US April Inflation – Four Times Higher Than Market Expectations

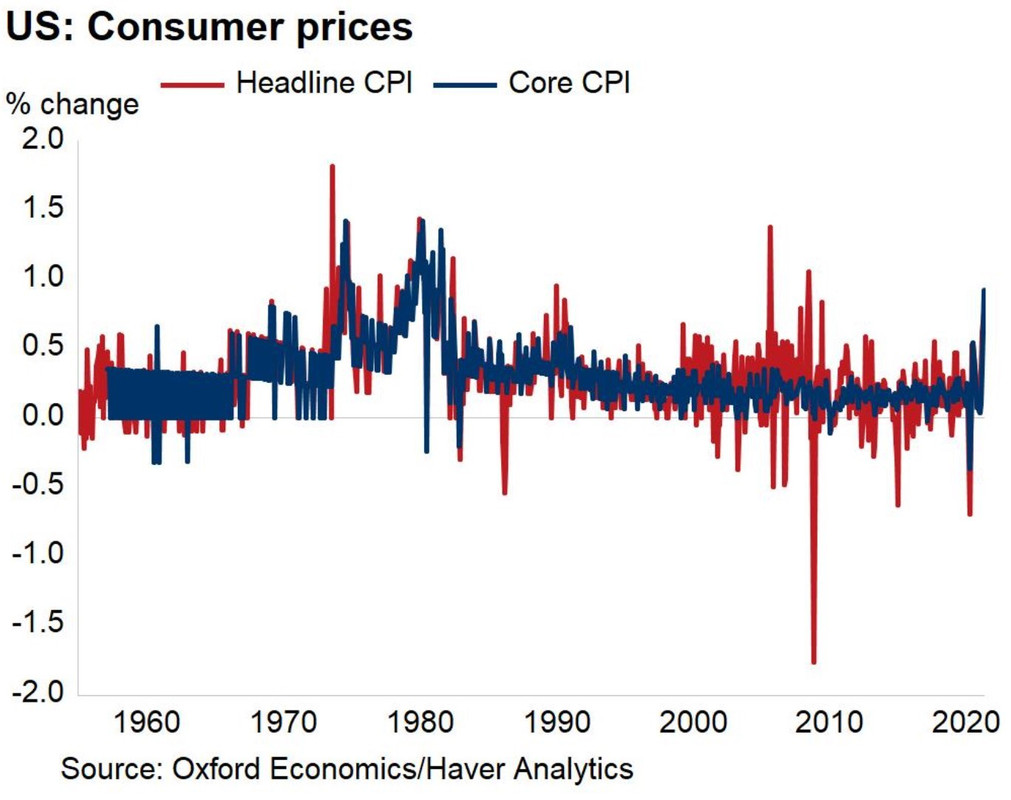

Last Wednesday, the Consumer Price Index (CPI) in the United States showed that inflation runs hot in the largest economy in the world. On expectations of an increase of 0.2% on a monthly basis, the headline CPI came out four times higher.

Moreover, the Core CPI, which tracks the changes in the price of goods and services over a period, without accounting for food and energy, was three times higher in April than the market expected. As such, inflation is running hot in America, and the whole world is watching.

[

A Comparison With the 1970s

Back in the 1970s, inflation in America was printing double-digits on a monthly basis. The Fed fought a long battle to bring inflation down, mainly by raising the interest rates on the world’s reserve currency.

This was a problematic thing to do at the time, because the US just gave up the gold standard. In other words, for the world to still trust the dollar without gold backing, the Fed stepped in and offered a higher interest rate.

Fast forward to our times, and the Fed is unlikely to do the same despite rising inflation, for several reasons. First, the Fed changed its inflation mandate last year.

We should mention here that the Fed has a dual mandate – price stability and job creation. For the first part of its mandate, it used an inflation-targeting framework for decades. Its aim was to create inflation close to the 2% target. This is similar to what other central banks in the world use, like the ECB, which aims at inflation below, but close to 2%.

But the Fed chose to change the inflation-targeting framework last year. It announced that it no longer considers price stability at 2% inflation, but around 2% inflation.

More precisely, the Fed averages inflation for a period, aiming at 2%. The problem is that the period considered is unknown to the market participants.

In April this year, inflation exceeded the Fed’s 2% by a mile, if we consider the annualized data. Yet, the Fed says that the data is transitory. Indeed, if we average inflation for the past six or twelve-month, the result is way below the 2% level. Hence, the Fed is right in adopting a wait-and-see approach.

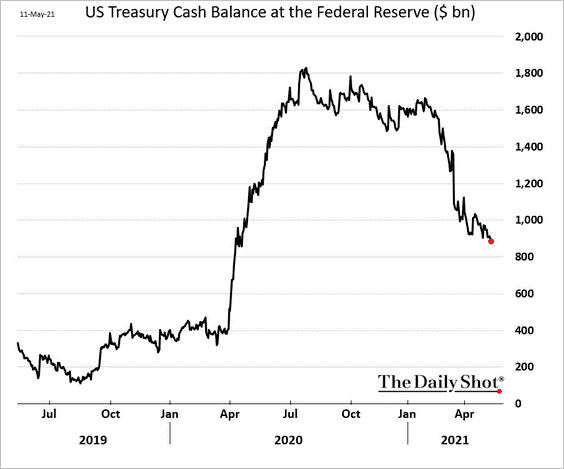

Yet, more money is in the pipeline. The chart above shows the US Treasury cash balance at the Federal Reserve. Effectively, this is money held at the Fed, used by the US government to finance various projects or to support its fiscal expansion policy.

Close to a trillion dollars are still available to be deployed into the US economy. Therefore, inflation is likely to run even higher in the months ahead.

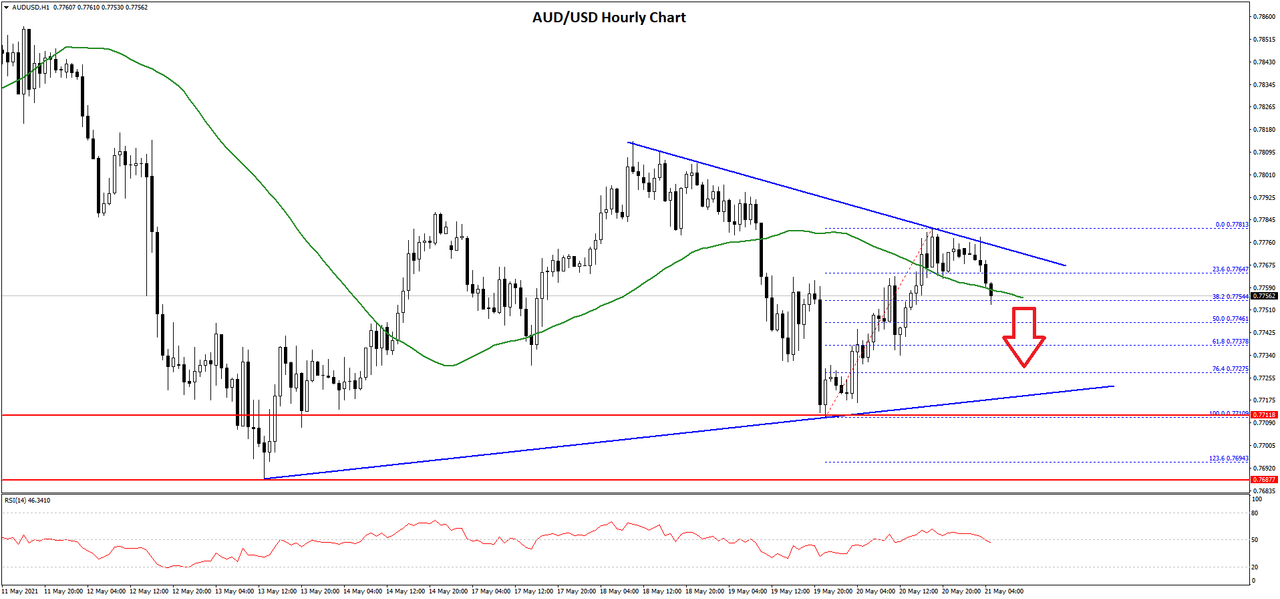

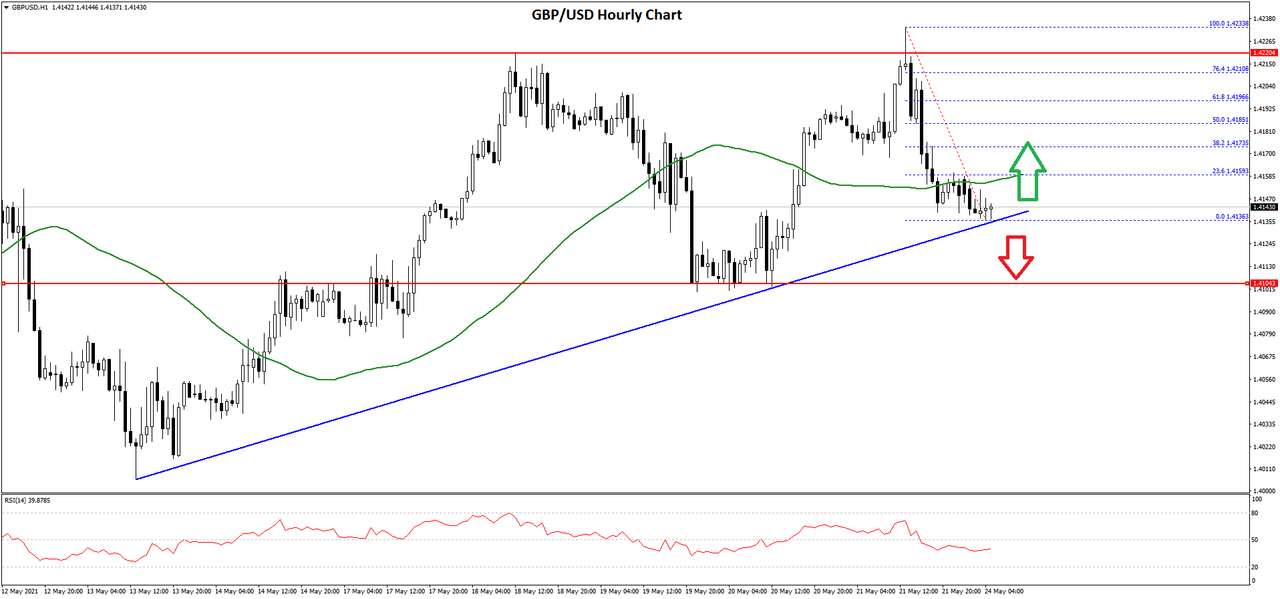

The question, at this point, is how much higher will inflation go, without the Fed to intervene? Also, how will the financial markets react?

The initial reaction to the higher inflation data last Wednesday showed weakness in the US equity markets. But that weakness reversed in the following two trading days, as the main stock indices recovered most of the lost ground in the two days left in the trading week.

However, if we use the 1970s as a benchmark, higher inflation triggers an equity bear market. Will we see one in 2021?

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks