Murrey Math Lines 08.10.2019 (AUDUSD, NZDUSD)

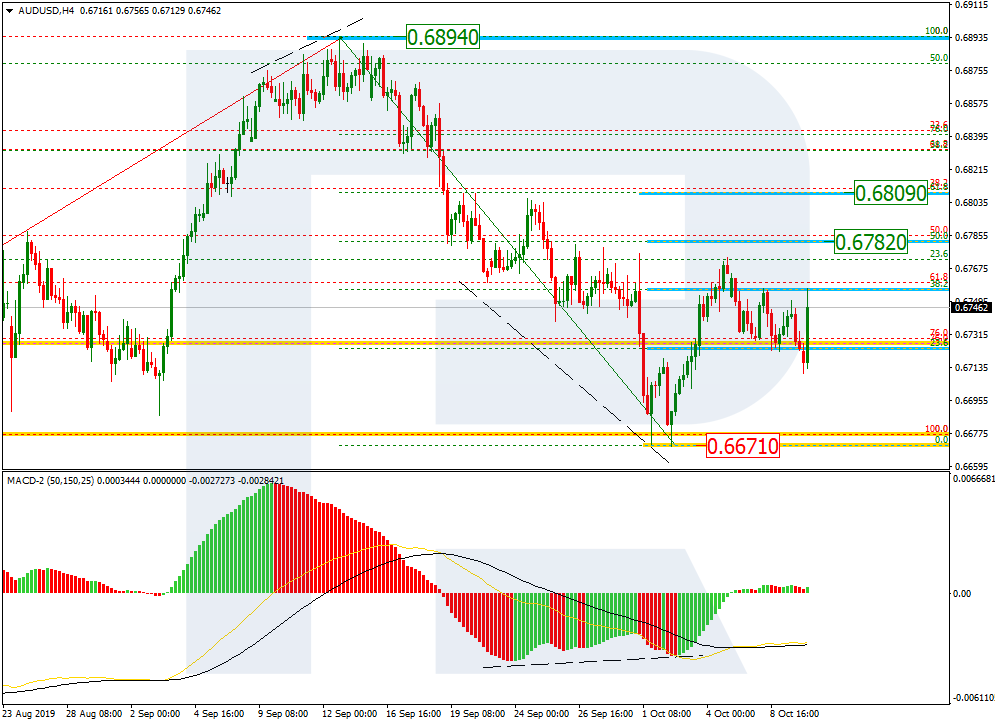

AUDUSD, “Australian Dollar vs US Dollar”

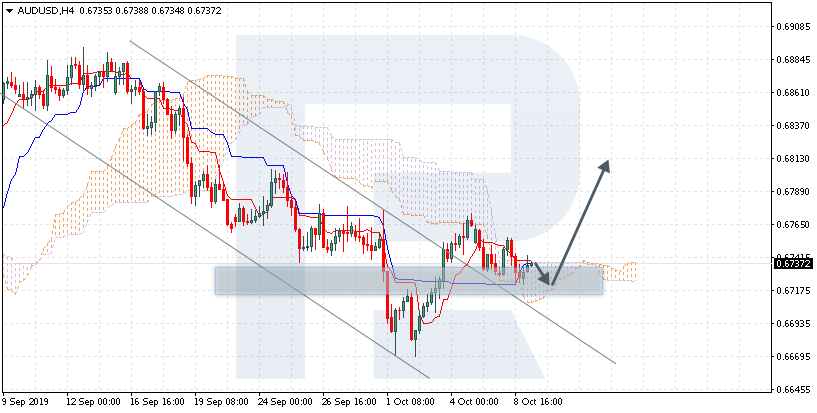

As we can see in the H4 chart, AUDUSD is consolidating at 5/8. In this case, the pair is expected to continue growing towards the resistance at 8/8. However, this scenario may no longer be valid if the price breaks 4/8. After that, the instrument may continue falling to reach the support at 3/8.

Read more - Murrey Math Lines AUDUSD, NZDUSD

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks