The USD was crashed by the Fed’s stance. Overview for 12.12.2019

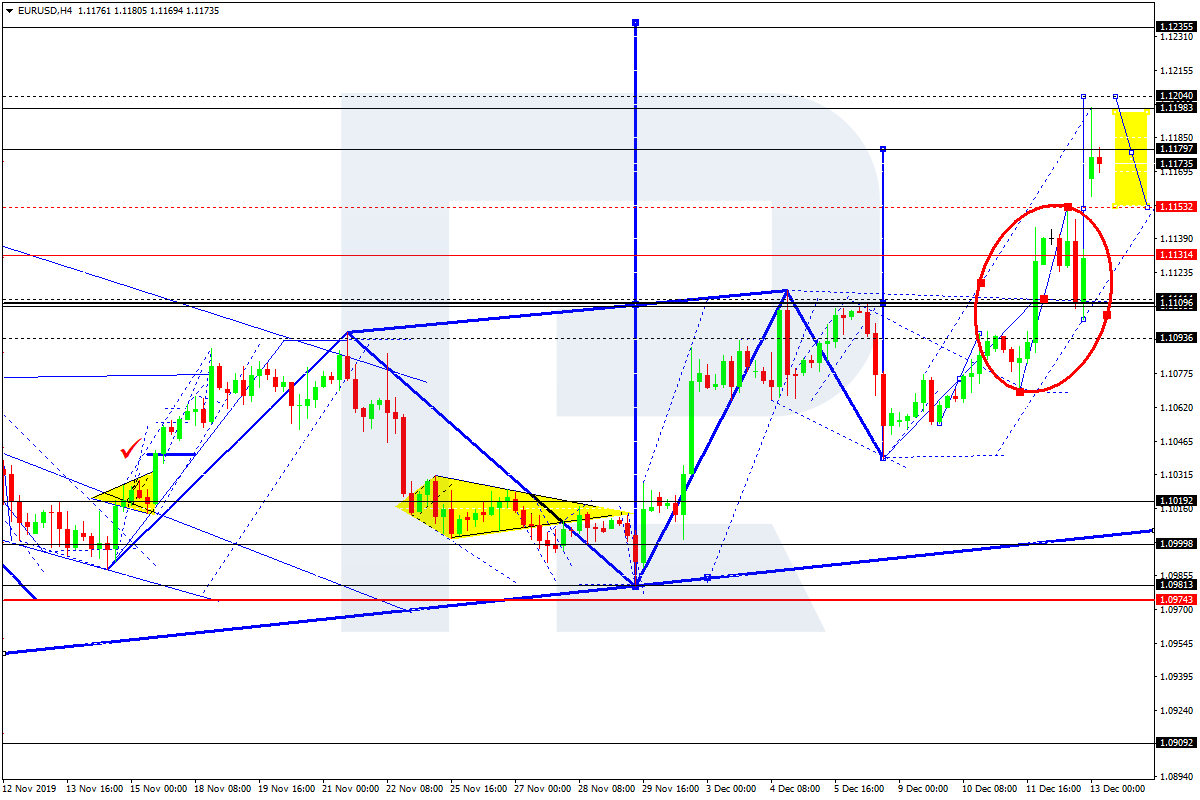

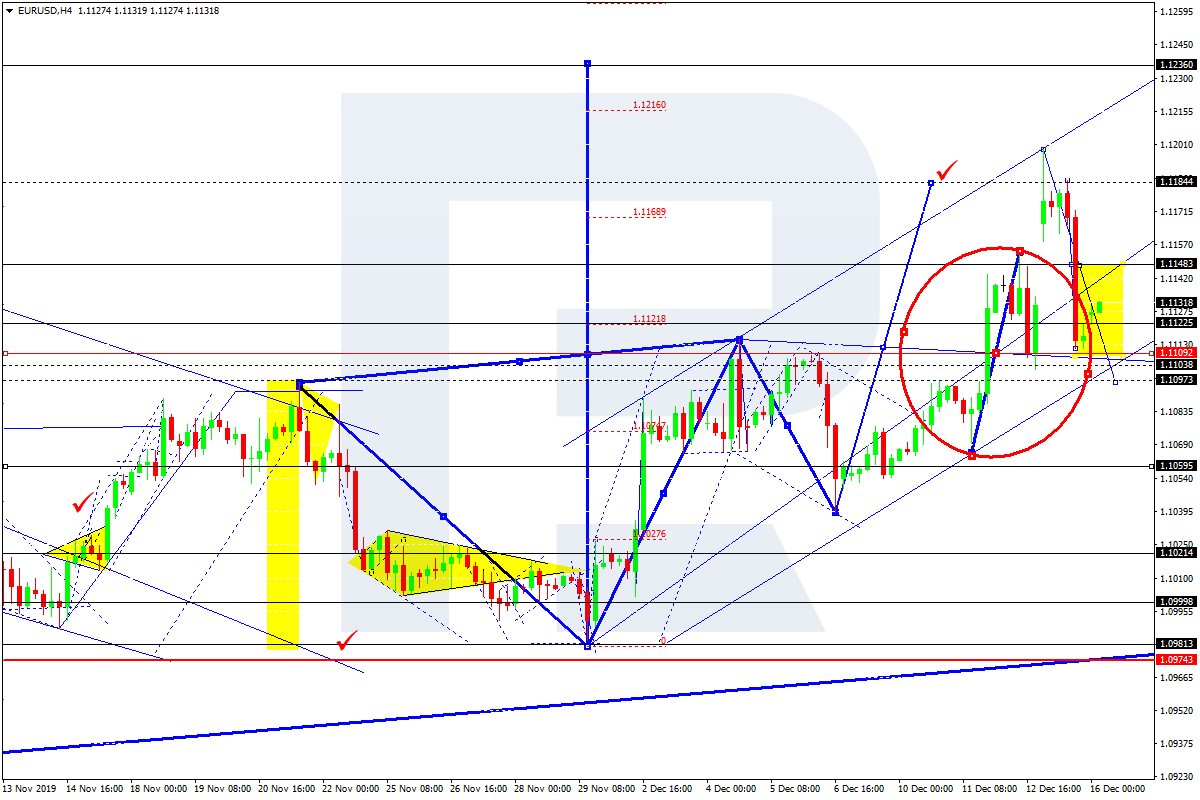

The major currency pair reached its five weeks highs influenced by the Fed’s comments after the December meeting.

On Thursday morning, EURUSD is trading close to its five weeks highs. The current quote for the instrument is 1.1138.

The US Fed December meeting, which was over yesterday, offered investors nothing new. The interest rate remained at 1.50-1.75%, the same as expected. However, the comments that followed surprised market players.

The regulator said that the current monetary policy was appropriate and in compliance with its economic purposes. The Fed continues monitoring home affairs and inflation pressure, which is quite reserved. It means that the interest rate wouldn’t be cut unless the regulator witnesses some serious changes in the country’s economy.

It was a pretty unpleasant surprise for the USD because market players were sure that the American economy was strong enough for the rate increase in the nearest future.

The revised forecast from the Fed was a bit worse. For example, inflation is expected to be 1.4-1.5% at the end of 2019 against the previous estimate of 1.5-1.6%.

Later today, investors’ attention will switch to the ECB meeting.

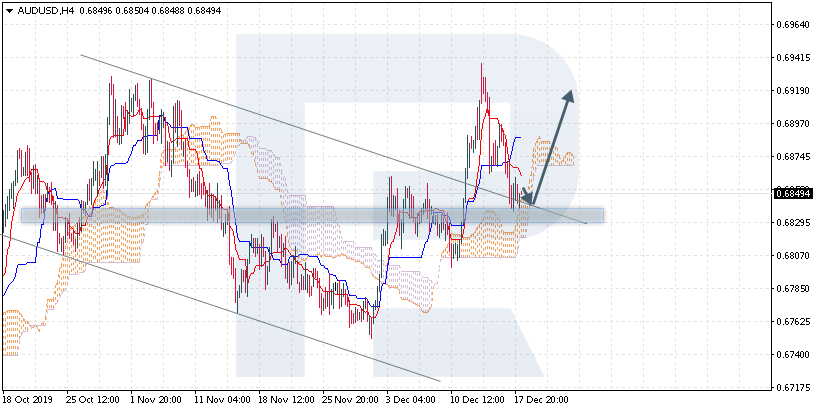

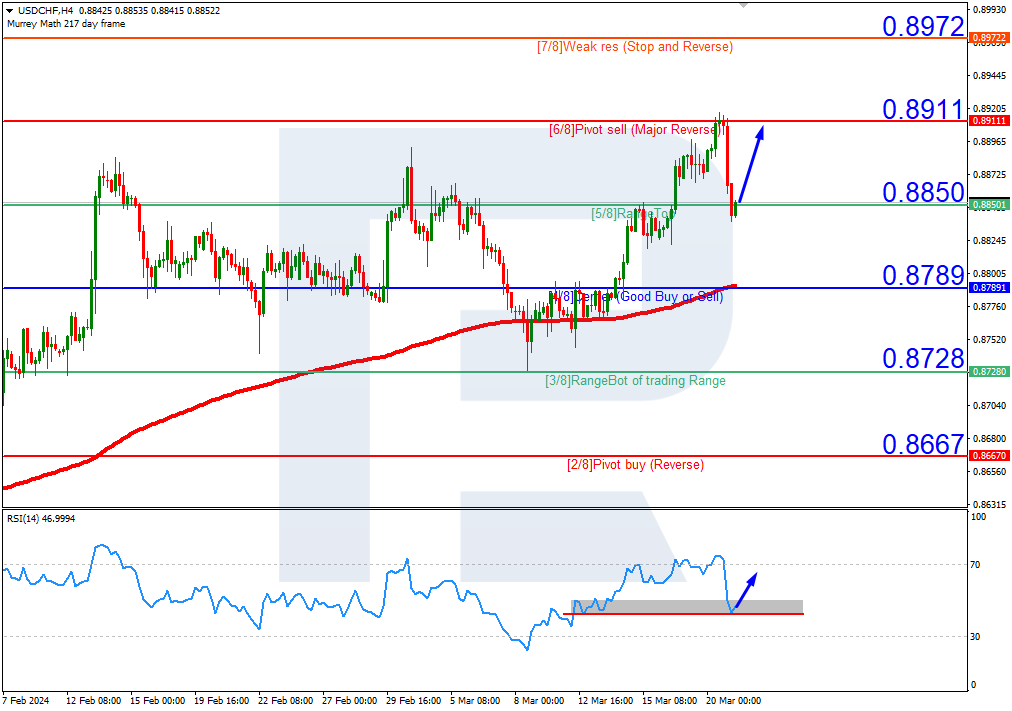

Forecasts for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks