Inflation top of the agenda as Euro slumps

The rampant inflation that has blighted the everyday lives of European citizens for over a year has now reached the high profile dialog of Christine Lagarde.

Ms. Lagarde, who is the President of the European Central Bank, has publicly stated that "inflation is a monster that we need to knock on the head”.

This may appear an obvious remark considering that consumers and businesses across Western Europe have been faced with inflation levels at around 10% to 11% for almost a year now, and in parts of Eastern Europe over 25% which has resulted in discernible levels of hardship for many citizens and businesses.

Perhaps the most concerning part of Ms. Lagarde’s direction on this matter is that she, along with many other central bankers across the Western world who are charged with the responsibility of managing inflation levels in the markets over which they preside, views interest rate increases as a solution.

This is a well-worn method of curtailing consumer spending and putting a stop to consumer borrowing, however it is also a generator of barriers to economic strength in that many members of the public can often become disenfranchised by being unable to afford to buy a house due to mortgage payment increases that are not in line with their earnings, and those who already have a mortgage feel the pinch as they have to find extra money to cover the increasing payments and spend less on other items.

Ms. Lagarde explained to press in Spain this week that the European Central Bank is not seeking to “break the economy” with rate increases as she appealed for banks to reschedule debt repayments for households struggling to cope with soaring borrowing costs on variable-rate mortgages.

That perhaps is one soundbite which attempts to try to soothe the fears of borrowers but ultimately the message remains that interest rates are increasing and have been for over a year now.

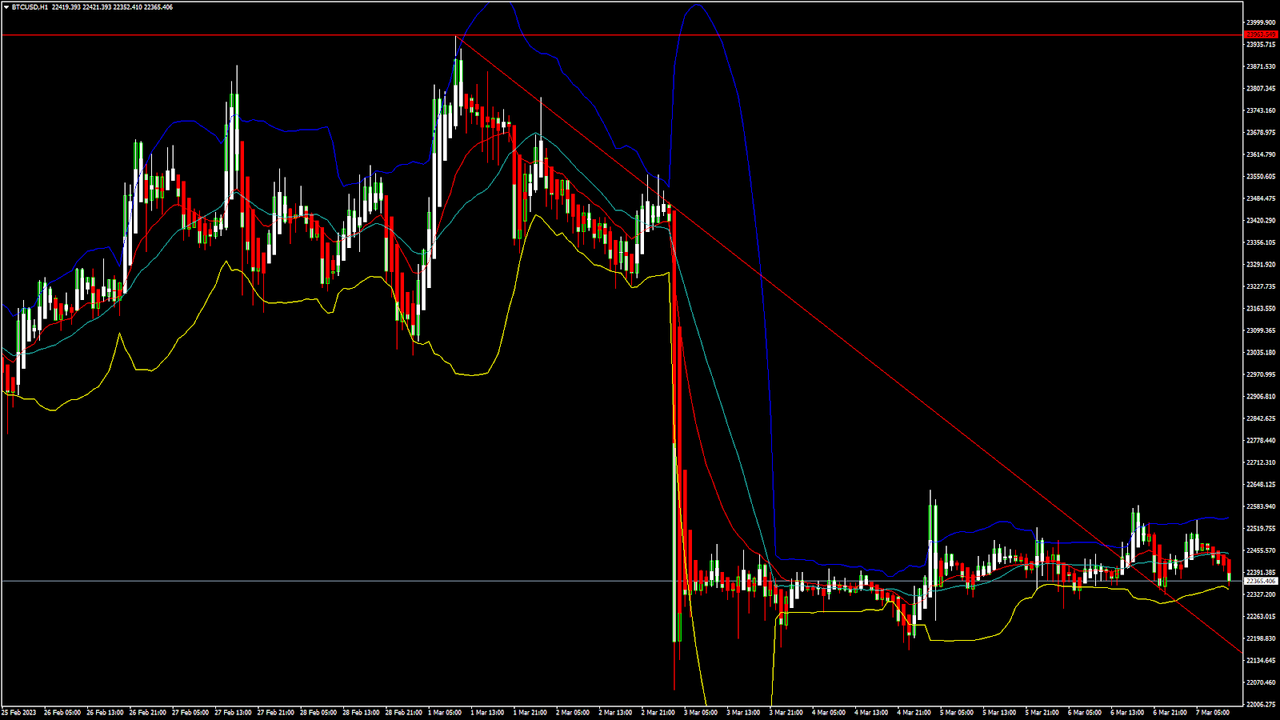

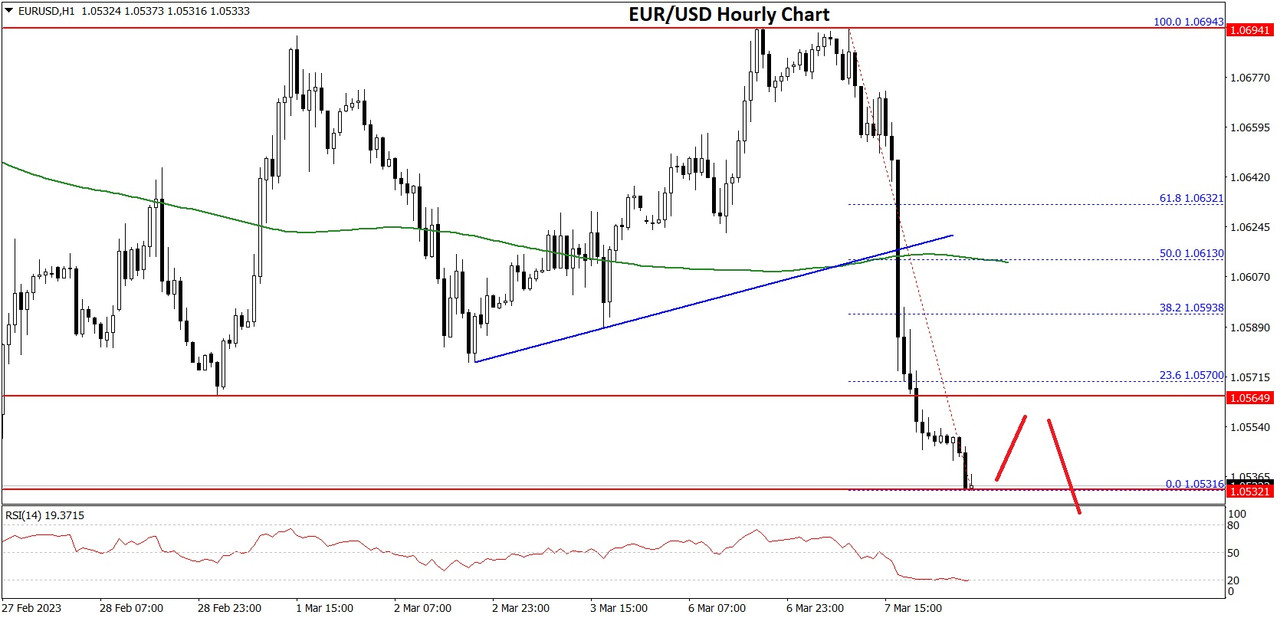

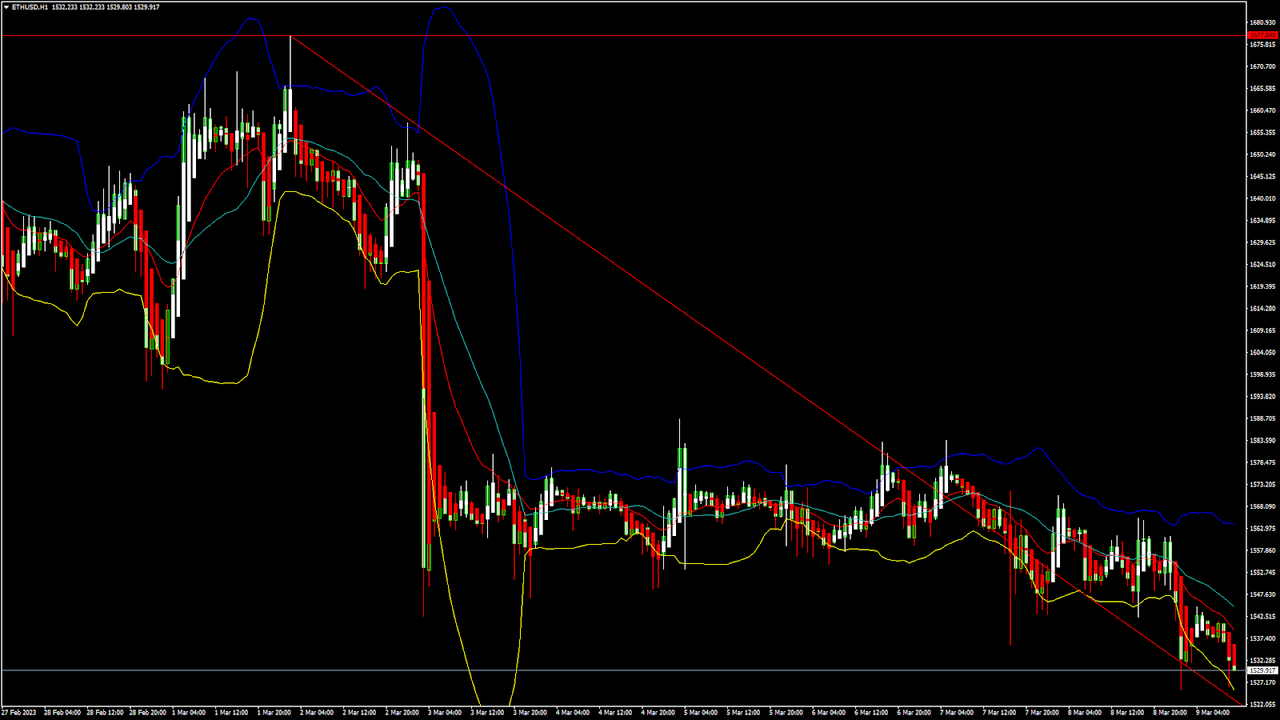

The Euro is now at almost parity with the US Dollar, this morning weighing in at 1.06, against a backdrop of US inflation having decreased from double figures last year to around 7% in recent weeks.

Of course, US inflation having decreased has its own disadvantages for US-based multinational businesses as they have to now pay more to supply and operate their European subsidiaries, however overall the domestic US economy appears to be settling down and the depreciation of the currency against everyday life expenses is nowhere near at European or British levels.

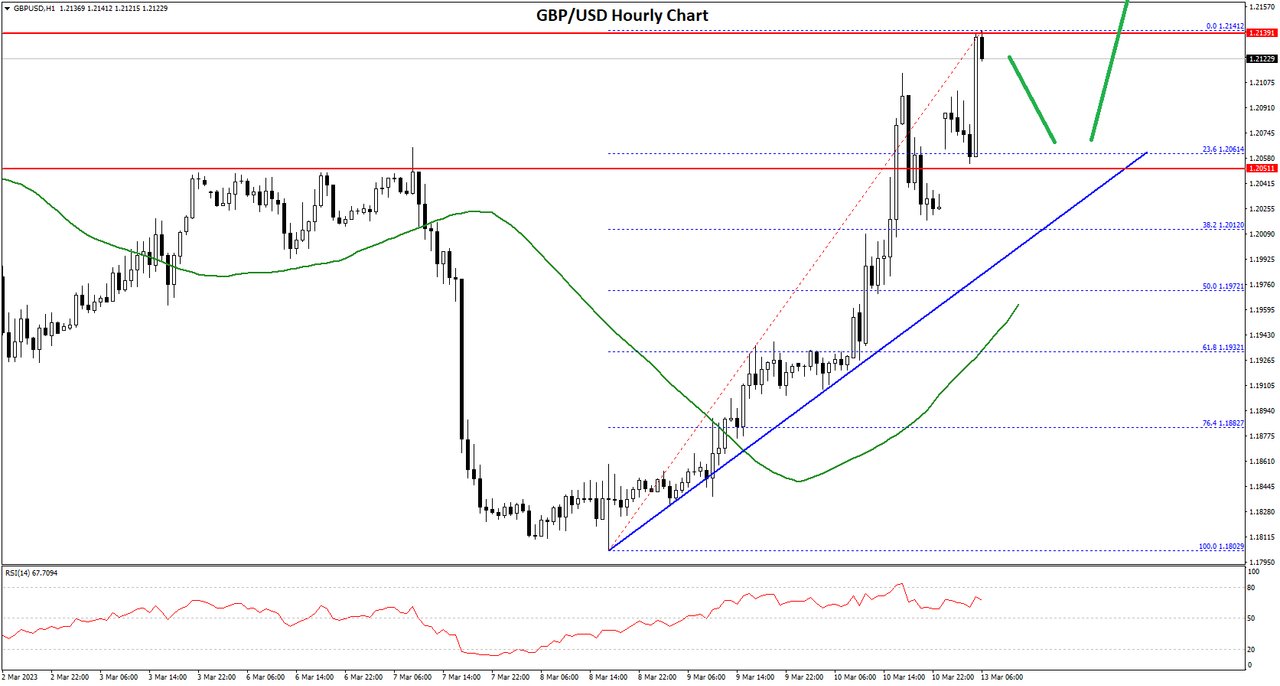

Certainly volatility is in the air for the Euro and likely the Pound too, as the British inflation level and monetary policy appears to resemble that of mainland Western Europe.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks