Murrey Math Lines 15.10.2019 (AUDUSD, NZDUSD)

AUDUSD, “Australian Dollar vs US Dollar”

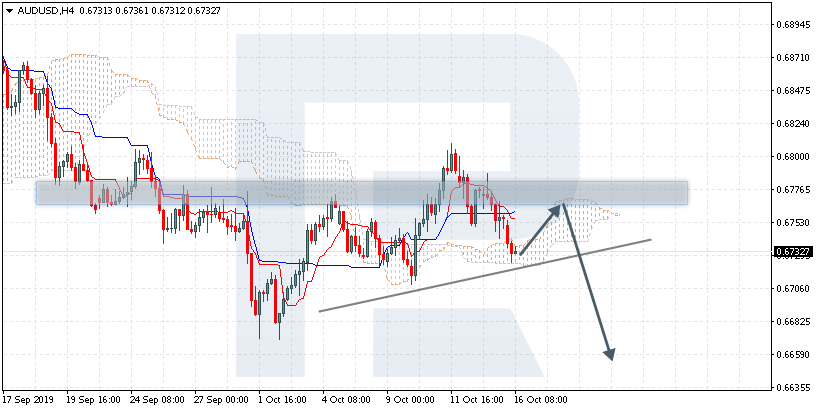

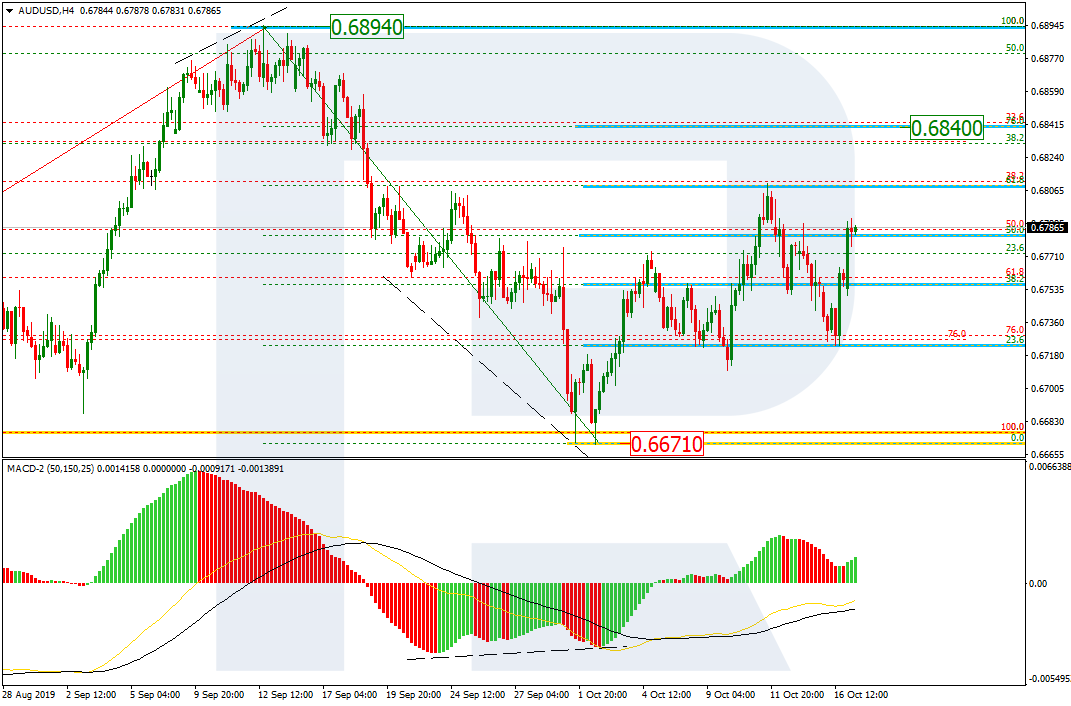

In the H4 chart, the pair started skyrocketing earlier, but then stopped close to the resistance at 7/8. In this case, the pair is expected to resume falling towards the support at 3/8. However, this scenario may no longer be valid if the price breaks 7/8. After that, the instrument may continue growing to reach the resistance at 8/8.

Read more - Murrey Math Lines 15.10.2019 (AUDUSD, NZDUSD)

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks