Brent Crude Oil is on the up as G7 price cap deals blow

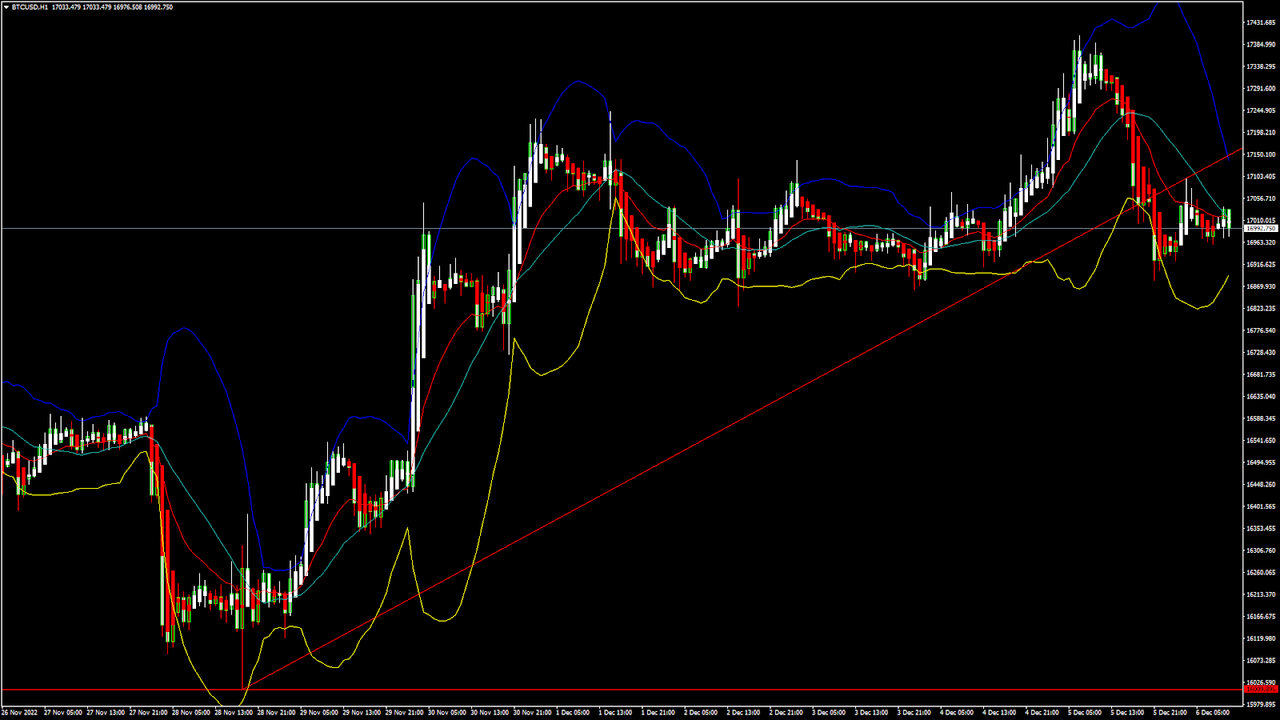

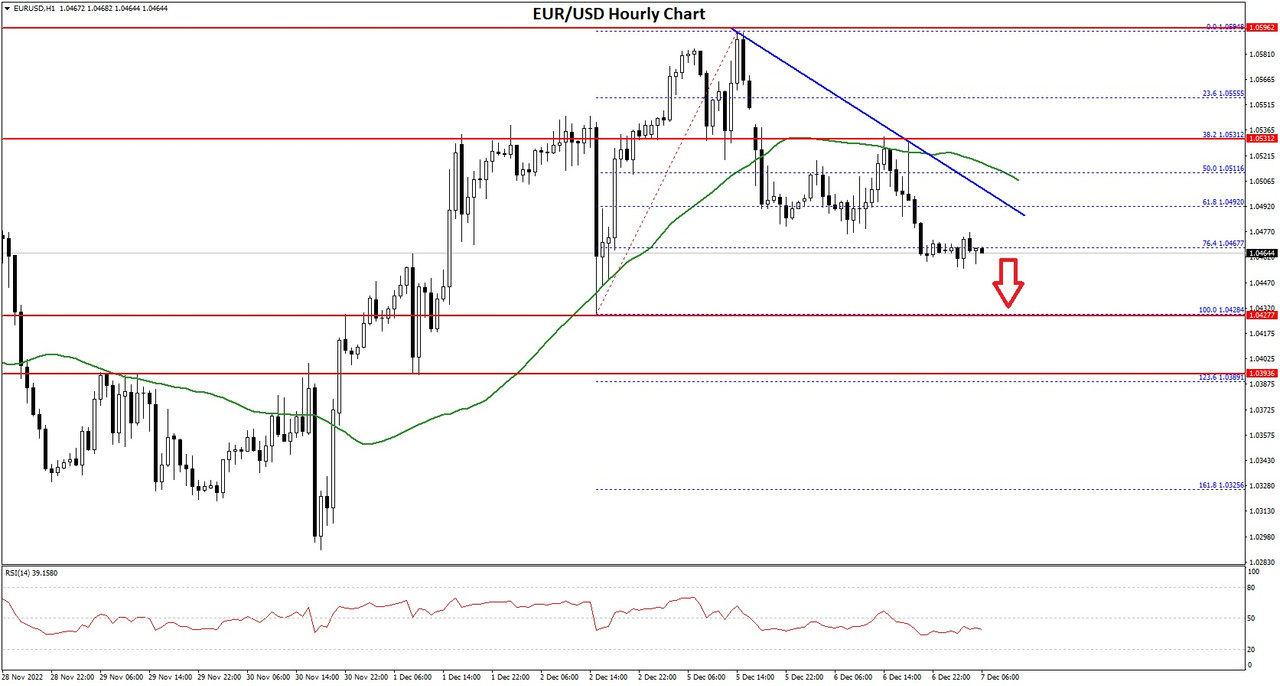

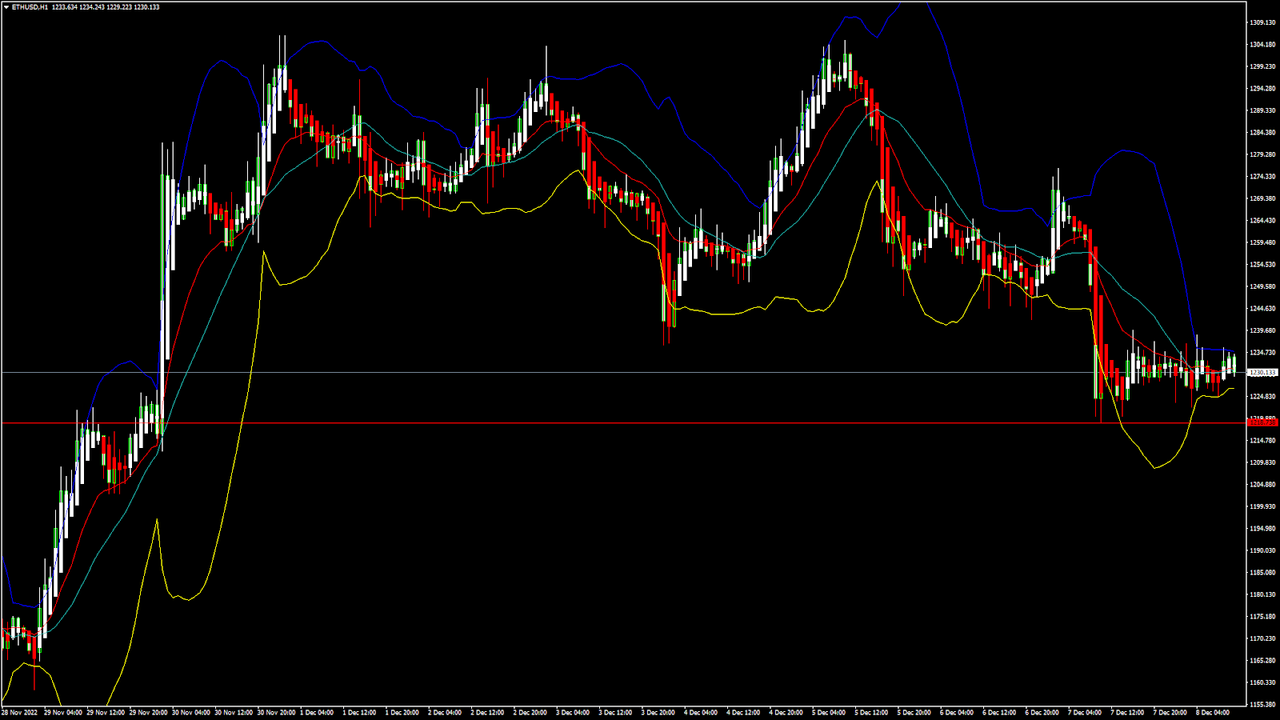

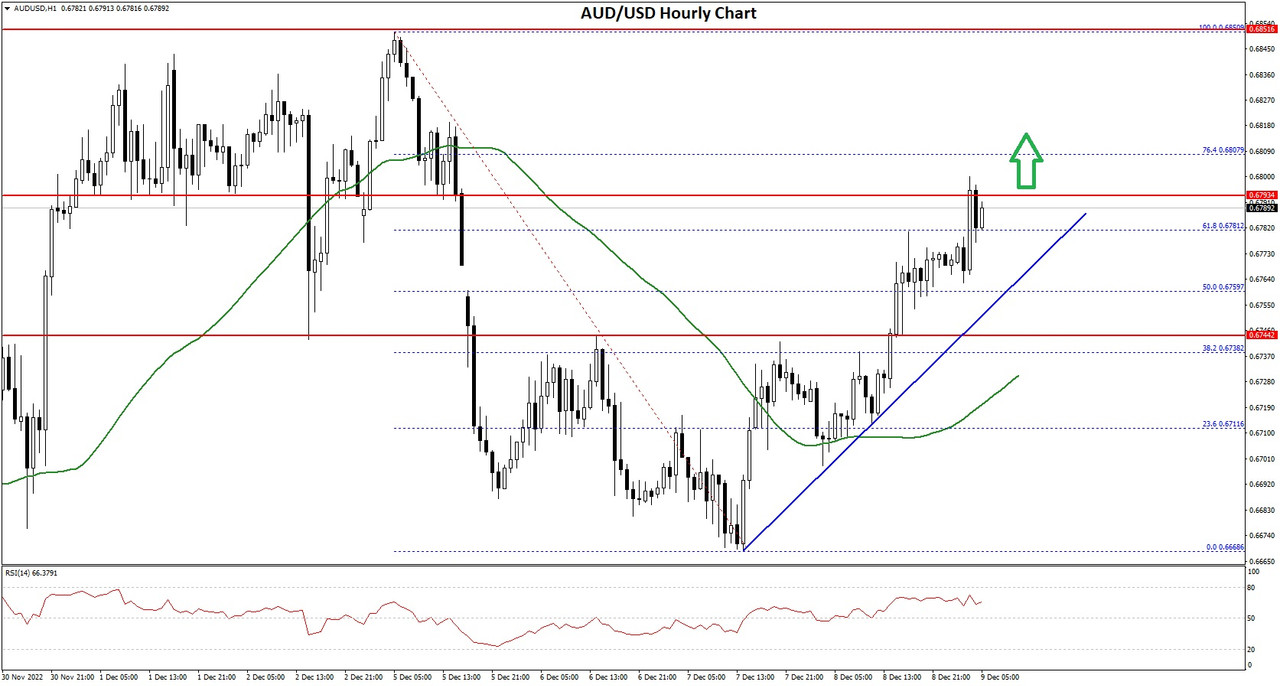

The price of Brent Crude oil is once again on the rise, after a slow and steady decline during early to mid November bottomed out at $76.28 per barrel on November 26.

Since then, the price has been increasing, and today Brent Crude Oil (WTI) is trading at $81.41 per barrel which is a two week high.

This could partly be down to the price cap for oil purchases from Russia having been set by the European Union at $60 per barrel.

This was set late last week in the form of a limit on the price of Russian seaborne crude and therefore constrain revenues the Kremlin makes from the commodity.

However, the market price of crude oil was at the time around $79 per barrel, meaning that the Russian oil companies refused to sell oil to European Union member states which adhered to this price cap, because it is far below the market value.

As a result, demand increased as the potential supply of crude oil to Europe could be affected by the price cap in which European oil purchasers would be expected to adhere to a policy of paying approximately $20 per barrel less than market value for oil imported from Russian oil giants, an offer which of course has been declined by said oil giants as there is no way they will sell oil to commercial clients for three quarters of its real value.

At the end of last week, Russian energy industry had issued a warning that an oil price cap could wreak havoc on the energy markets and push commodity prices even higher. They weren't wrong.

According to an official document from the European Union, this price limit would be subject to regular review in order to monitor its market ramifications. The document stated that the price should be “at least 5% below the average market price" however the $60 that the cap is currently set at is more than 20% less than the average market value of crude oil.

Given that Russia is an OPEC nation and one of its major national industries is the extraction, refinement and export of raw materials for energy generation, there is no likelihood that Russian energy firms would accept this price for oil products.

The raw materials that the Russian economy relies so heavily on are consumable commodities, traded on global exchanges and with the ability to be used as collateral to back economic asset classes and against national debts. These are liquid gold and therefore will be valued and treated as such.

Volatility in the oil market is here once again.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks