Crypto winter continues big freeze with values as frosty as weather

The weather across parts of Northern Europe and the United Kingdom this week has suddenly turned, and even areas which are ordinarily not associated with snowfall have been covered in a white blanket for a few days.

Travel disruptions at airports have taken place, and a minus figure has been displayed on temperature gauges since Monday.

Finally the real winter weather is here, however the term 'crypto winter' has been in place for quite some time, despite the unusually warm weather during October and November, during which it was not uncommon to see people wearing summer clothes and sitting outside cafes.

The only real sign of winter in the unusually long and pleasant summer conditions was the use in the financial markets sector of the term 'crypto winter', which does not refer to seasons or weather conditions, but instead the 'frozen' values of cryptocurrencies in which prices contract and remain low for an extended period.

Well, now there is a seasonal winter and a crypto winter at the same time.

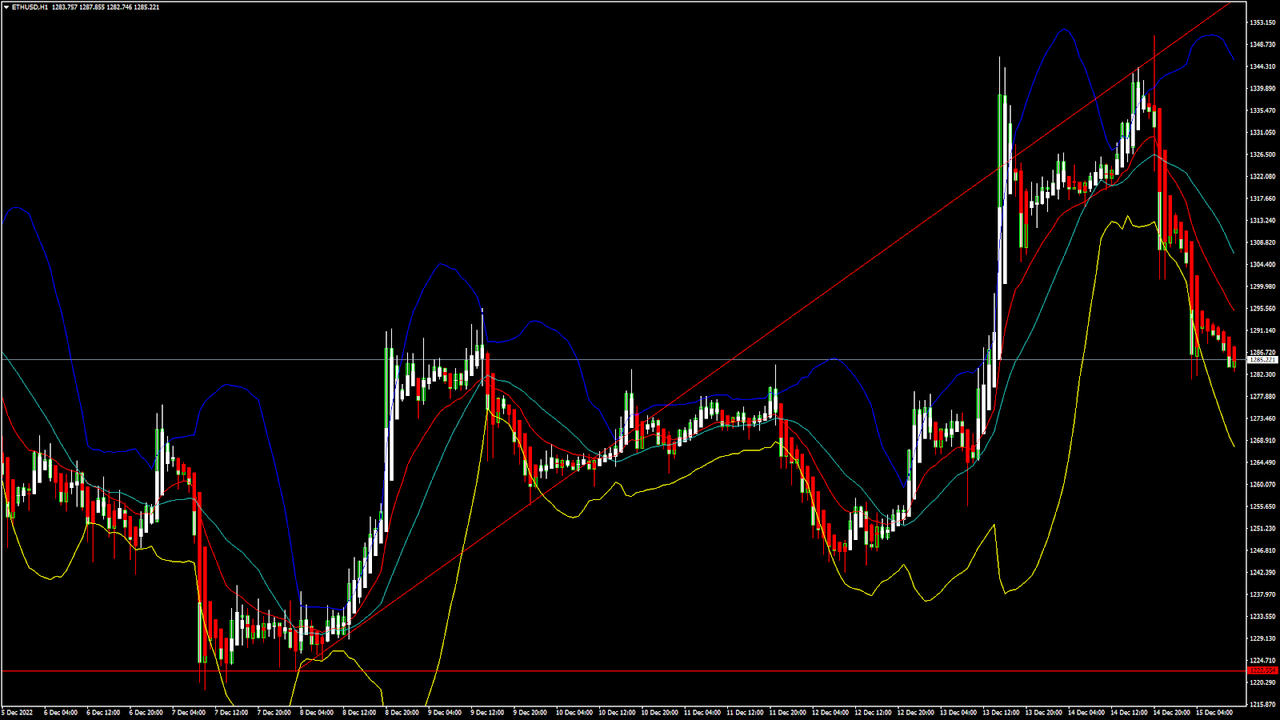

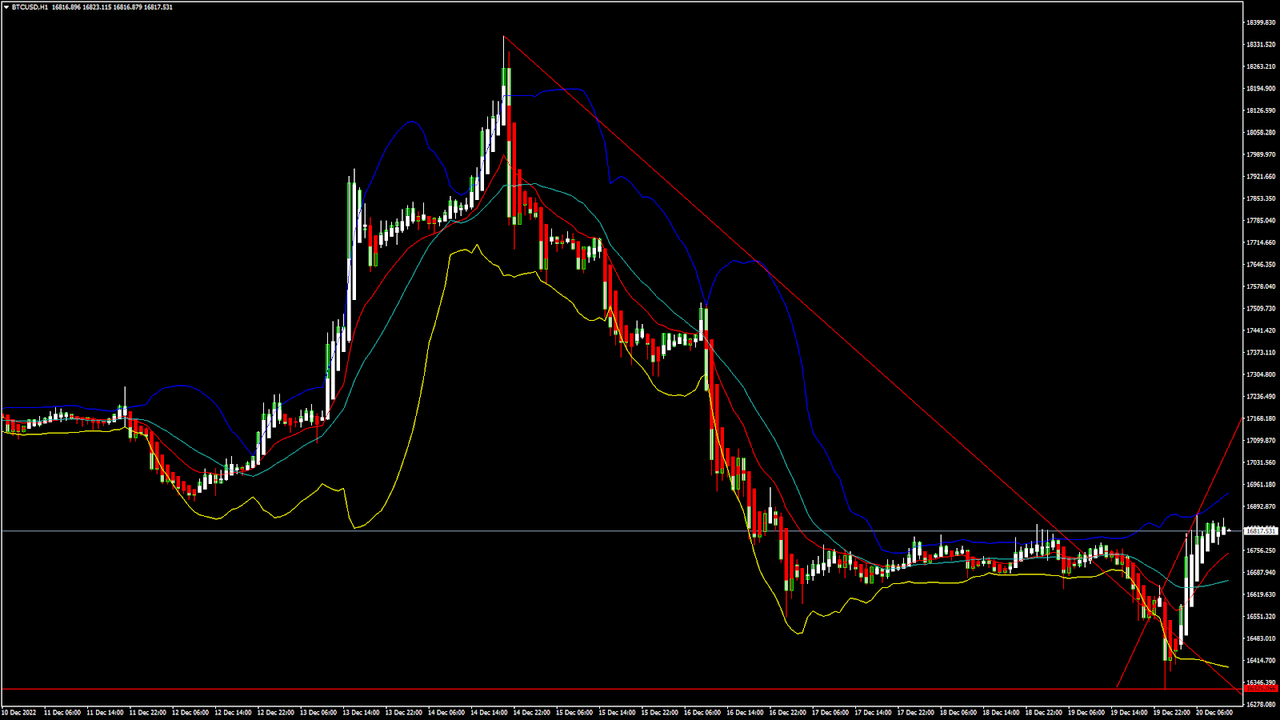

Bitcoin values once again took a tumble during the early hours of this morning, and by 7.20am UK time, had reached a low point of $17,125 per Bitcoin against the US Dollar.

Over the two hours which ensued, Bitcoin made some headway, increasing to $17,177 but that is still 0.21% down overall during today compared to yesterday.

Looking over the five day moving average, however, the dip in value appears to have been present for a longer period of time. On December 12, values plunged and did not recover until the middle of the morning on December 13, and a 0.44% reduction in value is displayed when charting Bitcoin's performance over the past five days.

Although we certainly still are well ensconced in the Crypto Winter scenario, things are a little brighter than they were last month however. The sun may have been shining across Europe but Bitcoin values were even lower than they are now.

Bitcoin has actually risen by over 5% in value over the course of the past 30 days, so the snow may have fallen and the winter clothes been suddenly put to use, but is this the beginning of the big thaw for the Crypto Winter?

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks