from across the ocean, if it does not please traders in 100% of cases, in most cases it turns out to be quite strong and does not disappoint. So it turns out that the prospects for the British currency are now approximately the same as those of the European currency - absolutely negative. We can still hypothetically hardly imagine what should happen in the States or the European Union, so that the balance of power between their economies is reversed. then the majority comes out strong enough and does not disappoint. So it turns out that the prospects for the British currency are now approximately the same as those of the European currency - absolutely negative. We can still hypothetically hardly imagine what should happen in the States or the European Union, so that the balance of power between their economies is reversed. then the majority comes out strong enough and does not disappoint. So it turns out that the prospects for the British currency are now approximately the same as those of the European currency - absolutely negative. We can still hypothetically hardly imagine what should happen in the States or the European Union, so that the balance of power between their economies is reversed. so that the balance of power between their economies is reversed. then the majority comes out strong enough and does not disappoint. So it turns out that the prospects for the British currency are now approximately the same as those of the European currency - absolutely negative. We can still hypothetically hardly imagine what should happen in the States or the European Union, so that the balance of power between their economies is reversed. so that the balance of power between their economies is reversed. then the majority comes out strong enough and does not disappoint. So it turns out that the prospects for the British currency are now approximately the same as those of the European currency - absolutely negative. We can still hypothetically hardly imagine what should happen in the States or the European Union, so that the balance of power between their economies is reversed.

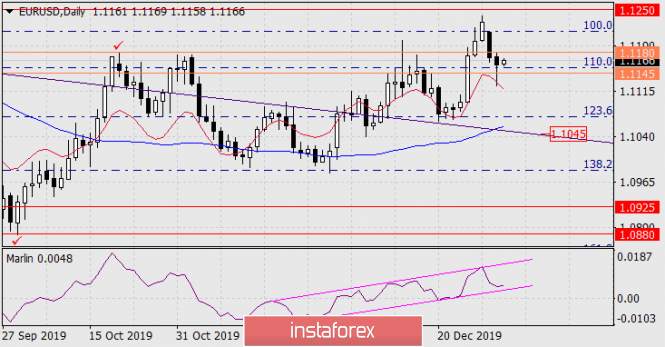

Trading recommendations:

GBP / USD continues to form a new downtrend. The price has worked out the bottom line of the Ichimoku cloud and the first support level of 1.3083. Thus, a rebound from these strong support levels may trigger a round of upward correction. However, without rebounding the price from the indicated supports or without turning up the MACD indicator, it is not recommended to reduce sell positions. The following targets for trading are lowering 1.2931 and 1.2833. It is recommended that purchases of the British pound be returned no earlier than the price fixing above the Kijun-sen line, which is clearly not expected in the coming days.

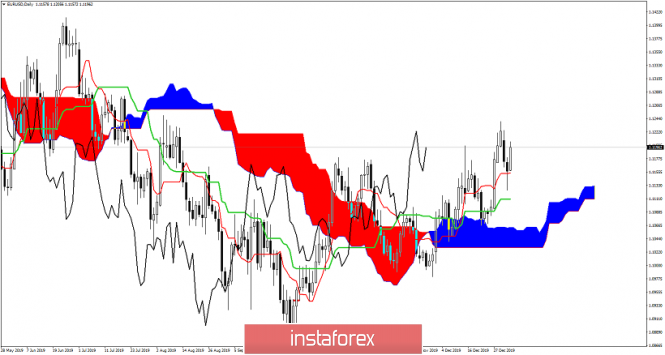

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chinkou Span - green line.

Bollinger Bands Indicator: 3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.Translation

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks