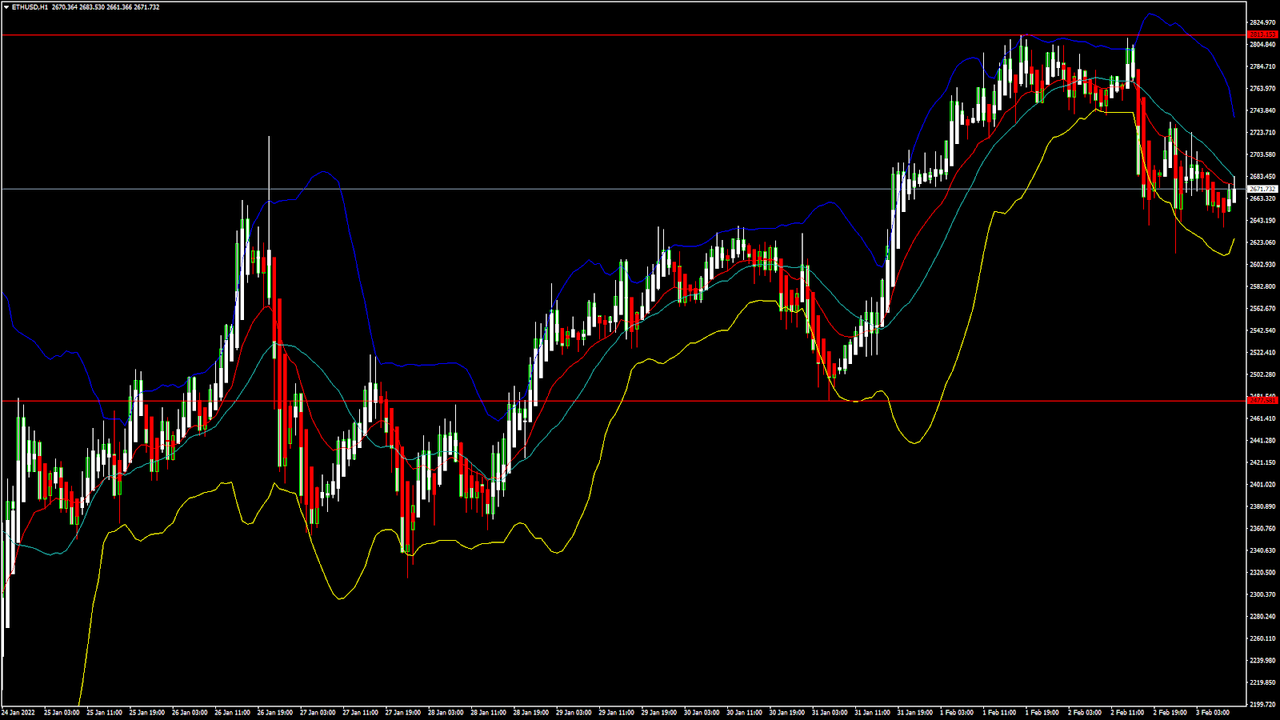

ETHUSD and LTCUSD Technical Analysis – 27th JAN, 2022

ETHUSD – Bearish Engulfing Pattern Below $2700

Ethereum started a major bearish correction from its highs of 3268 reached on 20th January. We can see that after a mild bullish correction wave, the bearish trend is back which continues to push down the prices of Ethereum below the $2500 handle in the European Trading session today.

ETHUSD touched an intraday low of 2355 in the Asian trading session today after which we can see some consolidation in its prices above the $2300 handle.

We can clearly see a Bearish Engulfing Pattern below the $2700 handle which is a bearish pattern and signifies a potential shift in the market direction towards a Downtrend.

ETH is now trading just above its Pivot levels of 2403 and is moving in a Consolidation Channel. The price of ETHUSD is now testing its Classic support levels of 2358 and Fibonacci support levels of 2392 after which the path towards 2200 will get cleared.

Relative Strength Index is at 41 indicating a WEAK demand for the Ethereum and the continuation of the Selling pressure in the markets.

Most of the of the Technical indicators are giving a STRONG SELL Signal.

ETH is now trading Below its both the 100 Hourly and 200 Hourly Simple Moving Averages.

- Ether Bearish momentum is seen below the $2700 mark.

- Short-term range appears to be BEARISH.

- Ultimate Oscillator is indicating a NEUTRAL market.

- Average True Range is indicating LESS Market Volatility.

Ether Bearish Momentum seen Below $2700

ETHUSD continues to move into a Mild Bearish channel below the $2700 handle in the European Trading session today.

Average Directional Change is indicating a NEUTRAL market, and the overall sentiment is shifted towards the Bearish market.

The heavy selling pressure in Ethereum and its subsequent liquidation by the long-term investors is due to the fear of a Russian Attack on Ukraine and its broader implications on the Crypto markets.

We are now looking at the key support levels of $2300 which if broken would push down the prices of Ethereum towards the $2200 handle.

ETH has lost -2.71% with a price change of -66.95$ in the past 24hrs and has a trading volume of 22.749 Billion USD.

We can see an Increase of 42.78% in the total trading volume in last 24 hrs. which is due to the heavy selling seen after the bullish momentum failed.

The Week Ahead

Ethereum is now approaching its important support levels of $2300 which will decide whether we will see a Bullish reversal in the markets.

If the prices of ETHUSD continue to remain above the $2300 handle as we can see today, it will signify a Bullish reversal with an Upside target of $2500 to $2800 in the next week.

The immediate short-term outlook for the Ether has turned as BEARISH, the Medium term outlook is NEUTRAL, and the Long term outlook for Ether is BULLISH towards the $3000 handle.

We have detected an MA 5 crossover pattern above 2398 levels which signifies a Bullish Trend reversal in the short term.

In this week Ether is expected to move in a range between the $2300 and $2600 and in the next week Ether is expected to trade at levels above $2600.

Technical Indicators:

Rate of Price Change: It is at -7.782 indicating a SELL.

STOCH (9,6): It is at 23.42 indicating a SELL.

Moving Averages Convergence Divergence (12,26): It is at -24.08 indicating a SELL.

STOCHRSI (14): It is at 25.04 indicating a SELL.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks