The Euro is under pressure again. Overview for 27.11.2019

The major currency pair got under pressure on Wednesday morning; investors can’t find reasons for stability.

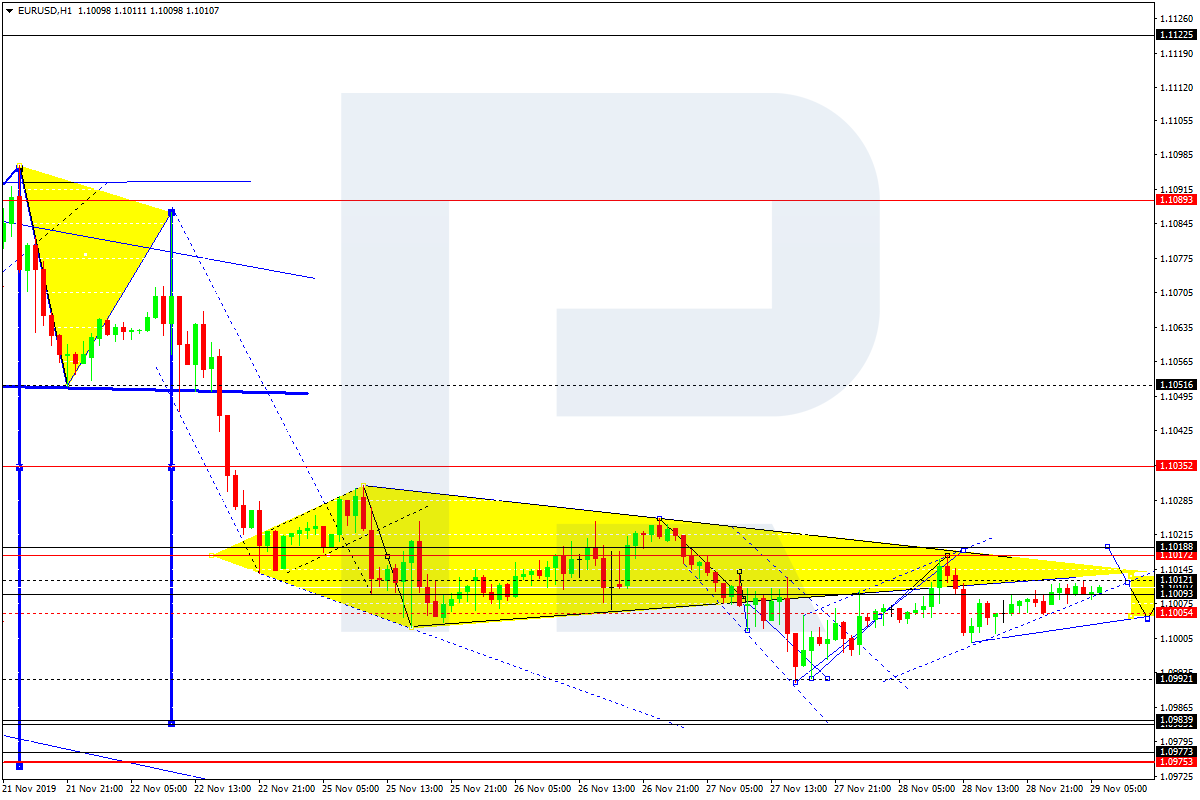

EURUSD moved upwards a little bit yesterday, but this morning the pair lost everything it “gained” earlier. The current quote for the instrument is 1.1009.

Yesterday, the major currency pair was supported by a gleam of optimism referring to slight progress in the US-China trade talks. However, after the American and Chinese officials talked on the phone and both said that it was necessary to continue negotiations, market players were braced for more details, but nothing happened.

The statistics published by the USA weren’t too good for the USD. The New Home Sales showed 733K in November after being 738K the month before and it was still better than expected. The Conference Board Consumer Confidence was 125.5 points in November after being 126.1 points in the previous month and against the expected reading of 126.9 points.

The decline of the indicator means that the consumer sentiment in the USA is getting worse, which, in its turn, means a reduction of expenses. It’s not a good signal for the USD and the American economy.

There will be a lot of numbers from the USA today. The ones worth paying attention to are the preliminary report on the GDP in the third quarter, which is not expected to change in comparison with the previous reading (1.9% q/q), and the Durable Goods Orders for October, which is pretty volatile and may show 0.5% m/m after being -1.2% m/m in September. For better understanding, one should take a closer look at the components.

One more interesting thing is the report on Personal Income and Spending: both indicators are expected to add 0.3% m/m, which is equal or a bit better than in the previous month. If the readings are good, they may provide support to the USD.

Forecasts for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks