EURUSD rose: the market awaits US employment market statistics

Supported by expectations regarding the Federal Reserveís policy, the EURUSD pair returned above 1.1100, rising for the third consecutive session. Find out more in our analysis for 6 September 2024.

EURUSD forecast: key trading points

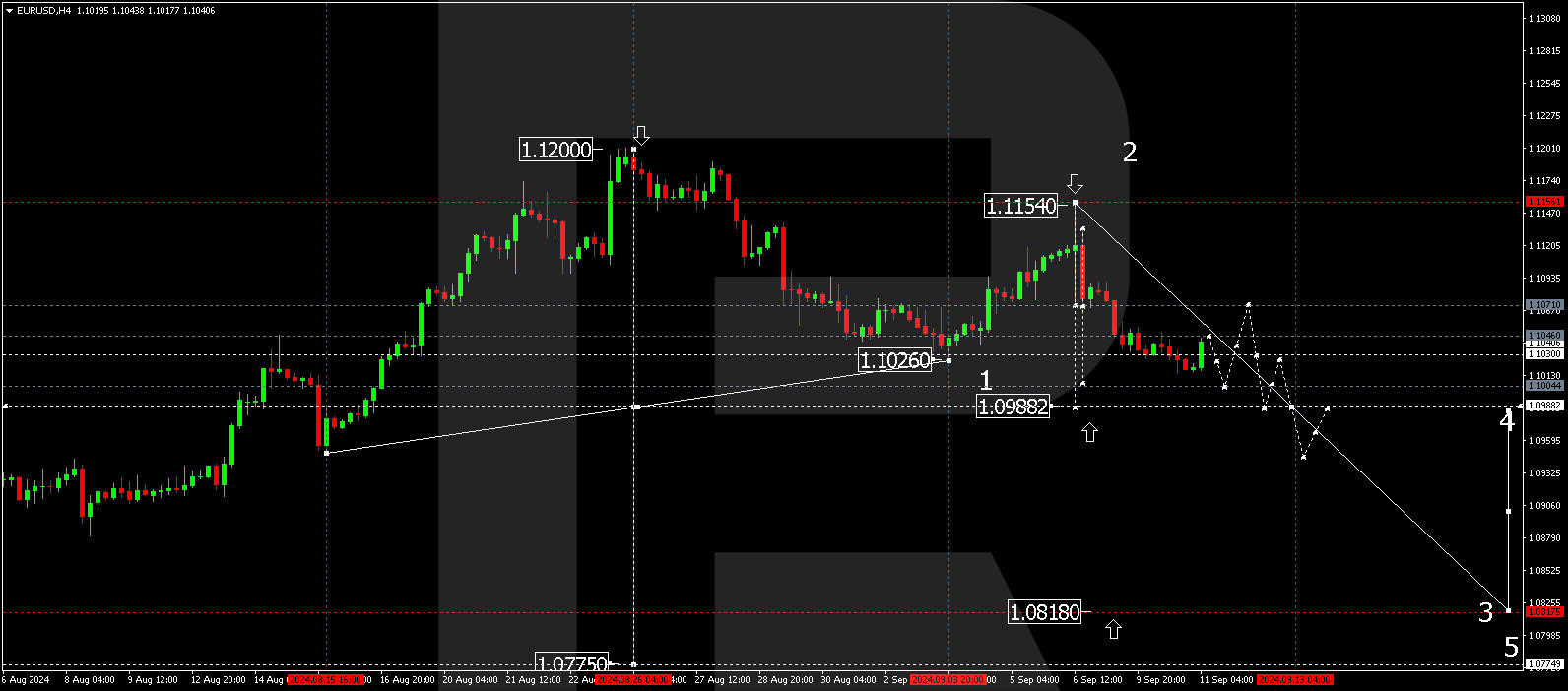

- The EURUSD pair has resumed steady growth

- Today, investors are awaiting the crucial US employment sector releases for August

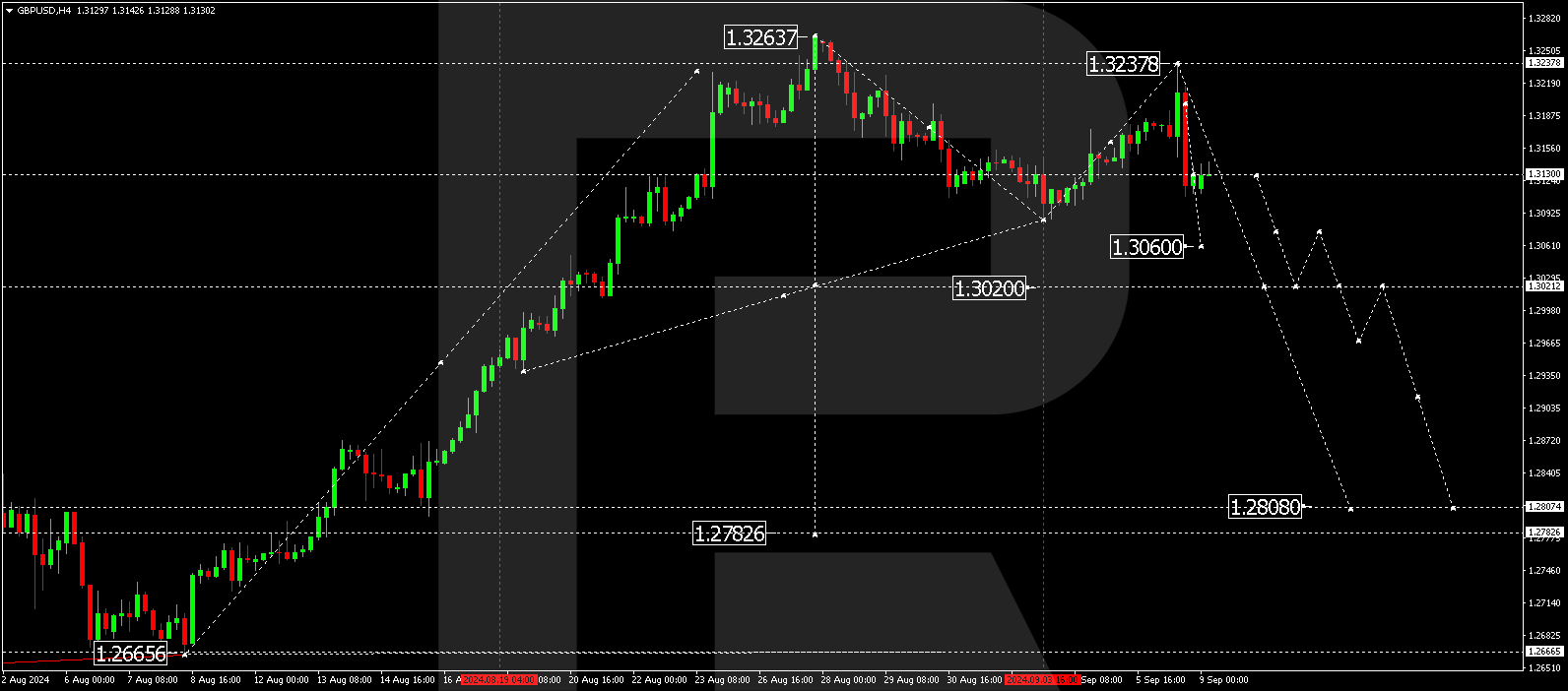

- EURUSD forecast for 6 September 2024: 1.1133, 1.1026, and 1.0985

Fundamental analysis

The EURUSD rate climbed to 1.1115.

The first release of US employment market data for August surprised the market yesterday. ADP private sector jobs increased by only 99,000, missing the forecast of 144,000 and falling short of the previous increase of 122,000. While there is no direct correlation between these figures and nonfarm payrolls, the sentiment is clear: the employment market is losing jobs.

This may prompt the US Federal Reserve to act even more swiftly than planned. In this context, todayís statistics are crucial, with the US unemployment rate report for August scheduled for release this evening. The main forecast suggests a decrease to 4.2% from 4.3%. Nonfarm payrolls could expand by 164,000 following previous growth of 114,000. However, statistics may bring surprises.

The EURUSD forecast suggests an increase in volatility later this afternoon.

RoboForex Market Analysis & Forex Forecasts

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks