Forex Analysis & Reviews: Forecast for GBP/USD on February 23, 2024

GBP/USD

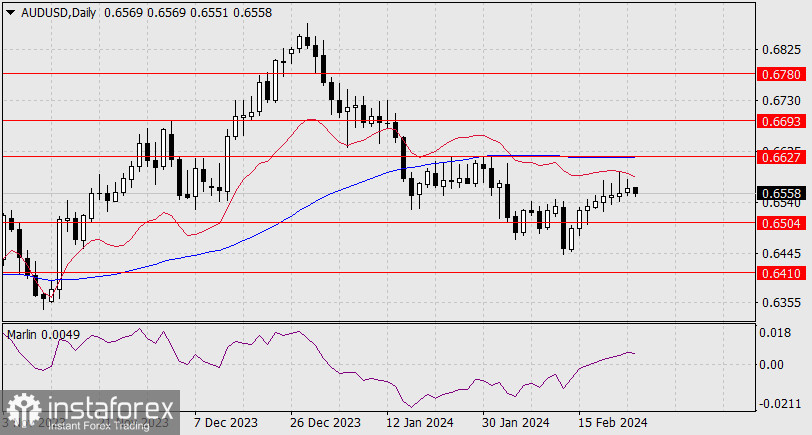

Yesterday, the composite PMI index for the UK increased to 53.30 in February from 52.90 in January of 2024. The British pound, also influenced by external markets, gained 22 pips. The intraday growth was 74 pips, but the price could not break out of the grids of the indicator lines in the daily timeframe.

The signal line of the Marlin oscillator is growing in the positive territory, but visually it is getting weaker. In order to rise to the nearest target of 1.2745, the price must close today with a white candle to settle above the MACD line. To realize the opposite scenario, the quote must overcome the support of 1.2610. We are waiting for Monday.

On the 4-hour chart, the price has settled and is rising above both indicator lines. However, the Marlin oscillator moves horizontally, in a sideways range. The uptrend is getting weaker, and it is better to wait for the start of next week.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks