Facebook Stock Price Under Pressure After This Week’s Outage

At the beginning of this trading week, Facebook suffered an outage that lasted for several hours and prevented the users of its apps and services, including Instagram, WhatsApp, and even the company’s website, from accessing them.

Facebook stock price dropped down, too. Investors reacted quickly by selling the stock short, as the outage has created a dangerous precedent.

Facebook makes most of its revenues from running ads on its platforms, mainly on Facebook, but also on Instagram. The shutdown of any of its income sources is a threat to the company’s future, and the fact that Facebook was not able to recover for several hours worried investors.

A faulty configuration change was responsible for the outage, according to Facebook. The big question is, could it happen again?

What Does Technical Analysis Say?

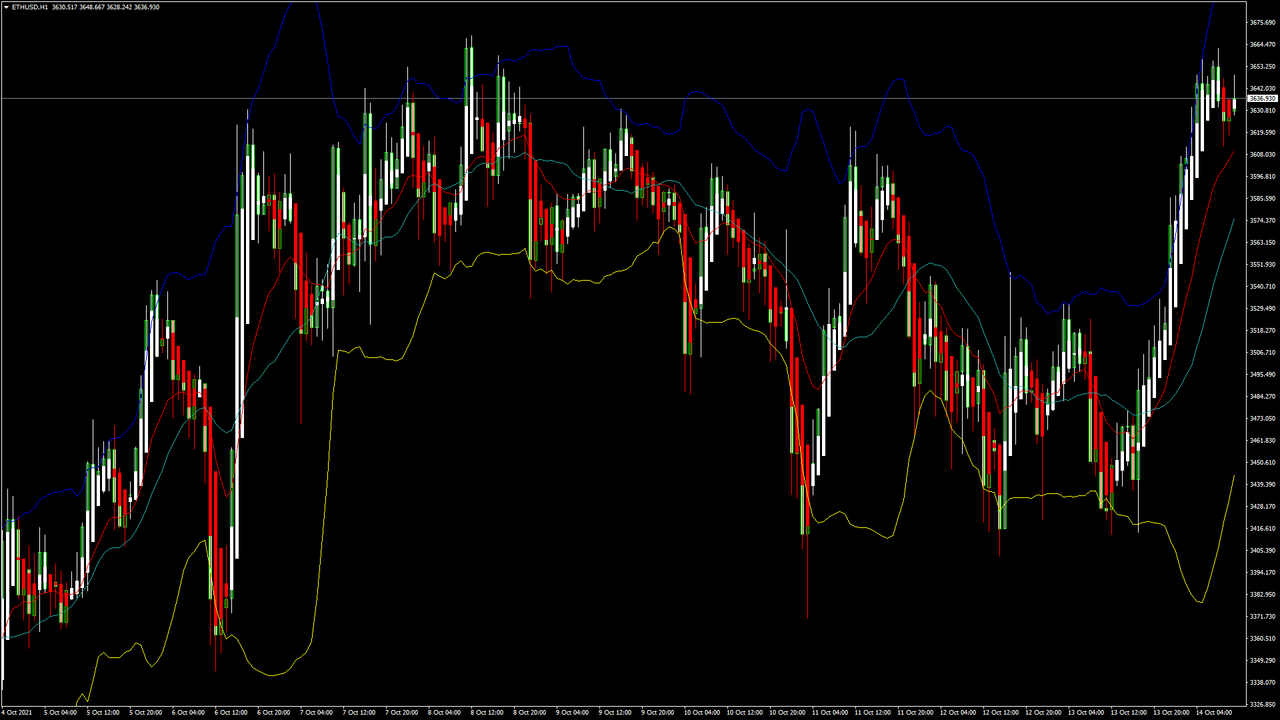

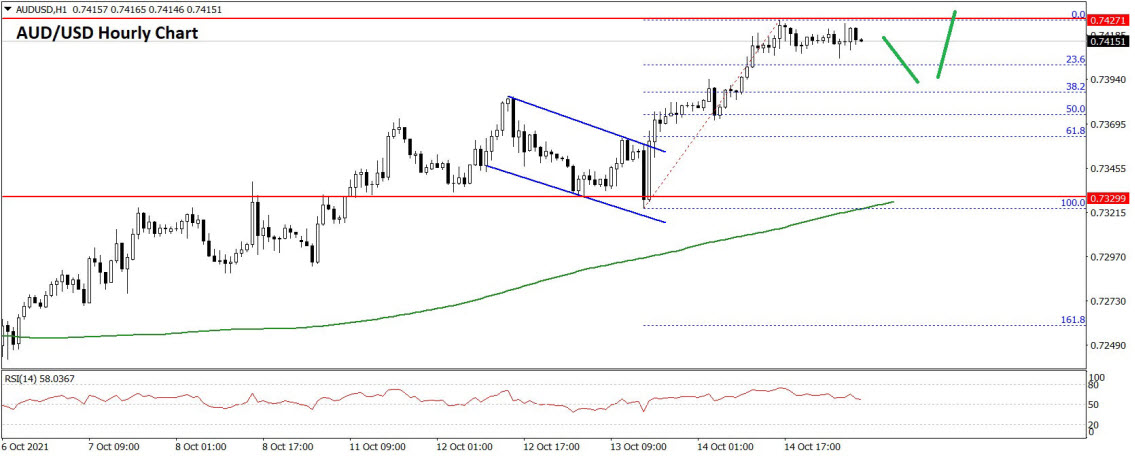

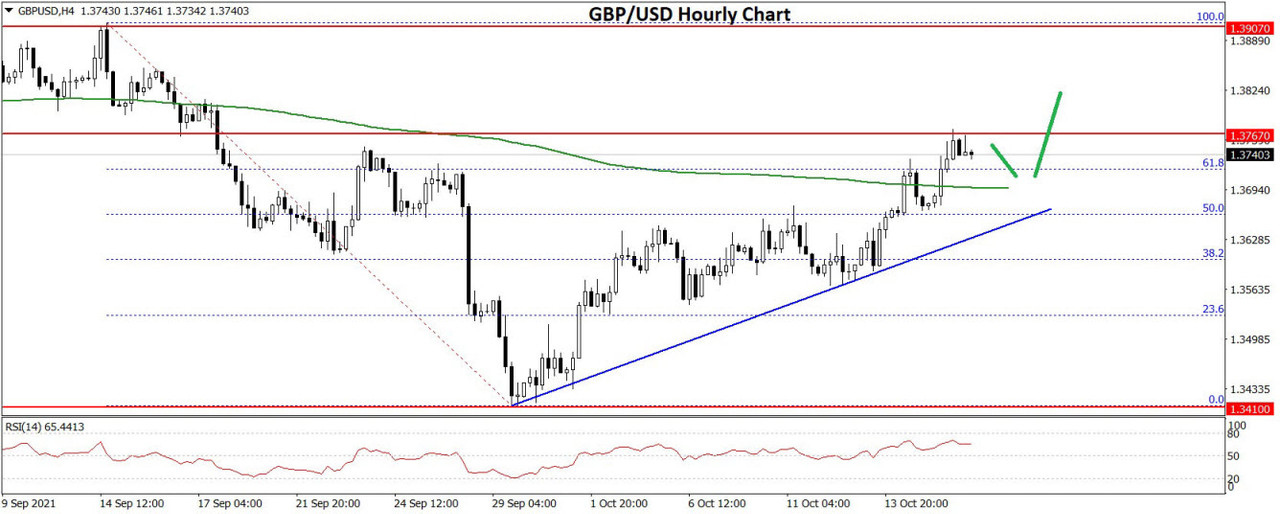

Truth be told, Facebook charts looked bearish well before this week’s shutdown. The stock price started trending higher after it broke out of a bullish triangle in spring, and did not look back all the way until it reached $380.

It climbed to record levels making a series of higher highs and higher lows, typical in rising trends. Technical traders can even spot a bullish channel, but one that is broken now.

Moreover, the price action is bearish at the moment because the decline caused by this week’s incident broke the higher lows series. Such a break is said to be bearish, as it signals the end of the previous bullish trend. Moving forward, support is not seen until the level of $300.

Facebook is to report its quarterly earnings on October 25, and the market expects EPS of $3.17. The company operates with a gross profit margin of 80.98%, much higher than the 51.07% sector median. Facebook stock price is up +21.89% this year.

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks