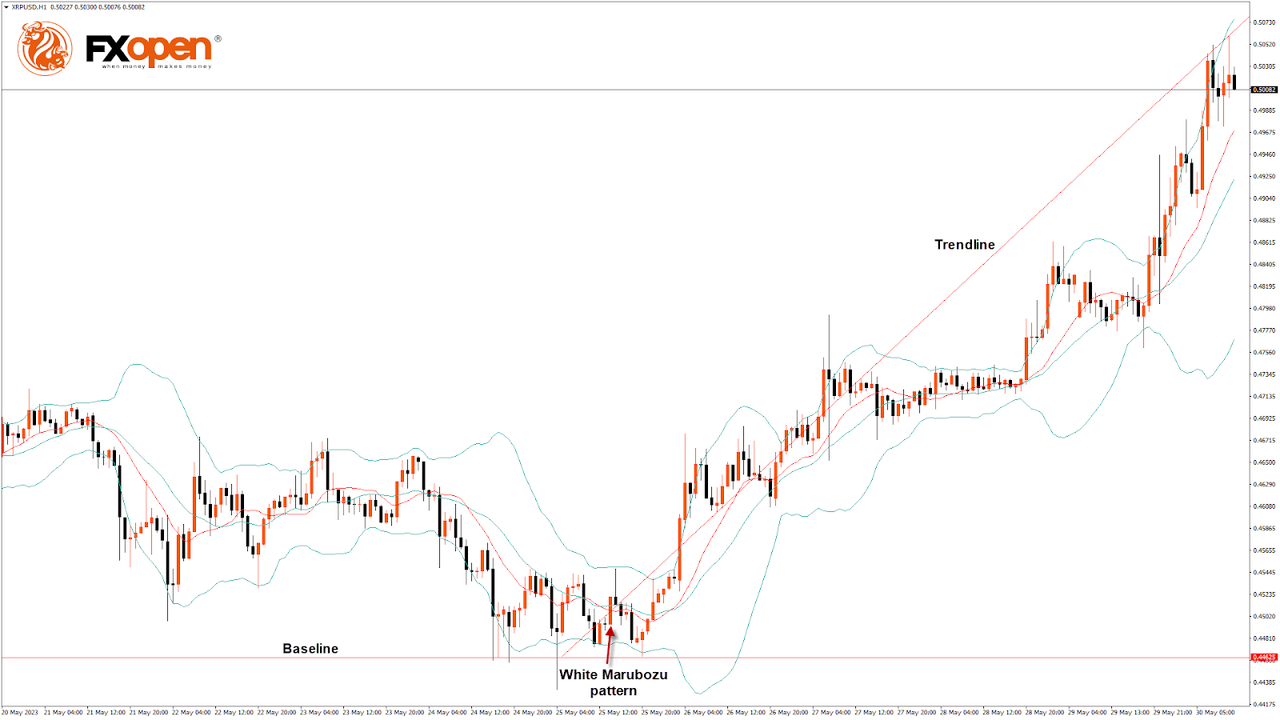

LTCUSD Analysis: Black Marubozu Pattern below $93.46

Bulls couldn’t take control of the market, and after touching a high of $93.46 on 23 May, the LTC/USD pair started moving in a bearish trend, touching a low of $82.60 today in the early Asian trading session.

The short-term outlook for Litecoin has turned mildly bearish.

On the hourly chart:

- There is a black Marubozu candle below the $93.46 handle. It signifies the start of a bearish phase in the market.

- Litecoin price is trading below its 100-hour simple moving average, 200-hour exponential moving average, and its pivot level of $84.49.

- The relative strength index is at 38.28, indicating weak demand for Litecoin and a shift towards the bearish phase in the markets.

- Litecoin remains below most of the moving averages, which are giving a bearish signal at current market levels of $84.49.

- Some of the technical indicators are neutral.

- The average true range indicates low market volatility.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks