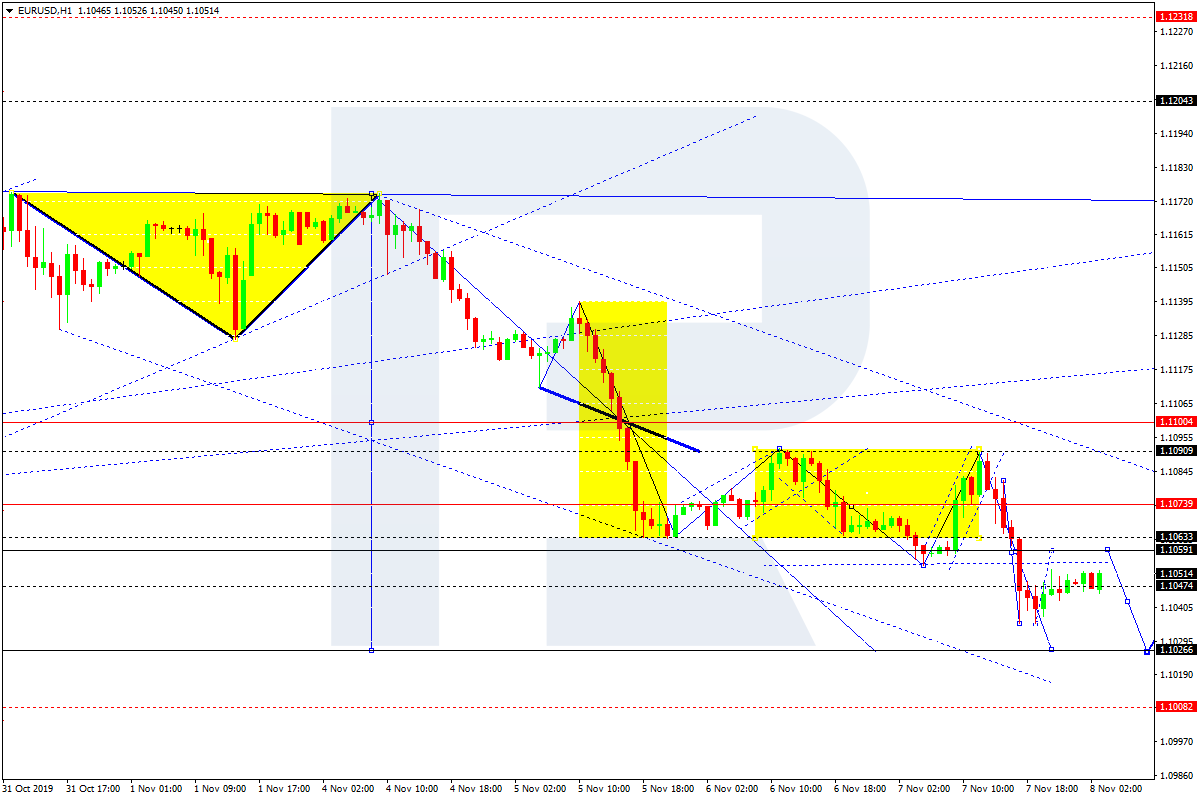

The Euro plunged to its three weeks lows. Overview for 06.11.2019

Bears continue pushing EURUSD; investors are waiting for the trade agreement.

The major currency pair slowed down its decline on Wednesday but remains pretty weak. The current quote for the instrument is 1.1076.

The key source of positive for the USD is the anticipation of the trade agreement between the USA and China, the first part of which may be concluded in the nearest future. For investors, it would mean an immediate reduction of any possible risks. These expectations are exactly what support the USD right now and make “safe haven” currencies go down.

The statistics published yesterday showed that the PPI in the Euro Area added 0.1% m/m in September after losing 0.5% m/m in August. The actual reading matched the expected one and surprised no one.

On the other hand, the statistics published by the USA in the evening were quite interesting. The final report on the Markit Services PMI showed 50.6 points in October after being 51.0 points the month before. At the same time, the ISM Non-Manufacturing PMI went from 52.6 points in September to 54.7 points in October. As a rule, we rely on the ISM report, which is currently showing a significant improvement in the sector. The thing that is really good is the ISM Non-Manufacturing Employment, which increased from 50.4 points to 53.7 points.

In the afternoon, the Euro Area and some of its countries, such as Spain, Italy, France, and Germany are scheduled to publish final reports on their Manufacturing PMIs for October. Moreover, the Euro Area will report on Retail Sales in September, which is expected to be rather weak. The evening statistics from the USA are mostly minor, that’s why the key focus will remain on the US-China trade talks.

Forecasts for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks