Forex Analysis & Reviews: Forecast for GBP/USD on April 5, 2022

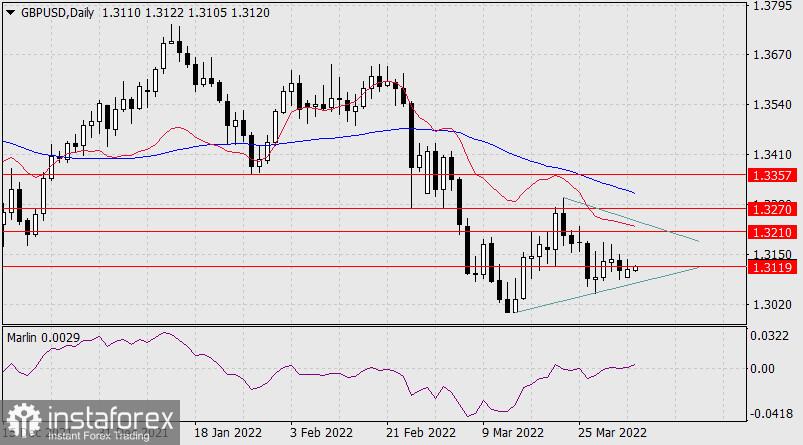

The British pound begins to form a pennant-shaped formation on the daily scale. From the ideological point of view, this is quite consistent with investors' expectations for the Bank of England meeting, which will take place exactly one month later, and the European Central Bank, which will take place in nine days. On the technical side, after the formation of the lower line of the pennant, the price now tends to rise, to the upper line of the supposed pennant, to the target level of 1.3210. The signal line of the Marlin Oscillator fixed in the positive area.

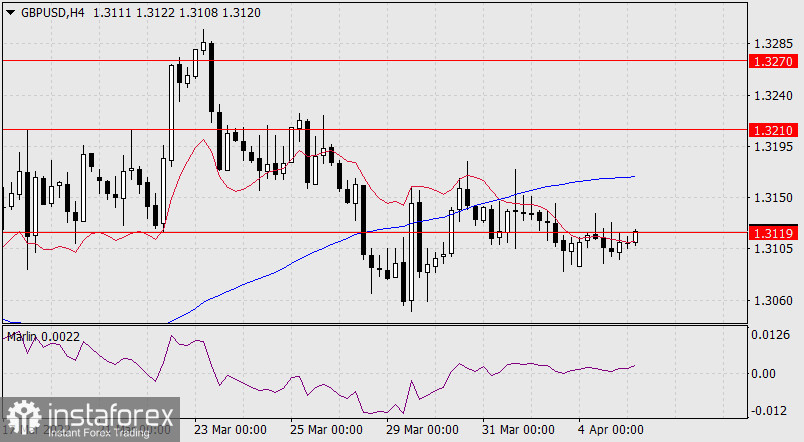

On the H4 chart, the price has not yet consolidated above the target level of 1.3119, and the signal line of the oscillator, although it is above the zero line, is still moving sideways. Today's trading day may be similar to yesterday's.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks