Weak Dollar Despite Strong U.S. Economic Performance

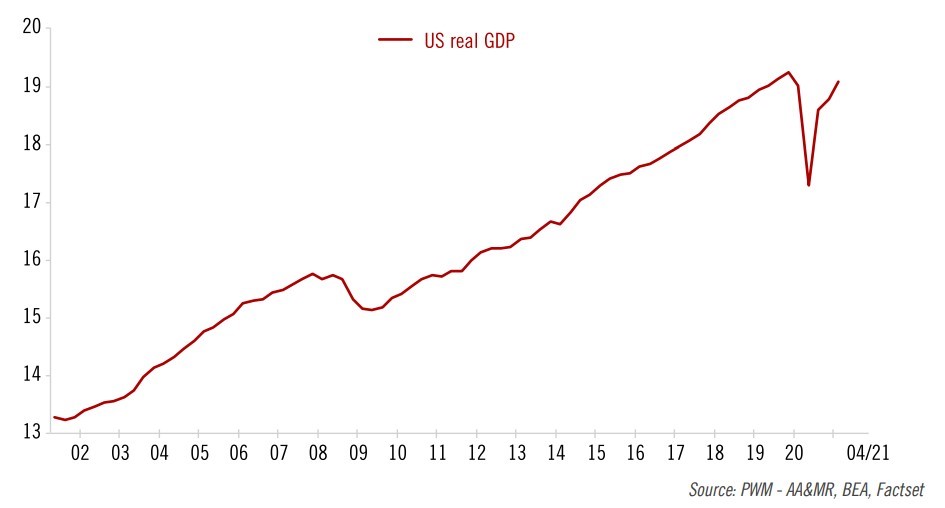

The U.S. economy grew at 6.4% in the first quarter of the year, and it is in line to exceed the pre-pandemic growth level. The good news goes even further, as the growth in the first quarter exceeds the previous quarter’s growth of 4.3%.

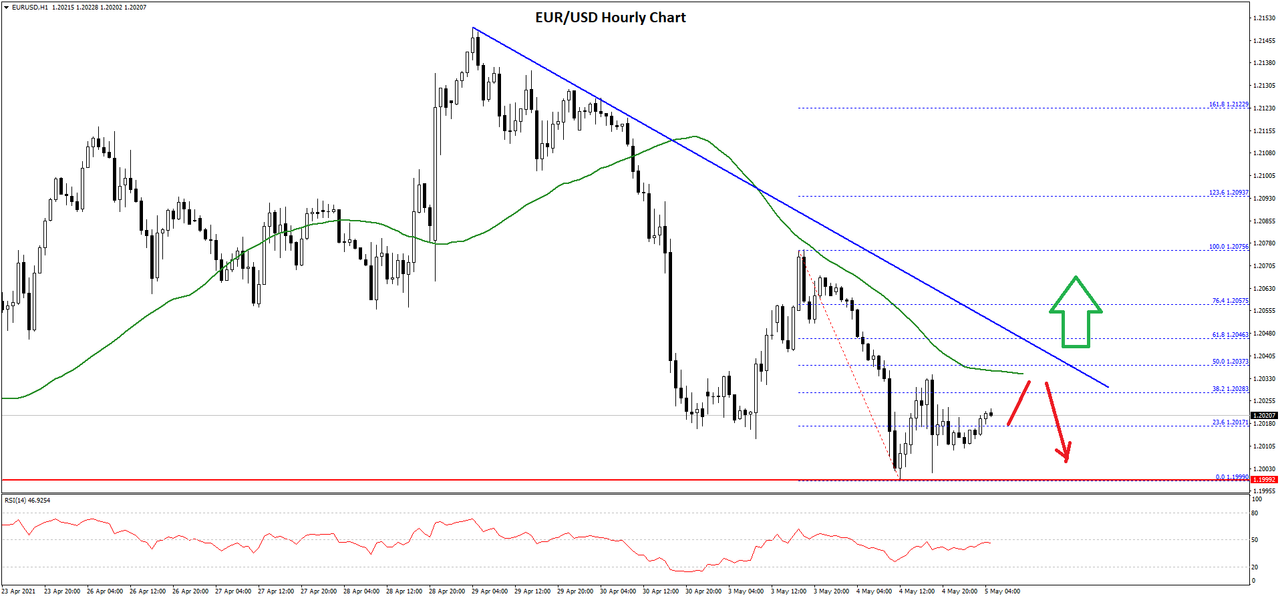

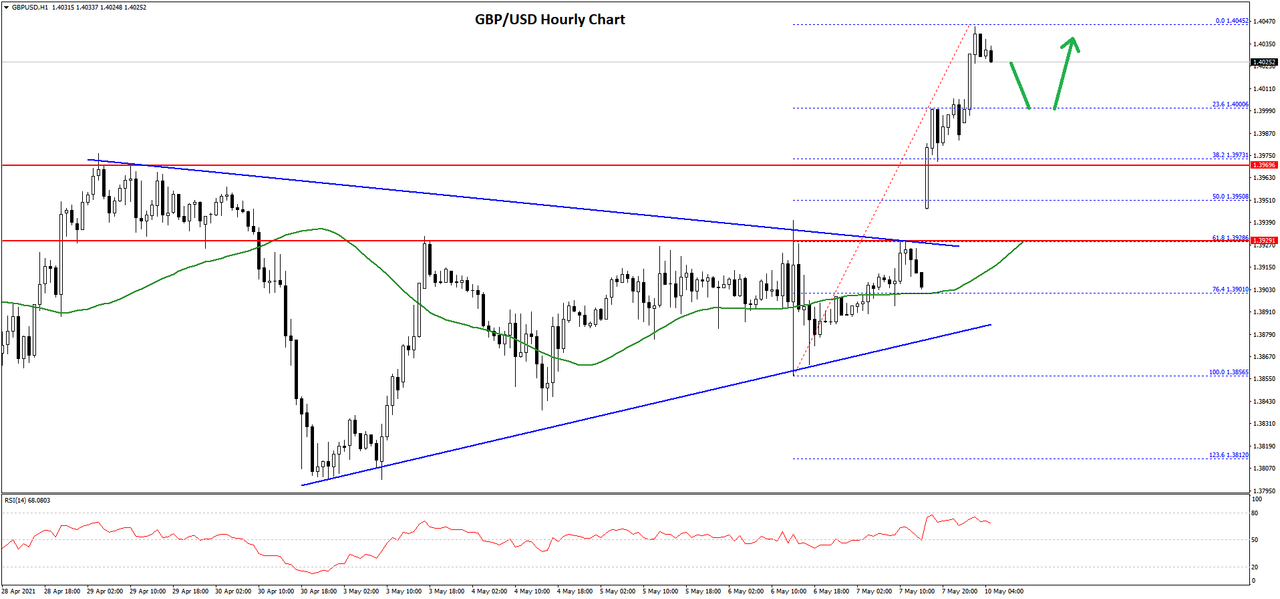

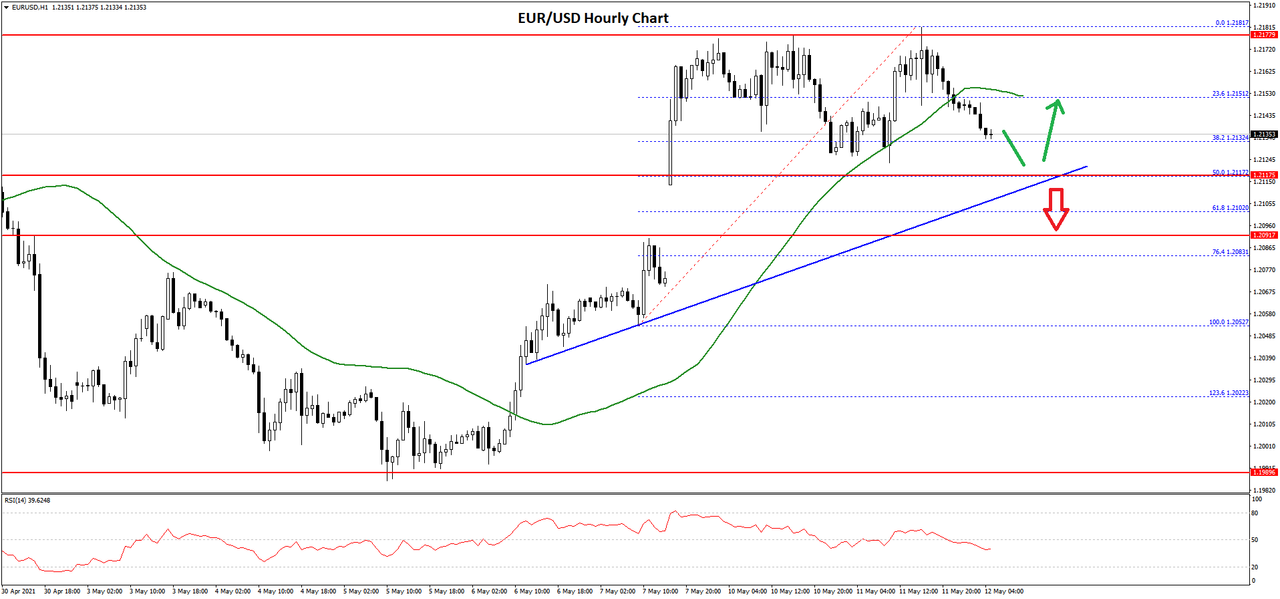

However, the U.S. dollar did not rise on the news. In fact, for the entire month of April, the dollar traded with an offered tone. For instance, with the exception of the last trading day of the month, the EURUSD moved only higher, from 1.17 to over 1.21 in less than thirty days.

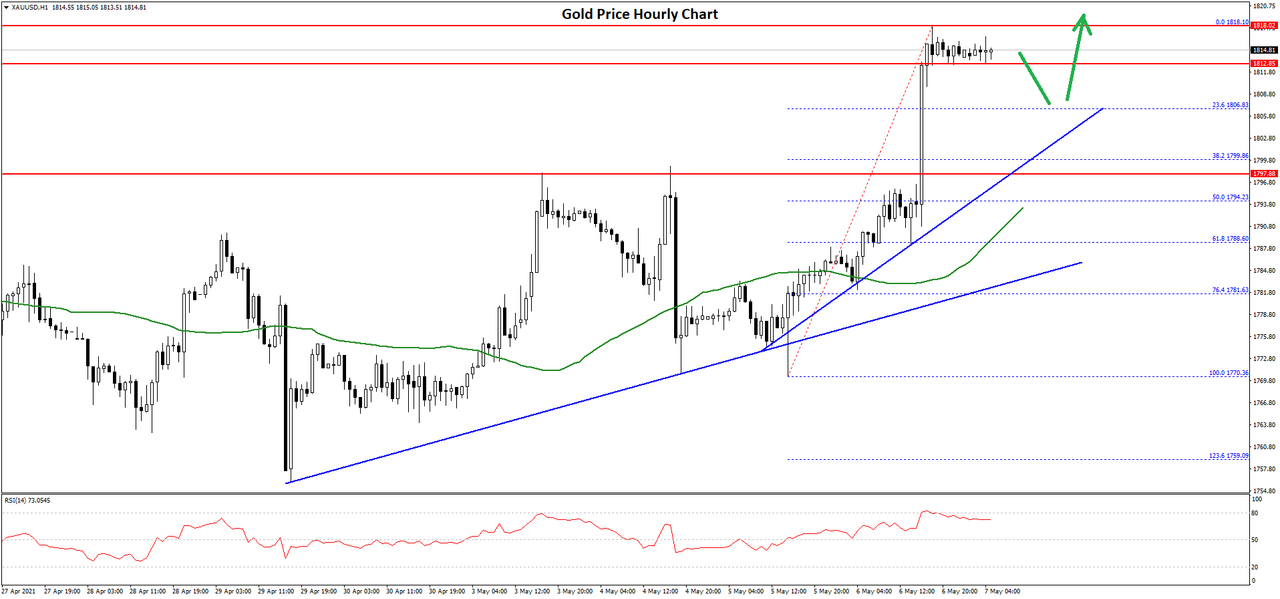

Fed Keeps the Accommodative Measures

One day before the GDP release, the Federal Reserve of the United States (Fed) announced that it keeps the monetary policy accommodative despite the remarkable economic performance. As such, the Fed continues to buy $120 billion worth of assets every month, putting pressure on the dollar.

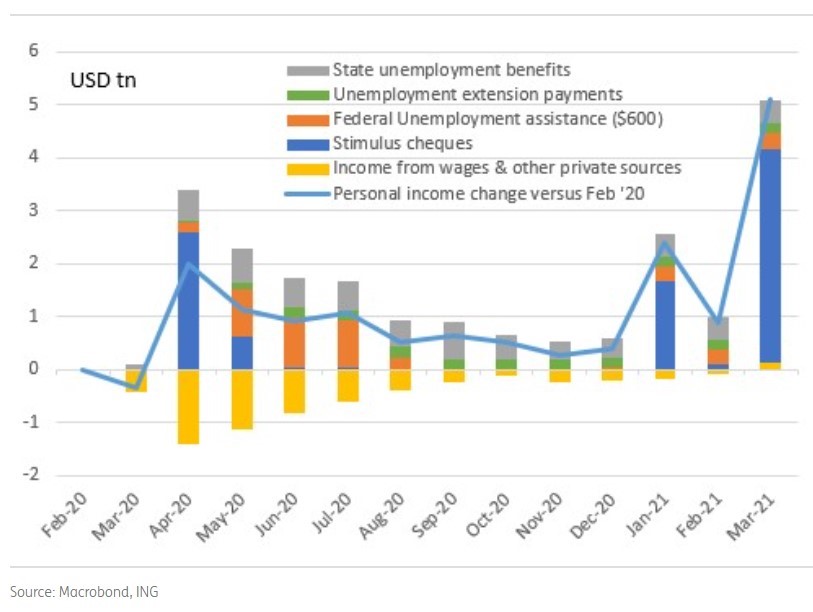

The households’ savings rate at the end of the first quarter was 21%, up from 13% in the last quarter of 2021. The uncertainty generated by the pandemic continues, as households keep stashing funds and postpone consumption.

However, the more people get a vaccine, the faster the U.S. economy will come back to normality. As such, the savings rate is expected to decline in the second quarter of the year, pushing the GDP even higher.

It all comes down to the stimulus checks received by households. As the chart above shows, the stimulus checks played an important role during the pandemic, but yet the U.S. consumer is not spending it entirely, as suggested by the high savings rate.

Moving forward, the trading month starts strongly with the Non-Farm Payrolls release scheduled next Friday. The market expects 975k new jobs to have been created in April and that the Unemployment Rate will decline to 5.7% from the previous 6%. However, the risk is that the data will be much better than expected, as suggested by the steady economic growth seen in the first quarter.

As for the dollar, at one point, it should start reflecting the economic reality. Moreover, if the NFP exceeds expectations, the Fed will have a hard time keeping its current monetary policy stance and will be forced to announce the tapering of its asset purchases sooner than expected.

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks