Forecast for USD/JPY on December 5, 2019

USD/JPY

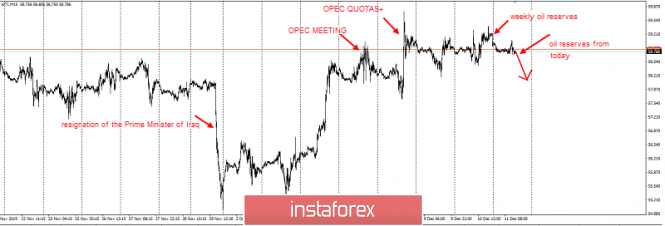

The information received yesterday from the headquarters of the US and Chinese negotiators on trade encouraged the markets - representatives of the parties allowed the conclusion of the first phase of the deal until December 15, before the date of the introduction of tariffs on Chinese goods. The US S&P 500 index gained 0.63%, Nikkei 225 is currently up 0.70% and China A50 grew 0.36%. The price turned from the achieved first bearish goal - from the enclosed line of the price channel, a little short of the MACD line. The signal line of the Marlin oscillator is still in the negative trend zone, growth could continue, but still within the correction.

The correction can continue to the range of 109.30/50 (highs of October 30 and November 7), going over the range will mean the correction will go into a trend growth, the target will be the line of the green price channel in the region of 109.95. Leaving prices at yesterday's low opens the next bearish target at 107.57 - the intersection of the lines of the red and green price channels.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks