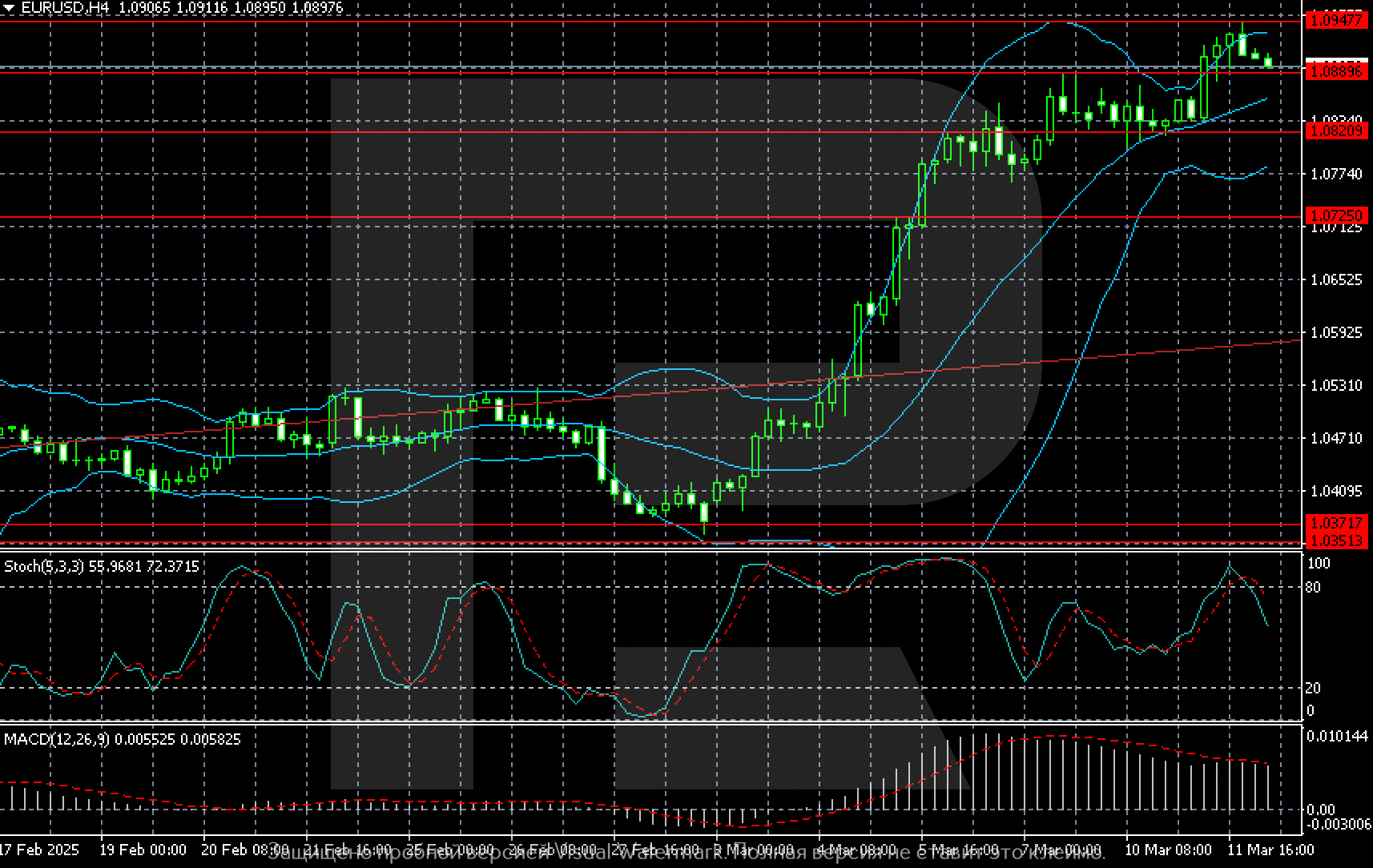

EURUSD is in positive territory again: another rise is likely

The EURUSD pair continues to rise and has already reached 1.0509. The market is interested in risk again. Discover more in our analysis for 24 February 2025.

EURUSD forecast: key trading points

- The EURUSD pair rose amid improved expectations for the eurozone

- The market is interested in risk but is still cautious

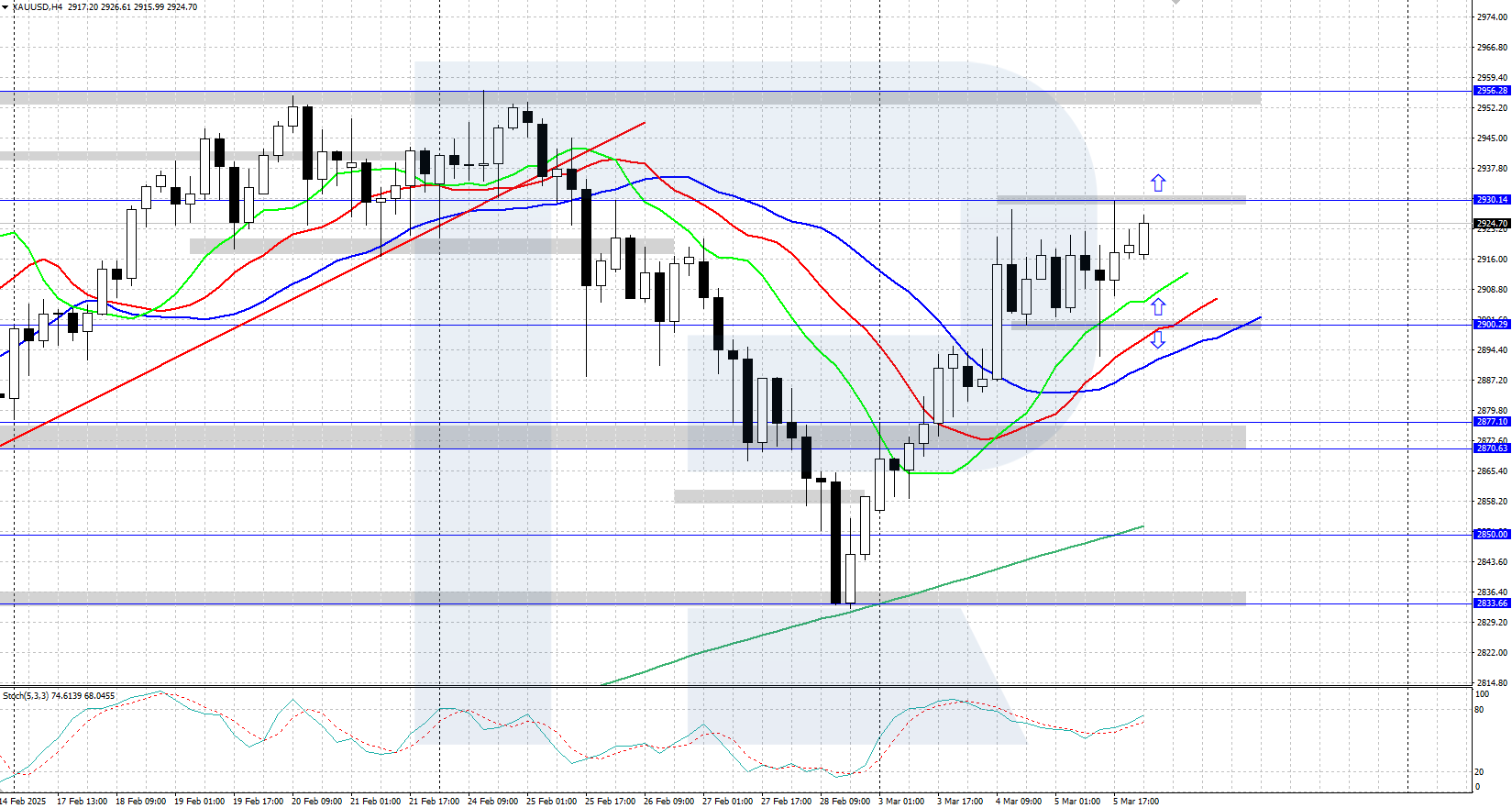

- EURUSD forecast for 24 February 2025: 1.0529

Fundamental analysis

The EURUSD rate strengthened, reaching 1.0509.

The euro fully recouped Fridayís losses after the conservative Christian democrats won the German elections. The preliminary elections were largely in line with investor expectations.

The market is now focused on the timing of forming a coalition. Conservative opposition leader Friedrich Merz intends to create one within the next two months. Strong and cohesive management is considered essential to push through much-needed fiscal reforms, especially amid economic stagnation in Germany and trade tensions over US tariff policy.

Reform of the debt system, which has restrained investments for years, is expected to support both the eurozoneís stocks and the EUR rate.

The latest data showed that private sector activity in the eurozone remained stable in February. The PMI decreased to 50.2 points, below the expected 50.5.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks