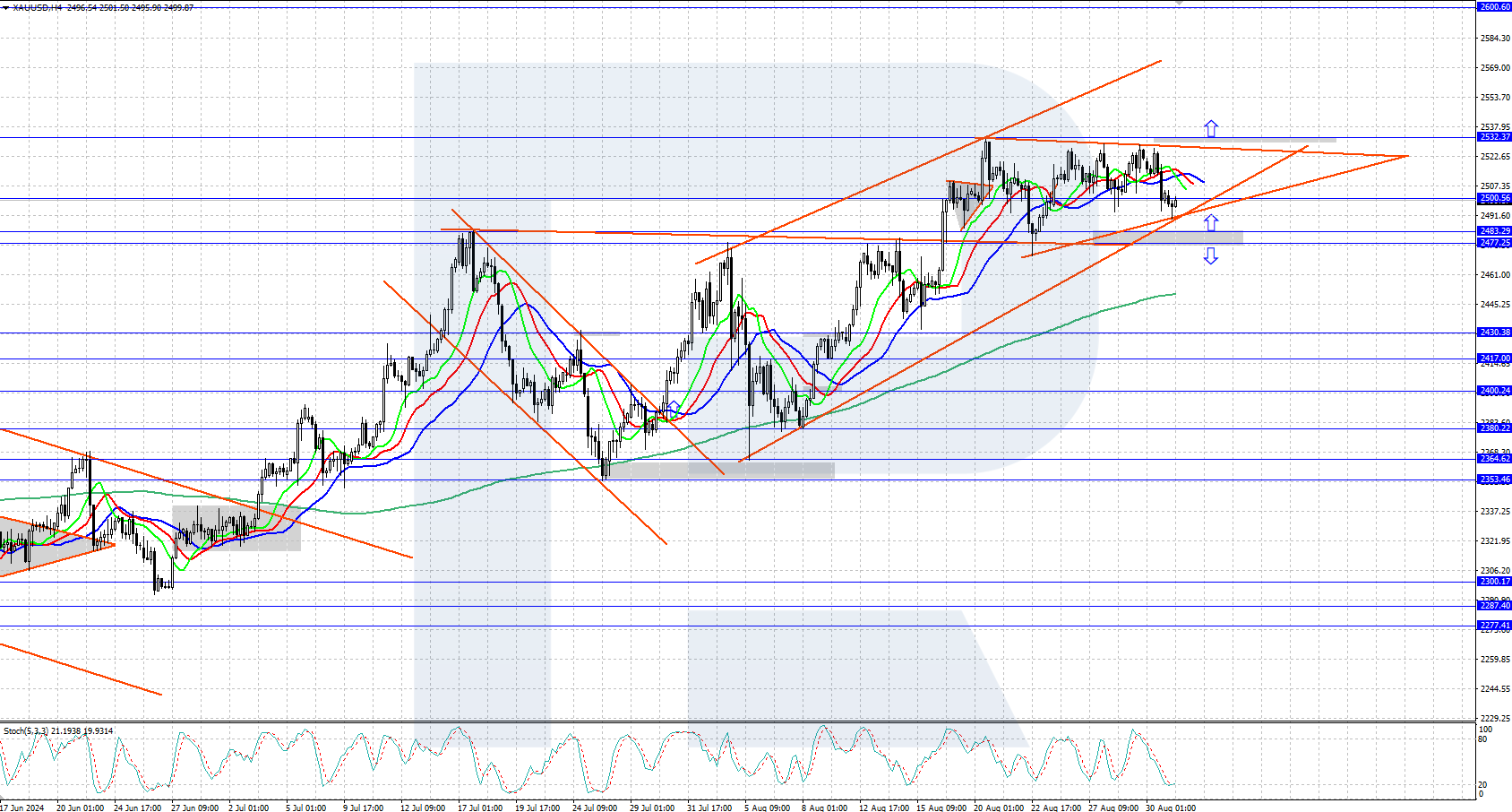

Gold (XAUUSD) retraces after reaching an all-time high of 2,532 USD, but the uptrend may resume

Although XAUUSD’s price dropped below 2,500 USD as part of a correction on Thursday, the prospects for further growth remain. Find out more in our XAUUSD analysis for today, 23 August 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await today’s speech by Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium

- Current trend: gold is trading in a strong uptrend, with growth likely after the correction

- XAUUSD forecast for 23 August 2024: 2532 and 2450

Fundamental analysis

XAUUSD quotes retraced, dropping below 2,500 USD during Thursday’s trading. The recent strong growth in gold prices was largely driven by increased expectations of a Federal Reserve interest rate cut this year. The current correction may be due to profit-taking by some investors.

Federal Reserve Chair Jerome Powell will deliver a speech at the Jackson Hole Symposium today. The Fed’s decisive stance on future interest rate reductions will provide gold with additional upward momentum. Conversely, if his speech raises doubts about future cuts, this may strengthen the US dollar and prompt further correction in the XAUUSD price.

RoboForex Market Analysis & Forex Forecasts.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks