Murrey Math Lines 01.10.2019 (AUDUSD, NZDUSD)

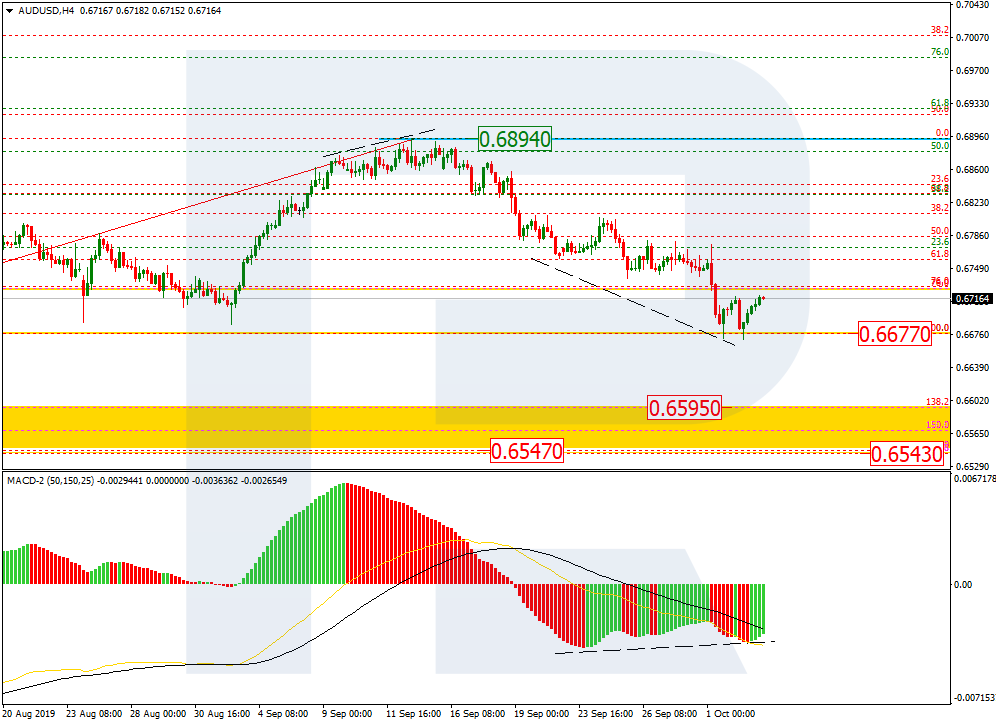

AUDUSD, ďAustralian Dollar vs US DollarĒ

In the H4 chart, AUDUSD is consolidating. In this case, the pair is expected to continue falling towards the support at 3/8. However, this scenario may no longer be valid if the price breaks 5/8. After that, the instrument may continue growing to reach the resistance at 7/8.

Read more - Murrey Math Lines AUDUSD, NZDUSD

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks