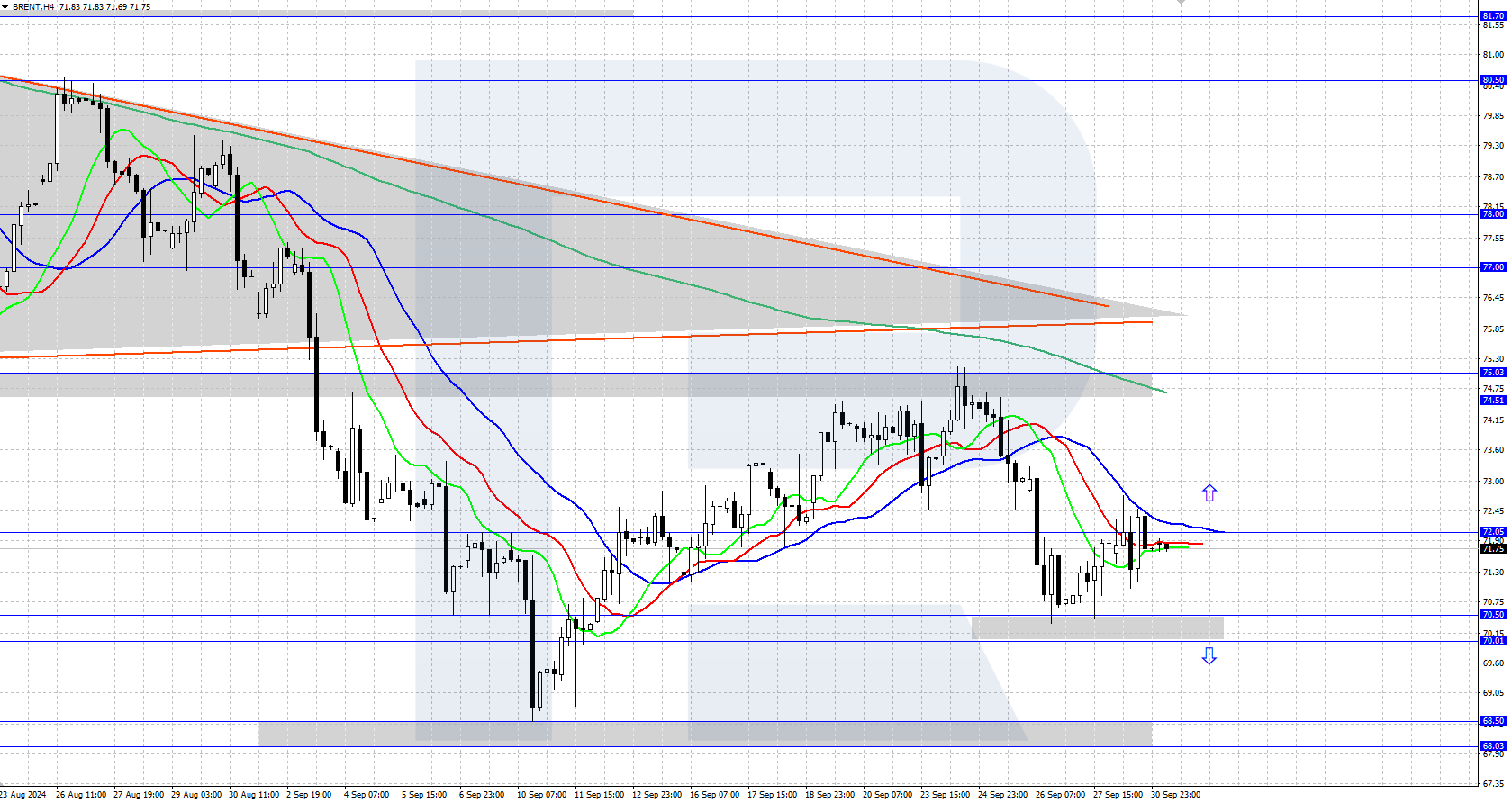

Brent crude oil continues its upward correction, trading near 74.00 USD

The Brent price is experiencing an upward correction, bolstered by investor optimism following the recent Fed rate cut. However, despite the current correction, the overall trend remains downward, and further declines are possible. For more detailed insights, read our Brent analysis and market outlook for today, 24 September 2024.

Brent forecast: key trading points

- US data: today, the market is anticipating the release of the API oil inventories data, which is expected to provide a significant indicator for the short-term direction of Brent prices

- Current trend: an upward correction of oil prices is underway within a broader downtrend

- Brent forecast for 24 September 2024: 75.00 and 70.00

Fundamental analysis

Brent prices are seeing a corrective rise after finding support in the demand zone of 68.00-68.50 USD. This price rebound is driven by the US stock market strengthening and growing investor optimism over the Federal Reserveís shift toward monetary easing.

Today, all eyes are on the APIís report on oil reserves in the US, which could provide further news on Brentís trajectory. A decline in inventories may offer short-term support for Brent prices, while an increase could generate a bearish signal, potentially accelerating the downtrend. Additionally, tomorrowís report from the EIA will provide more clarity on the future Brent forecast.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks