Japanese Candlesticks Analysis 14.05.2024 (EURUSD, USDJPY, EURGBP)

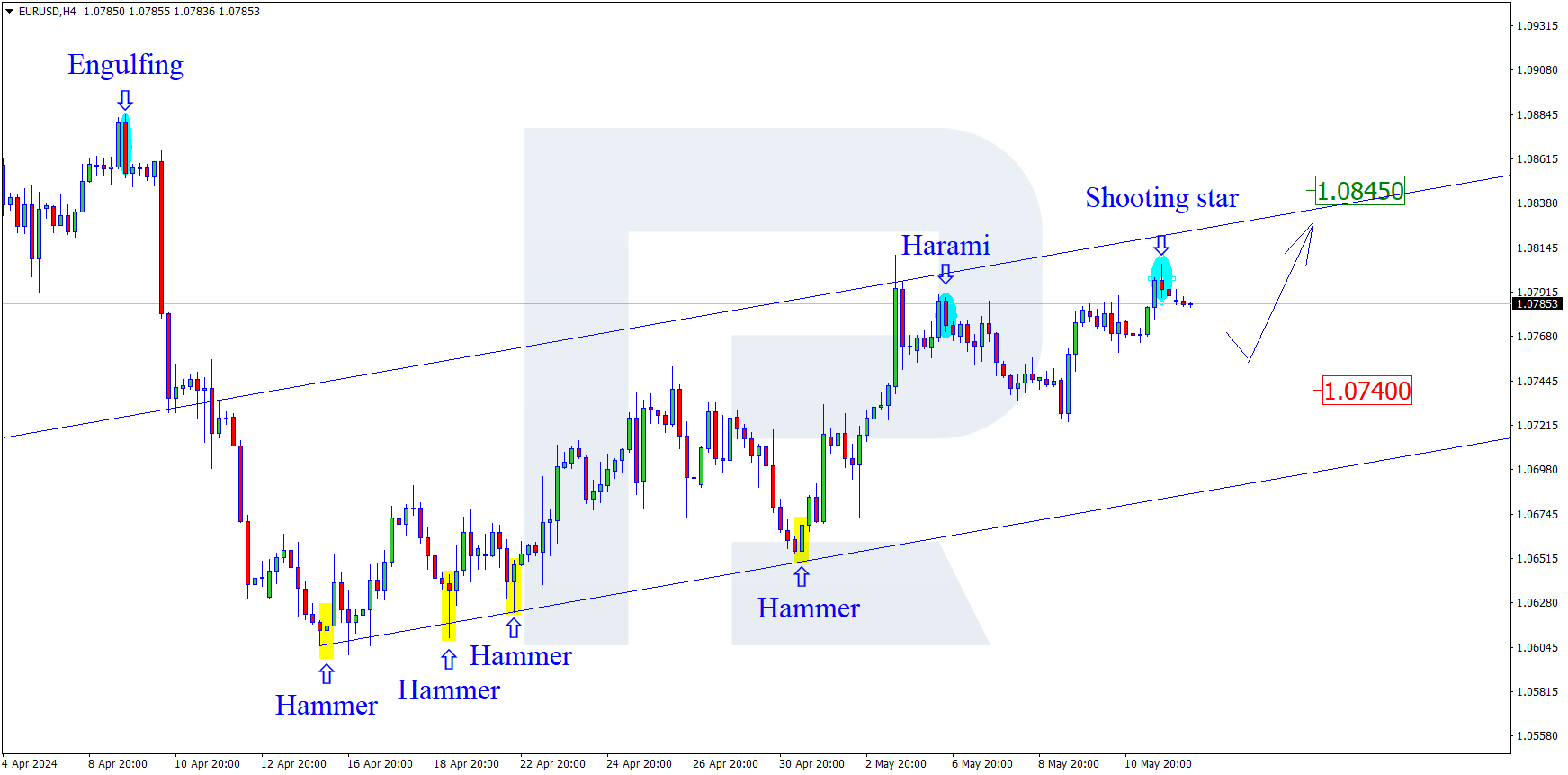

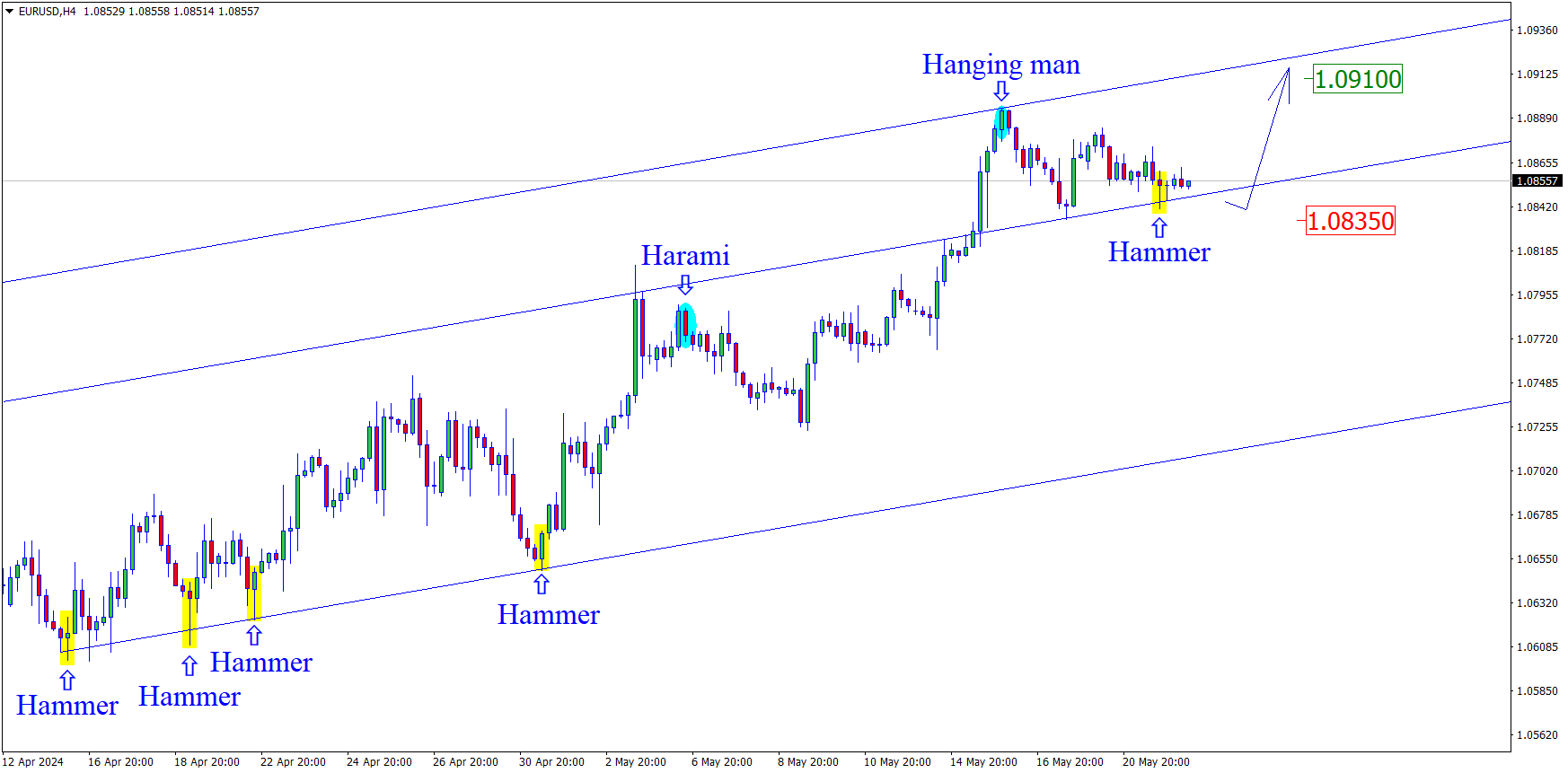

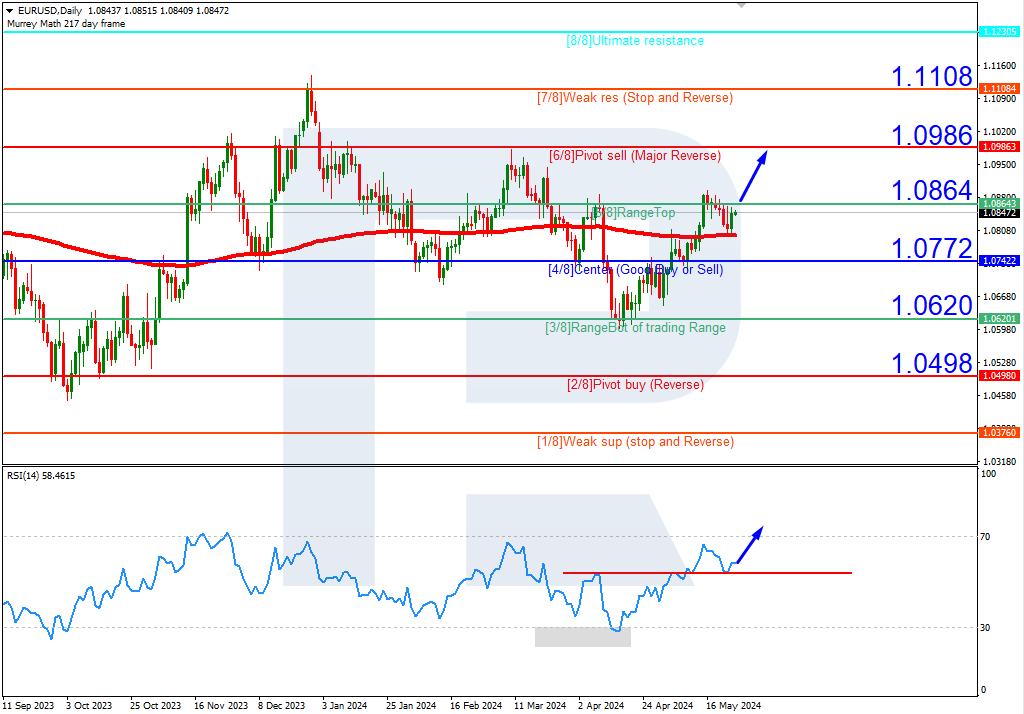

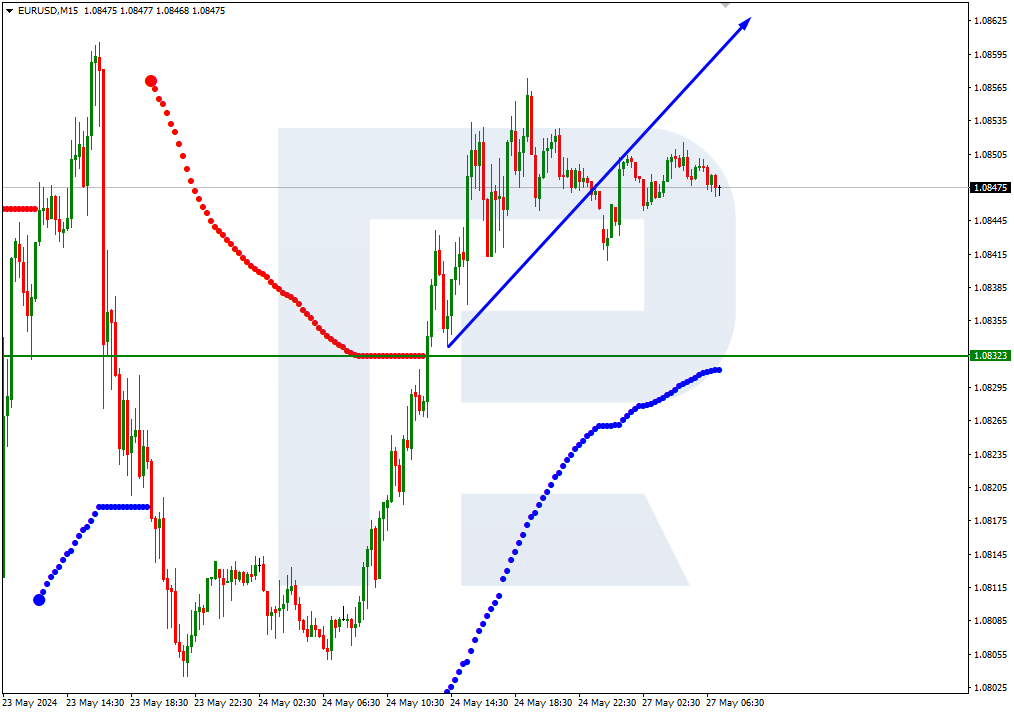

EURUSD, “Euro vs US Dollar”

EURUSD has formed a Shooting Star reversal pattern near the resistance level on H4. Currently, the instrument is going by the reversal signal in a descending wave. The decline target could be the 1.0740 support level. However, the price could rise to 1.0845 and continue its upward momentum after testing the support.

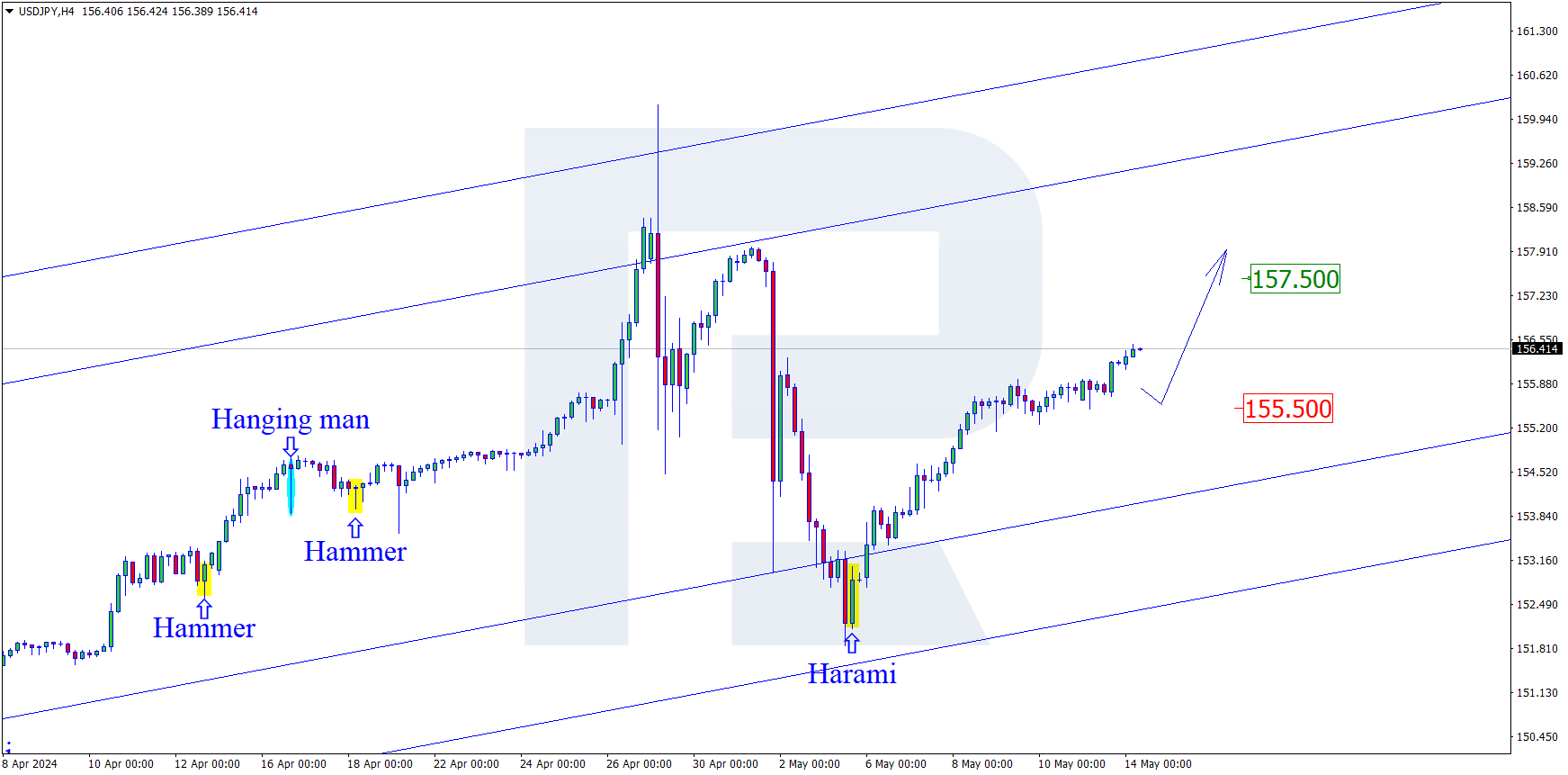

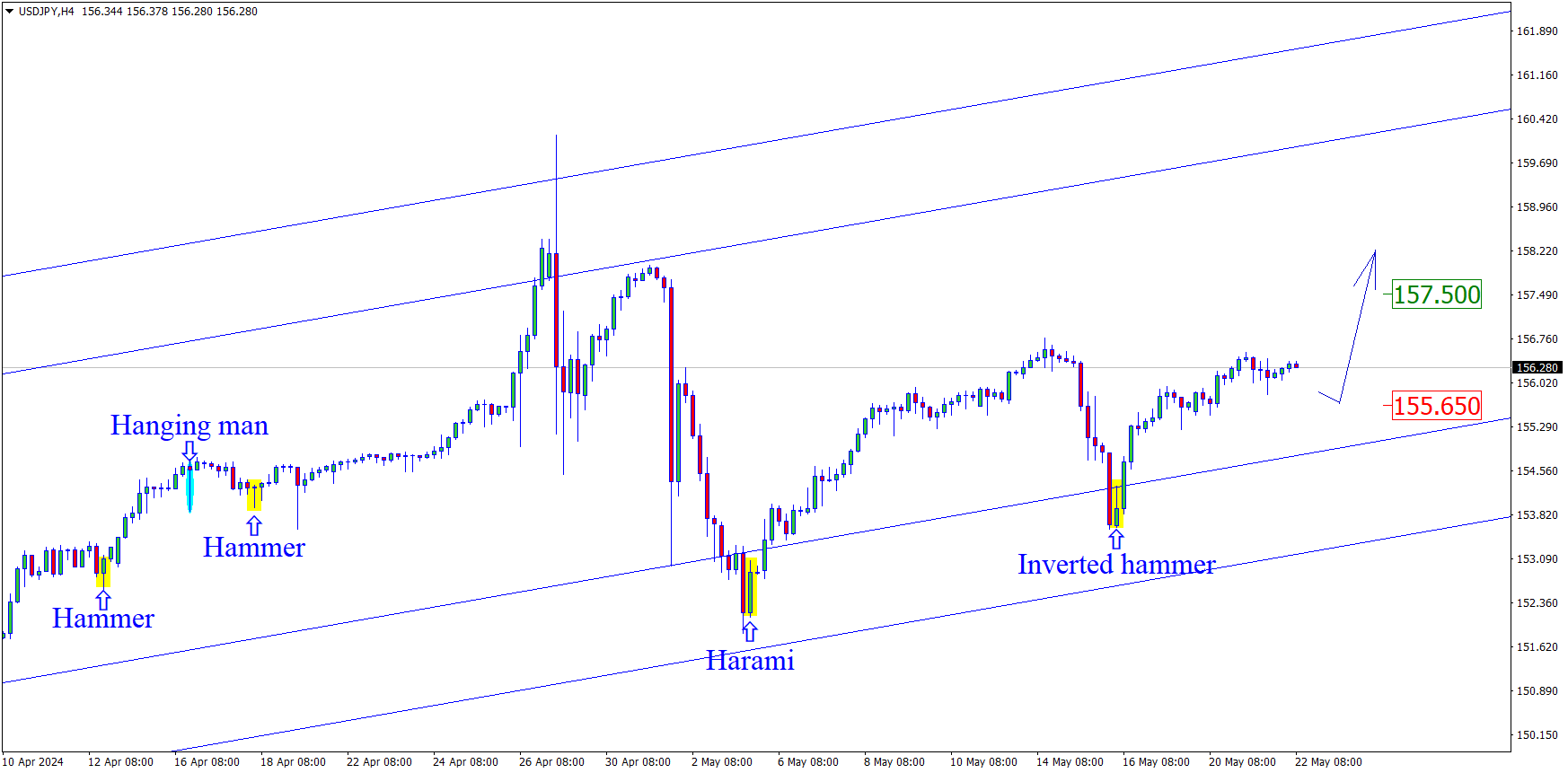

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has formed a Harami reversal pattern on H4. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target could be the 157.50 mark. However, the price could correct to 155.50 and maintain its upward trajectory after pulling back to the support level.

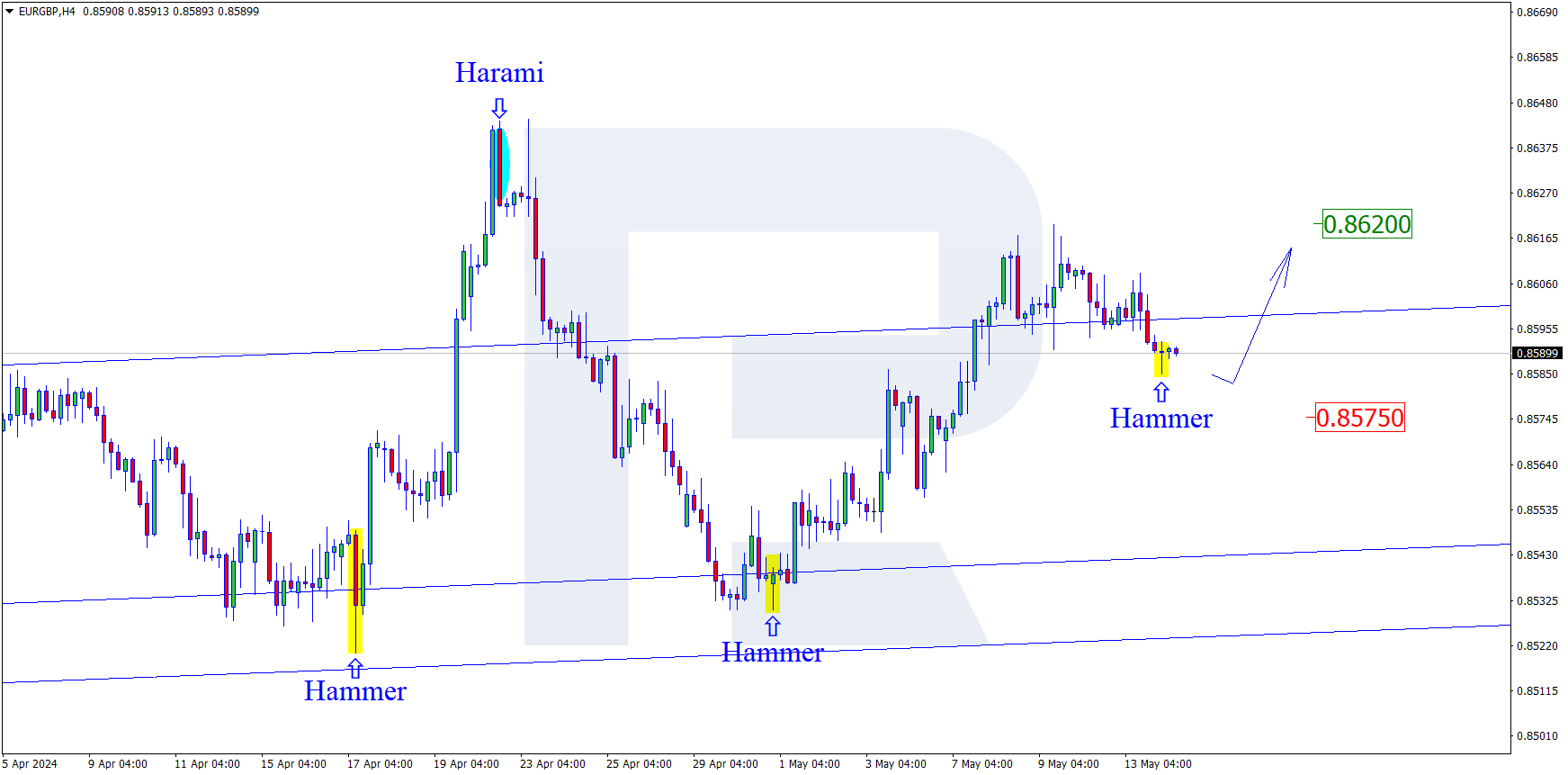

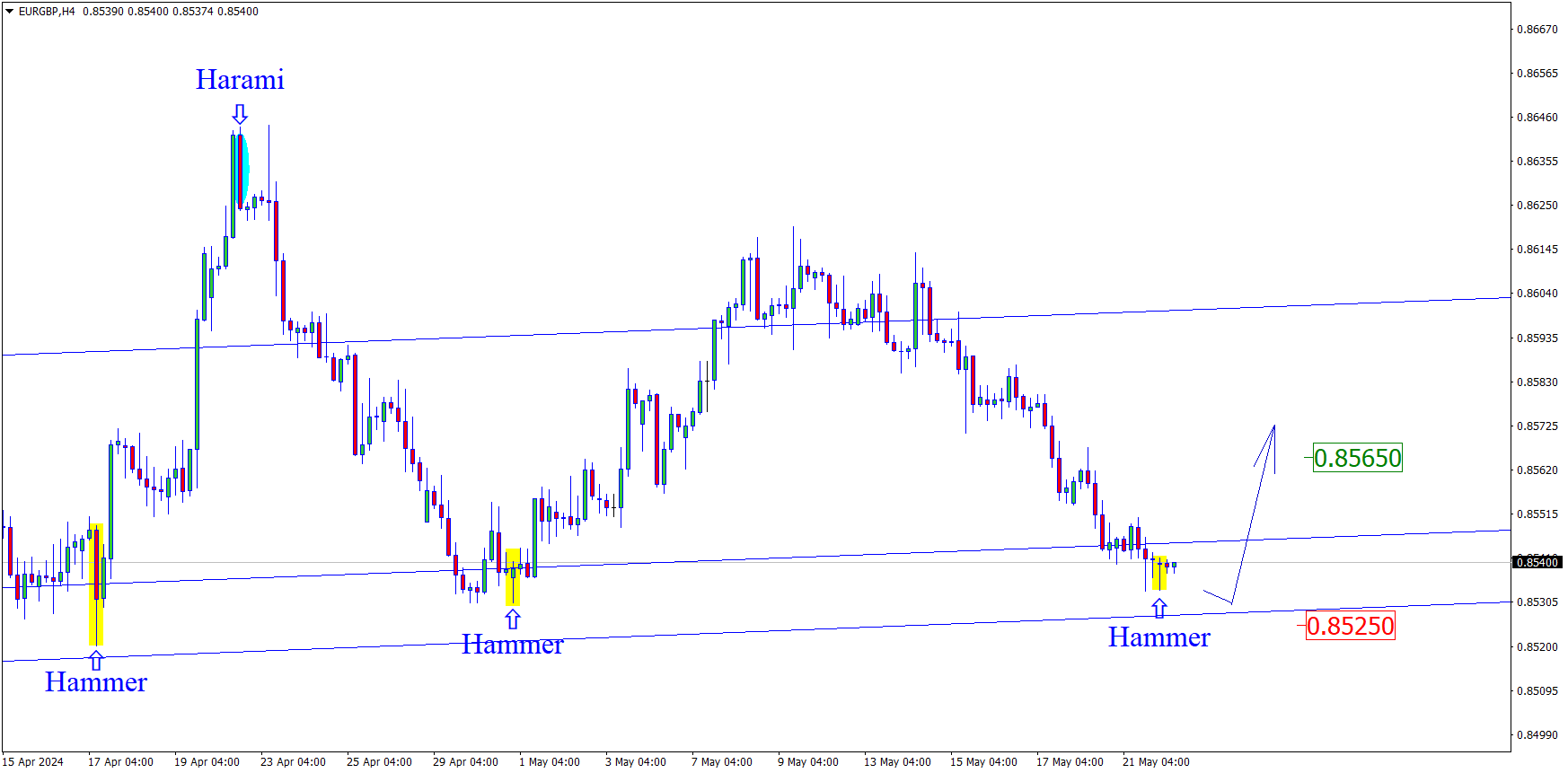

EURGBP, “Euro vs Great Britain Pound”

EURGBP has formed a Hammer reversal pattern on H4. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target could be the 0.8620 mark. After testing this level and breaking above it, the price might continue the uptrend. However, the quotes could pull back to 0.8575 before rising.

Read more - Japanese Candlesticks Analysis (EURUSD, USDJPY, EURGBP)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks