USDCAD: Bank of Canadaís dovish stance supports the US dollar

The USDCAD pair remains locked within a Triangle pattern, driven by diverging monetary policies of the Fed and the Bank of Canada. The exchange rate currently stands at 1.3797. Find out more in our analysis for 22 September 2025.

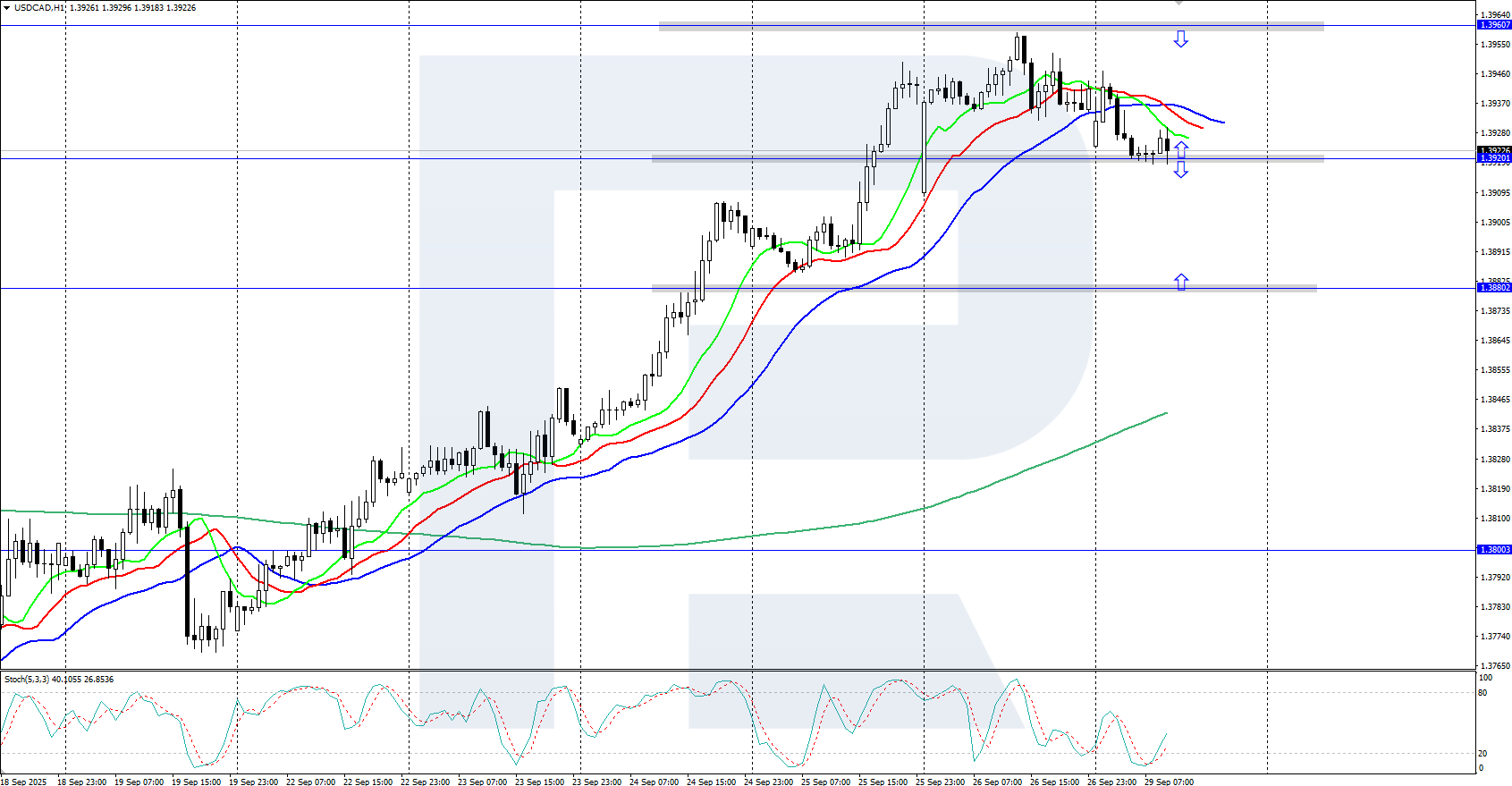

USDCAD technical analysis

The USDCAD rate is trading within a developing Triangle pattern. The pair recently bounced from the upper boundary of the descending channel and is attempting to hold above the Moving Averages, indicating sustained buying pressure.

The combination of the Bank of Canadaís dovish policy and expectations of guidance from the Fed creates conditions for further US dollar strength.

Read more - USDCAD Forecast

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks