Forex Analysis & Reviews: Forecast for EUR/USD on January 7, 2022

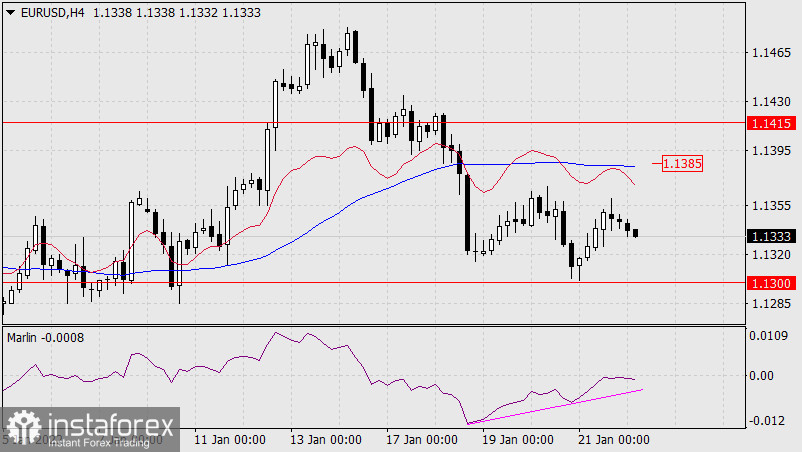

The euro slightly fell last Thursday, consolidating ahead of today's US employment data. The forecast is very optimistic: 400,000 new jobs are expected in the non-agricultural sector in December, the unemployment rate may decrease from 4.2% to 4.1%.

The price settled below the MACD indicator line on the daily chart, the Marlin Oscillator is still hesitating to cross the border with the bears' territory. This will probably happen if the data is not very different from the forecast for the worse - weekly applications for unemployment benefits in the last month came out flat and, we believe, non-farms will also be in the forecast area. As a result, we expect the euro to decline in the next few days to the target level of 1.1170 - to the support area of June 2020.

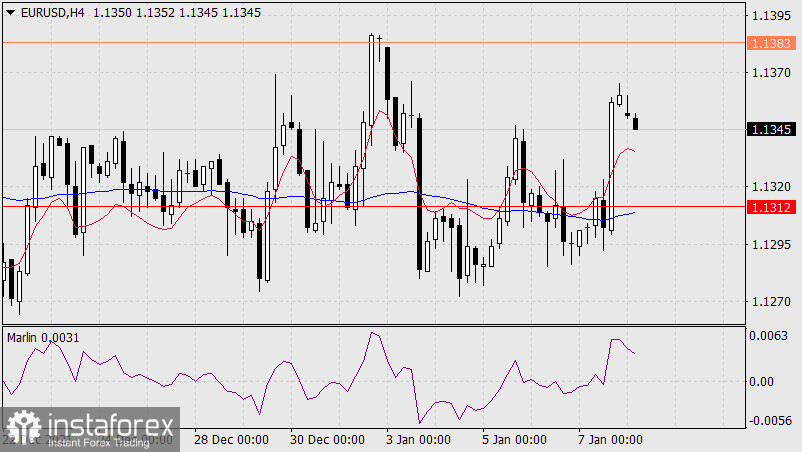

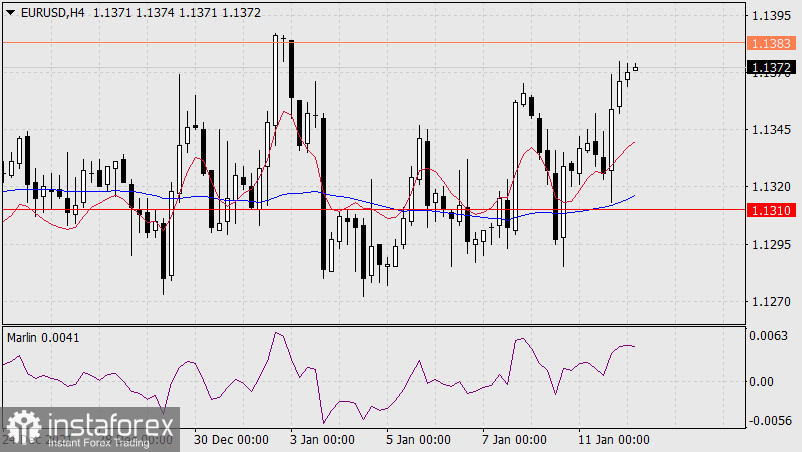

The price also settled below the MACD line on the four-hour scale, the Marlin Oscillator is already in the negative area. There is pressure on the price, we are waiting for the resolution of the situation with the release of news.

The alternative scenario assumes the price settling above the level of 1.1310 and further growth to the upper border of the 1.5-month range at 1.1222-1.1383.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks