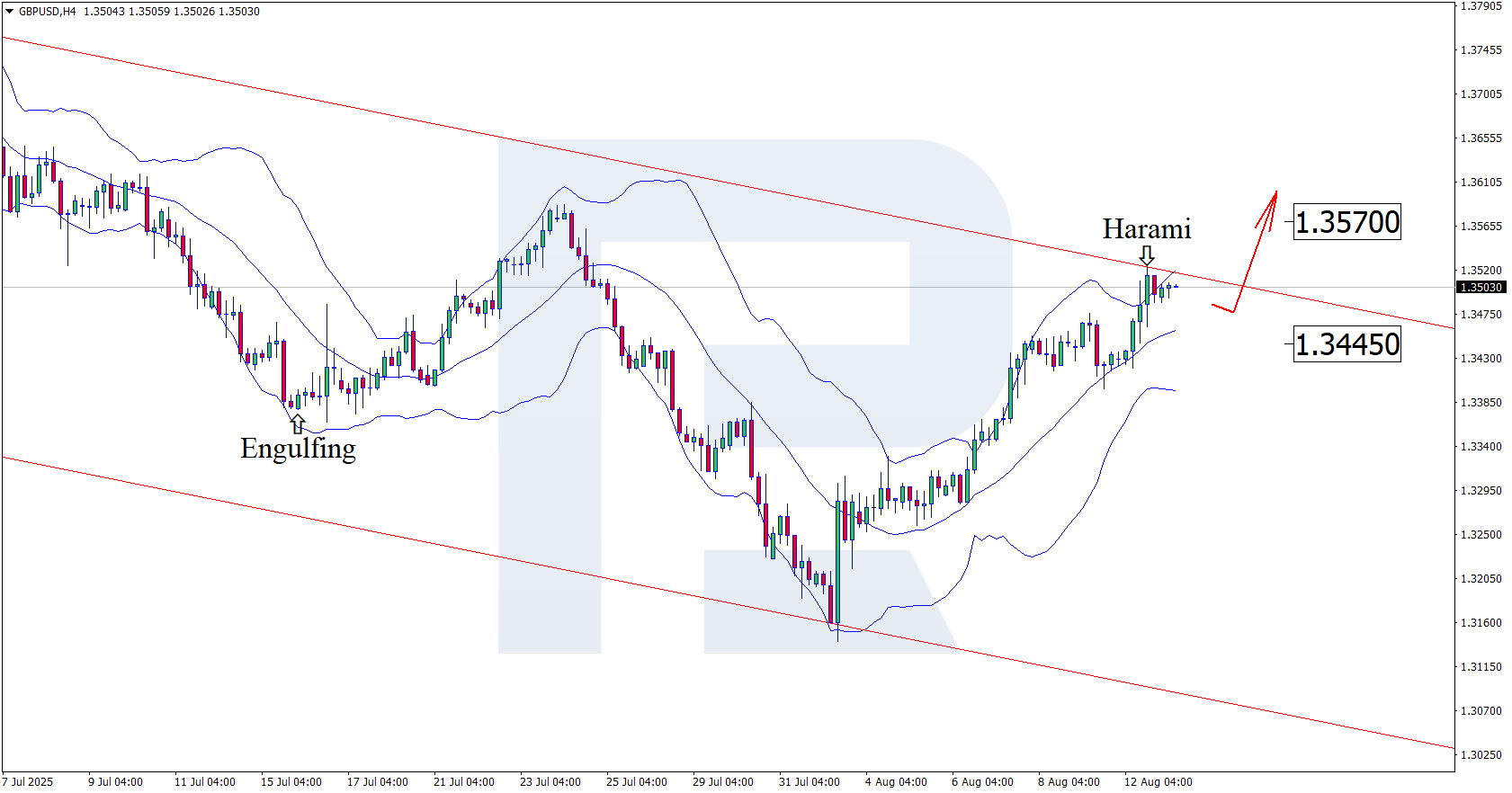

Bullish correction in GBPUSD slows near resistance at 1.3350

Investors remain cautiously optimistic about GBPUSD amid a weakening US dollar, with the price currently at 1.3306. Discover more in our analysis for 6 August 2025.

GBPUSD forecast: key trading points

- The US ISM services PMI fell to 50.1 in July

- The ISM report indicates almost complete stagnation in the services sector

- GBPUSD forecast for 6 August 2025: 1.3090

Fundamental analysis

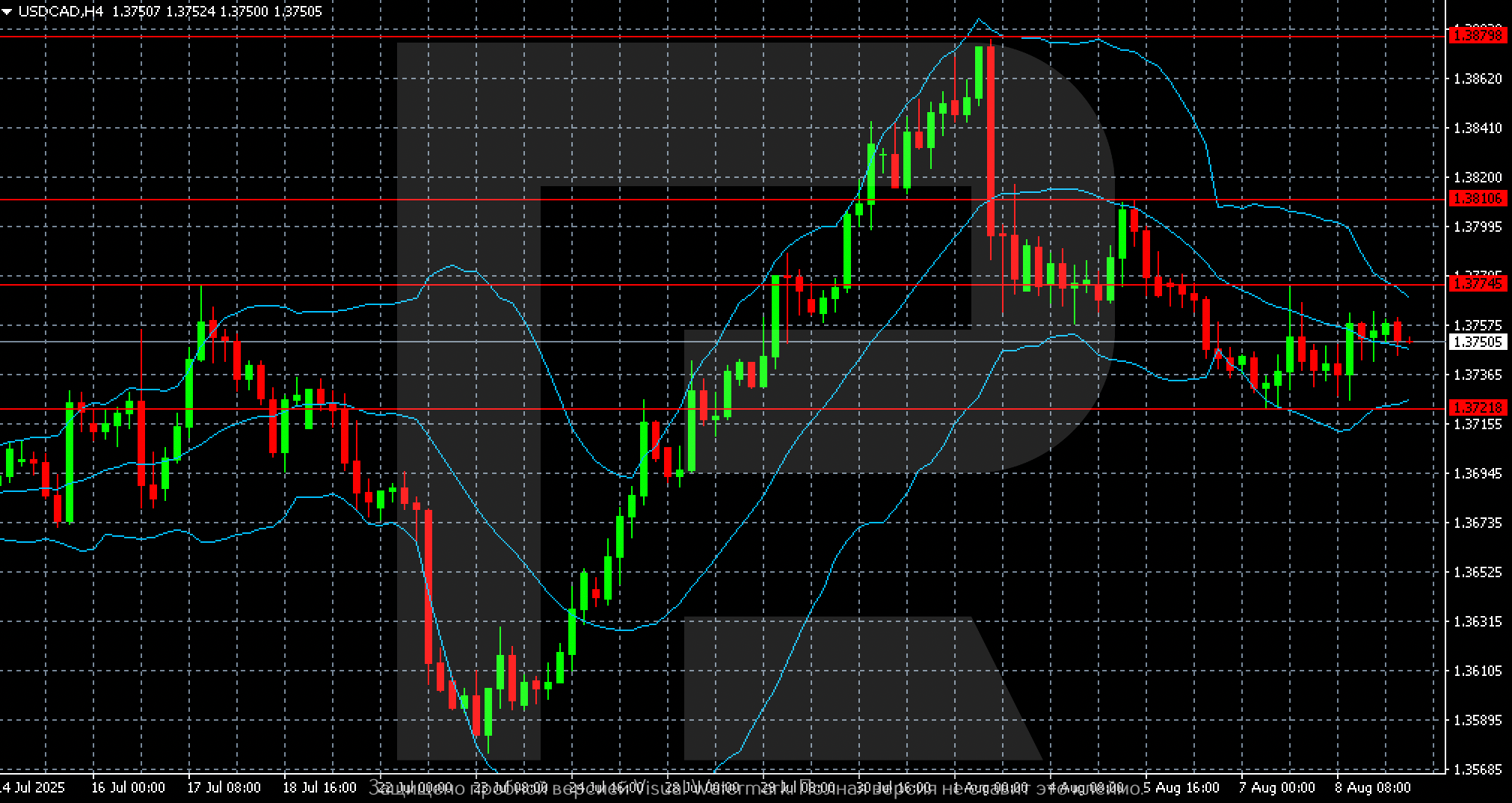

The GBPUSD rate has been strengthening for the fourth consecutive session, forming a moderate bullish correction. However, the price remains below the key resistance level at 1.3350.

The US dollar remains under pressure following the unexpected drop in the ISM services PMI to 50.1 in July, down from 50.8 in June. The market consensus had expected an increase to 51.5. The release suggests a near standstill in services sector growth, highlighting the negative impact of President Donald Trump's tariff policy.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks