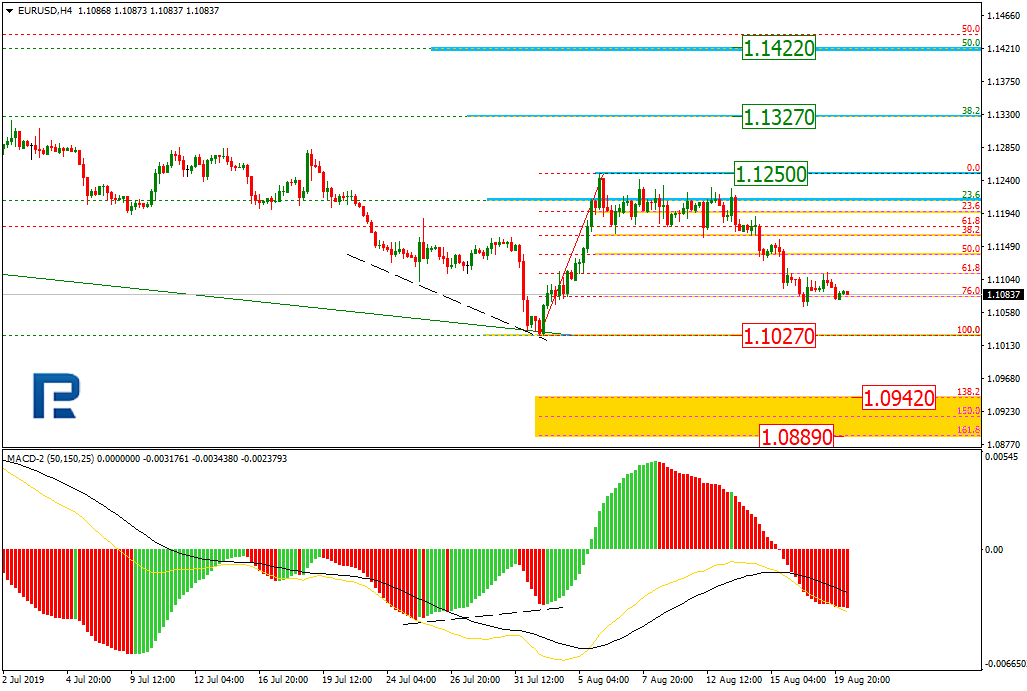

Fibonacci Retracements Analysis 20.08.2019 (EURUSD, USDJPY)

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, EURUSD has reached a very significant correctional level, 76.0% fibo and may continue falling towards the lows at 1.1027. After breaking the low, the price may continue trading towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively. Another scenario implies that the pair may start a new rising wave without breaking the low. In this case, the ascending correction may continue towards 38.2% and 50.0% fibo at 1.1327 and 1.1422 respectively.

Read more - Fibonacci Retracements Analysis EURUSD, USDJPY

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks