GBP found itself amid bears. Overview for 22.03.2024

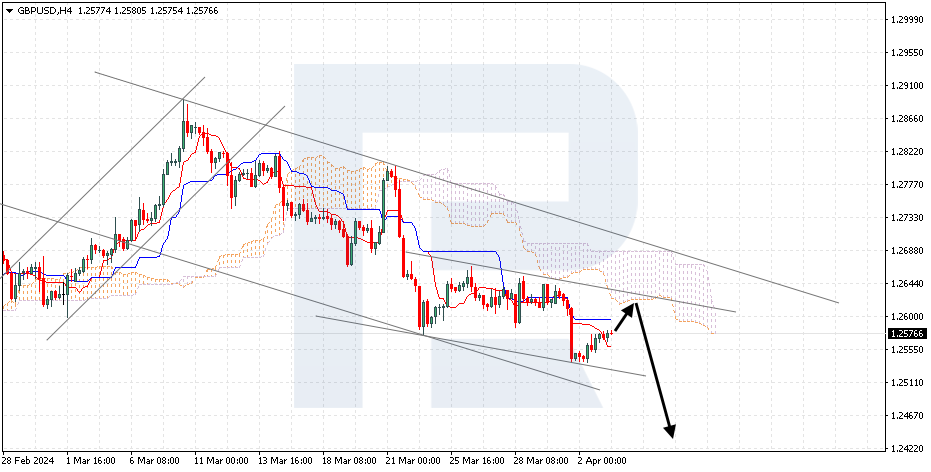

The UK pound sterling weakened noticeably against the US dollar. The current GBPUSD exchange rate stands at 1.2643.

As expected, the March BoE meeting ended predictably, with the interest rate kept at 5.25% per annum. The regulator's commentaries were restrained. The BoE indicated that the monetary policy would remain restrictive for as long as necessary to control inflation fully.

The Bank of England's inflation target remains at 2%, which the regulator believes can be achieved by the end of Q2 2024. However, no indication was given as to what the BoE intends to do after that.

It appears that the Bank of England is diverging from the general strategy of other global banks regarding interest rates, which is why the pound crashed.

The GBP exchange rate is under additional pressure from the US dollar, which has strengthened noticeably.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks