Talking Points

- AUD/USD Technical Strategy: Shorts Preferred

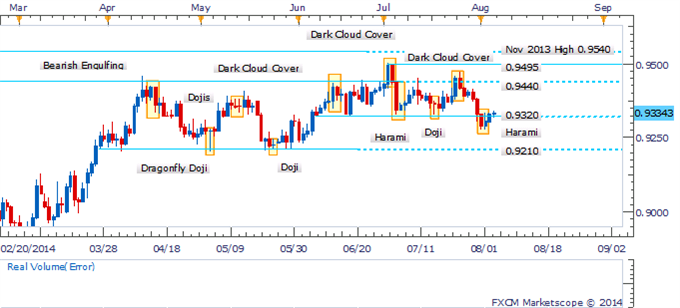

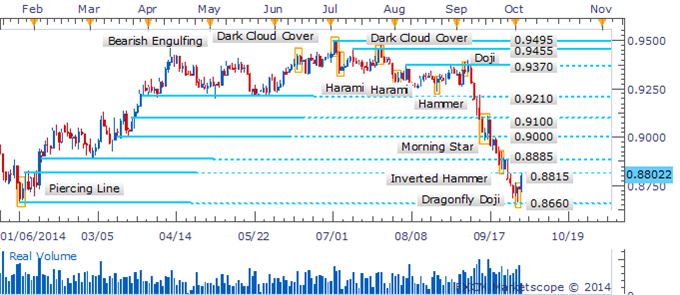

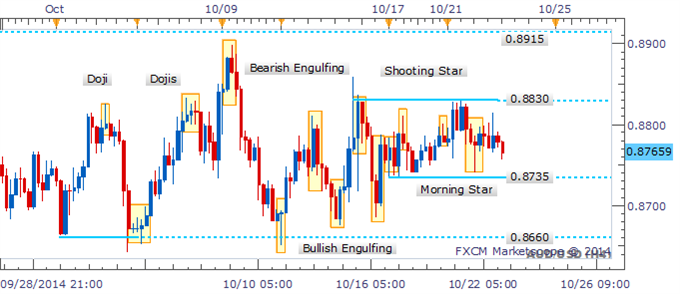

- Dark Cloud Cover Offered Warning Near Range-Top

- Harami Pattern May Find Limited Follow-Through

The Australian Dollar may struggle to recover further ground despite the emergence of a Harami pattern on the daily, given sellers remain nearby at 0.9320. A daily close above the critical resistance level would be required to confirm a bullish reversal, which would open the former range-top at 0.9440.

Harami May Find Limited Follow-Through

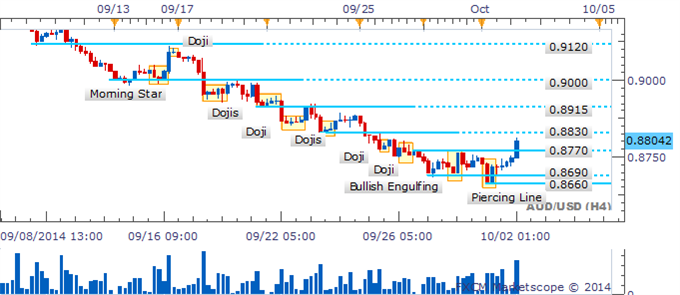

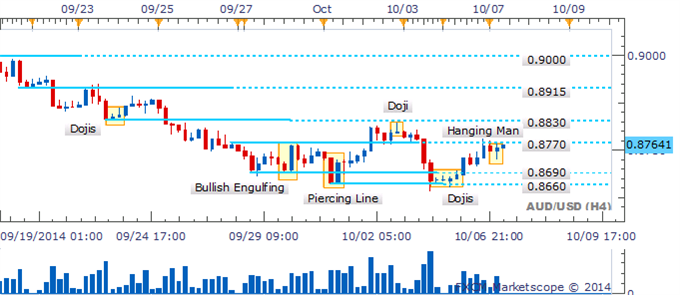

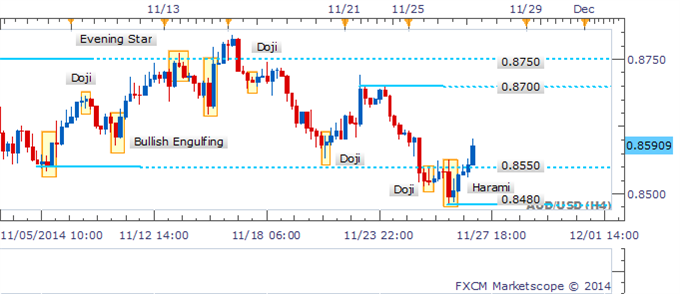

The four hour chart below reveals some hesitation by traders during the Asian session (denoted by a Doji candlestick near 0.9330). However, the pair has yet to see a bearish reversal pattern emerge, which would warn of a correction. This suggests the currency may consolidate over the session ahead.

Bulls Hesistate Near 0.9320/0.9330

By David de Ferranti, Currency Analyst, DailyFX

More...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

4

4

Bookmarks