EUR/USD Might Drop, USD/CHF Gains Bullish Momentum

EUR/USD is slowly moving lower below 1.0750. USD/CHF is rising and might accelerate further higher above 0.9720 resistance zone.

Important Takeaways for EUR/USD and USD/CHF

- The Euro failed to gain pace for a move above the 1.0780 resistance zone against the US Dollar.

- There is a major bearish trend line forming with resistance near 1.0720 on the hourly chart of EUR/USD.

- USD/CHF gained pace and was able to clear the 0.9700 resistance zone.

- There is a key bullish trend line forming with support near 0.9730 on the hourly chart.

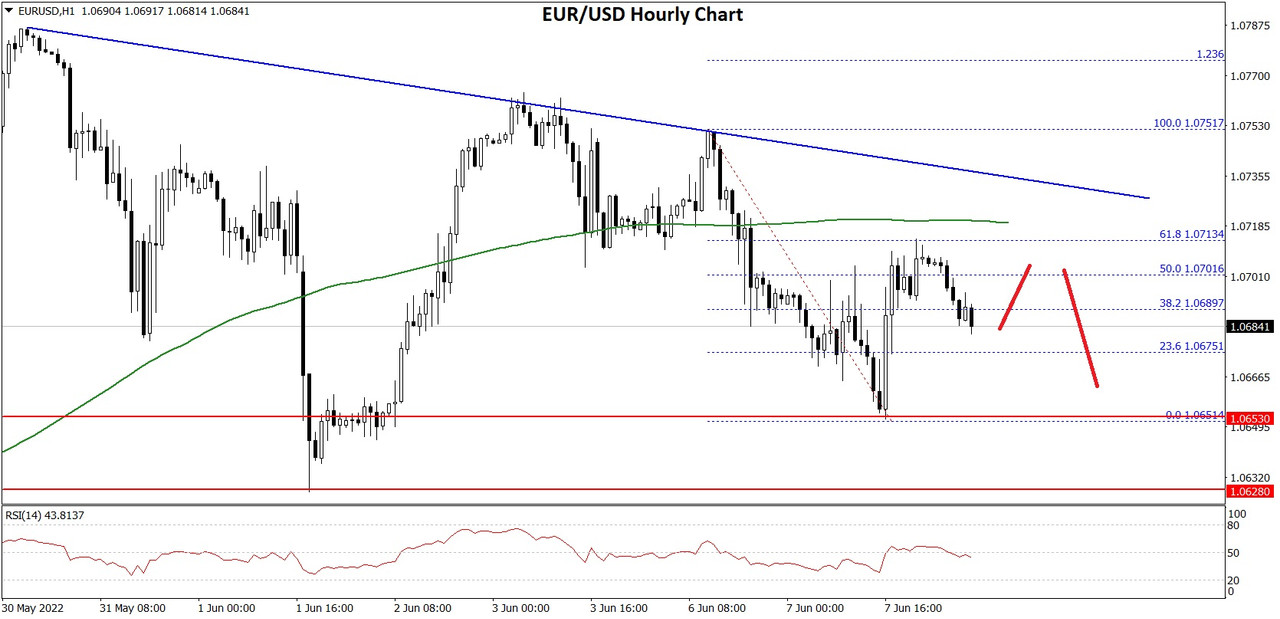

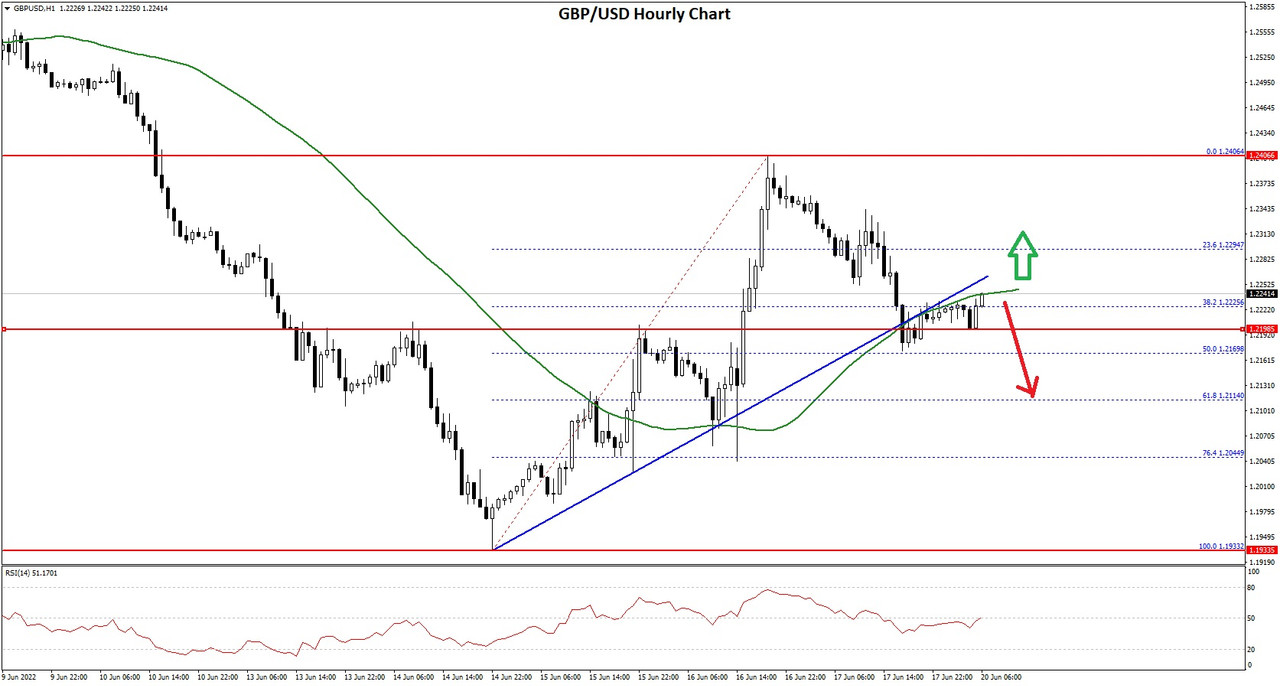

EUR/USD Technical Analysis

The Euro gained pace above the 1.0700 resistance zone against the US Dollar. The EUR/USD pair climbed above the 1.0720 resistance zone to move into a bullish zone.

The pair attempted a clear move above the 1.0750 resistance, but the bears remained active. The recent high was formed near 1.0751 before the pair started a fresh decline. The price declined below the 1.0700 level and traded as low as 1.0651 on FXOpen.

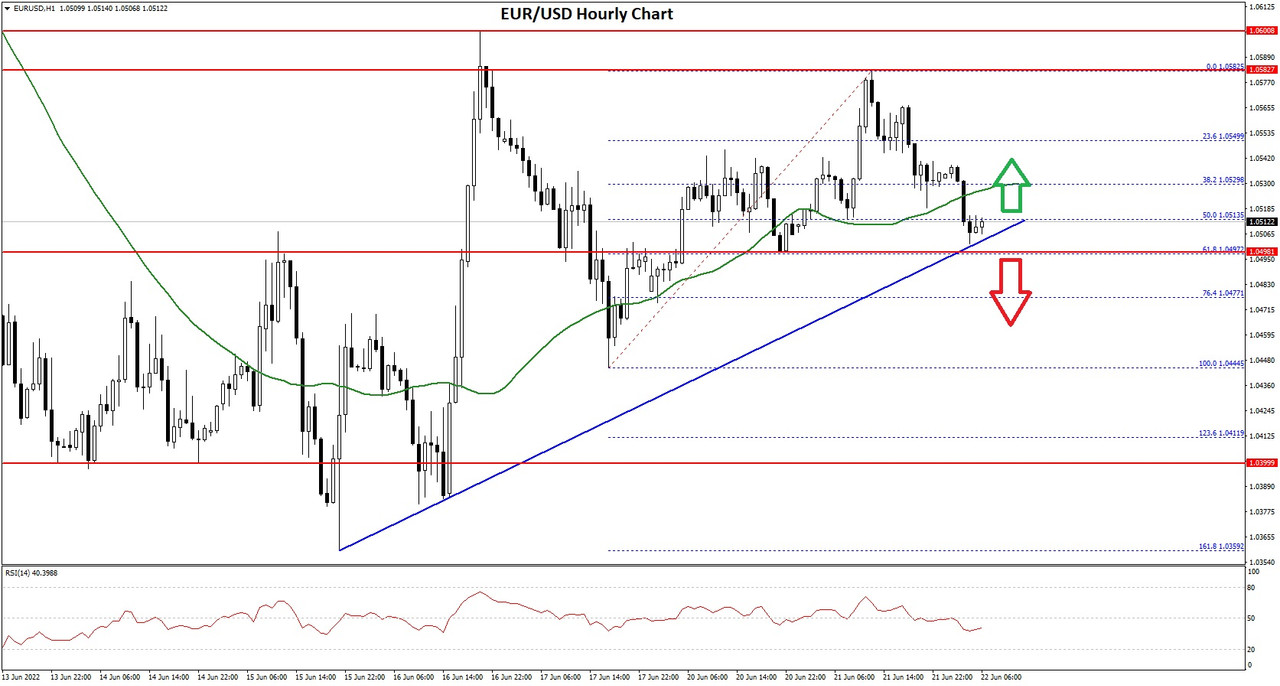

EUR/USD Hourly Chart

There was a recovery wave above the 1.0680 level. It cleared the 50% Fib retracement level of the recent decline from the 1.0751 swing high to 1.0651 low.

However, the pair faced sellers near the 1.0710 level and the 50 hourly simple moving average. Besides, there is a major bearish trend line forming with resistance near 1.0720 on the hourly chart of EUR/USD. The 61.8% Fib retracement level of the recent decline from the 1.0751 swing high to 1.0651 low is also acting as a resistance.

The next major resistance is near the 1.0750 level. A clear move above the 1.0750 resistance zone could set the pace for a larger increase towards 1.0850. The next major resistance is near the 1.0920 zone.

On the downside, an immediate support is near the 1.0650 level. The next major support is near the 1.0620 level. A downside break below the 1.0620 support could start another decline.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks