EUR continues to rise. Overview for 28.05.2024

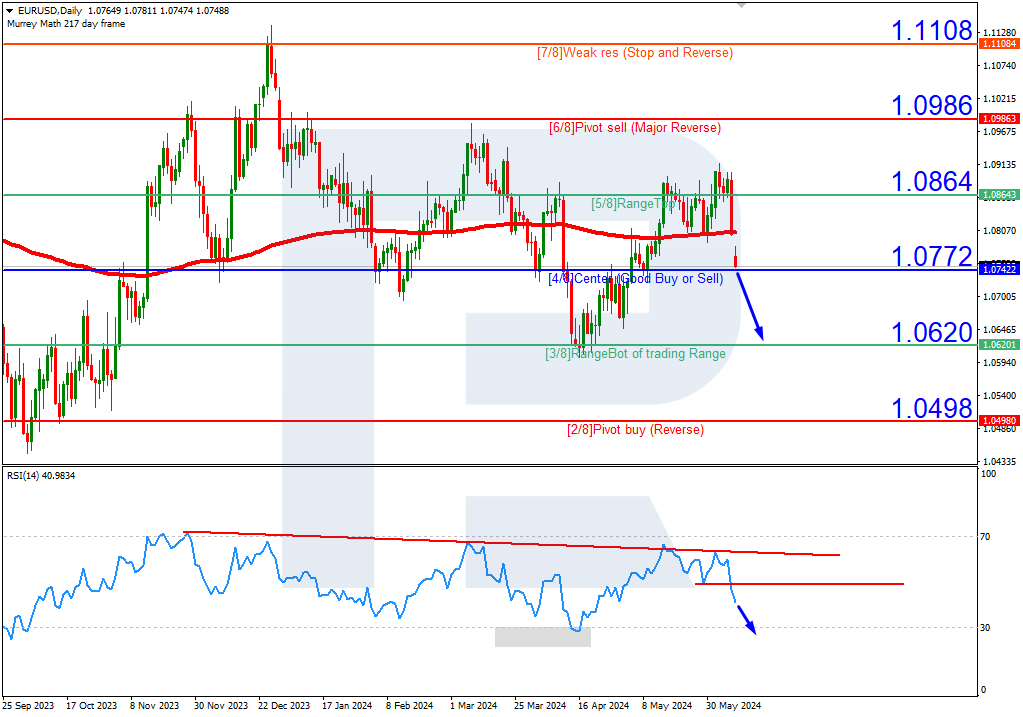

The primary currency pair is experiencing upward momentum. The current EURUSD exchange rate stands at 1.0875.

The currency market is witnessing an encouraging surge in risk appetite, bolstering the euro’s position and exerting pressure on the US dollar. The US currency is holding within narrow ranges against its major competitors ahead of Friday’s core PCE report. The inflation release is expected to provide investors with more data for insight into the Federal Reserve’s future monetary actions.

The European Central Bank has made neutral comments, while German statistics have reflected a deterioration in business sentiment in May.

Germany will release inflation data on Wednesday, and the eurozone will publish its reports on Friday. These figures are of utmost importance ahead of the ECB’s June meeting. Investors are eager to know how soon the ECB might ease monetary policy.

Inflation in the eurozone may continue to slow. If so, the European regulator has every argument to prepare for an interest rate cut next week.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks