EUR/USD and EUR/JPY Eye Additional Upsides

EUR/USD started a fresh increase above the 1.1380 resistance. EUR/JPY is rising and aiming an upside break above the 132.20 resistance zone.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro started a fresh increase after it formed a base above the 1.1300 level.

- There is key bullish trend line forming with support near 1.1410 on the hourly chart.

- EUR/JPY gained bullish momentum after it broke the 130.80 resistance zone.

- There is a major bullish trend line forming with support near 130.65 on the hourly chart.

EUR/USD Technical Analysis

The Euro formed a base above the 1.1180 level against the US Dollar. The EUR/USD pair started a steady increase and was able to clear many hurdles near 1.1250.

The pair traded above the 1.1350 resistance and the 50 hourly simple moving average. Besides, there was a clear move above the 1.1400 level. The pair traded as high as 1.1483 on FXOpen and is currently correcting gains.

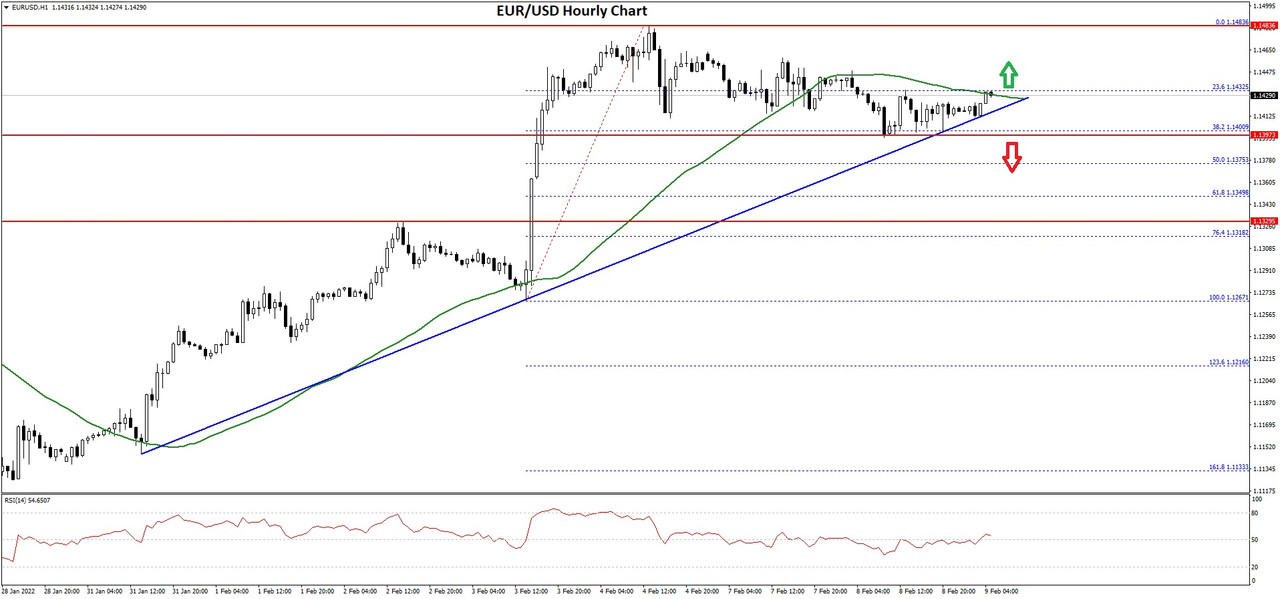

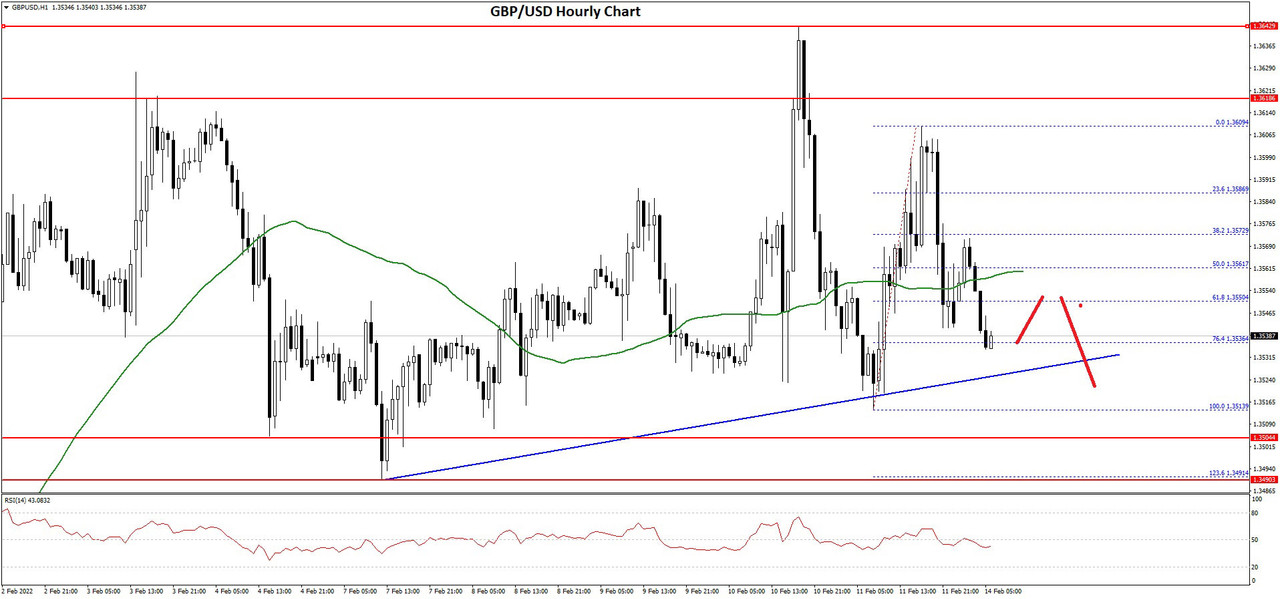

EUR/USD Hourly Chart

There was a move below the 1.1450 support level. EUR/USD declined below the 23.6% Fib retracement level of the upward move from the 1.1267 swing low to 1.1483 high.

However, the bulls are now protecting the 1.1400 support zone. There is also a key bullish trend line forming with support near 1.1410 on the hourly chart. If there is a downside break below the trend line, the pair could test 1.1375.

It is near the 50% Fib retracement level of the upward move from the 1.1267 swing low to 1.1483 high. The next major support sits near the 1.1340 level. On the upside, the pair is facing resistance near the 1.1450 level.

The next major resistance is near the 1.1480 level. The main resistance is forming near the 1.1500 level. A clear break above the 1.1500 resistance could push EUR/USD towards 1.1550. If the bulls remain in action, the pair could rise above the 1.1620 resistance zone in the near term.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks