GBP/USD Remains At Risk, EUR/GBP Could Extend Gains

GBP/USD is trading in a bearish zone below the 1.3750 resistance zone. EUR/GBP is rising and it could gain pace if it clears the 0.8600 resistance.

Important Takeaways for GBP/USD and EUR/GBP

- The British Pound declined below the 1.3800 and 1.3765 support levels.

- There is a key contracting triangle forming with resistance near 1.3685 on the hourly chart of GBP/USD.

- EUR/GBP started a decent increase and cleared the 0.8550 pivot level.

- There was a break above a major bearish trend line with resistance near 0.8565 on the hourly chart.

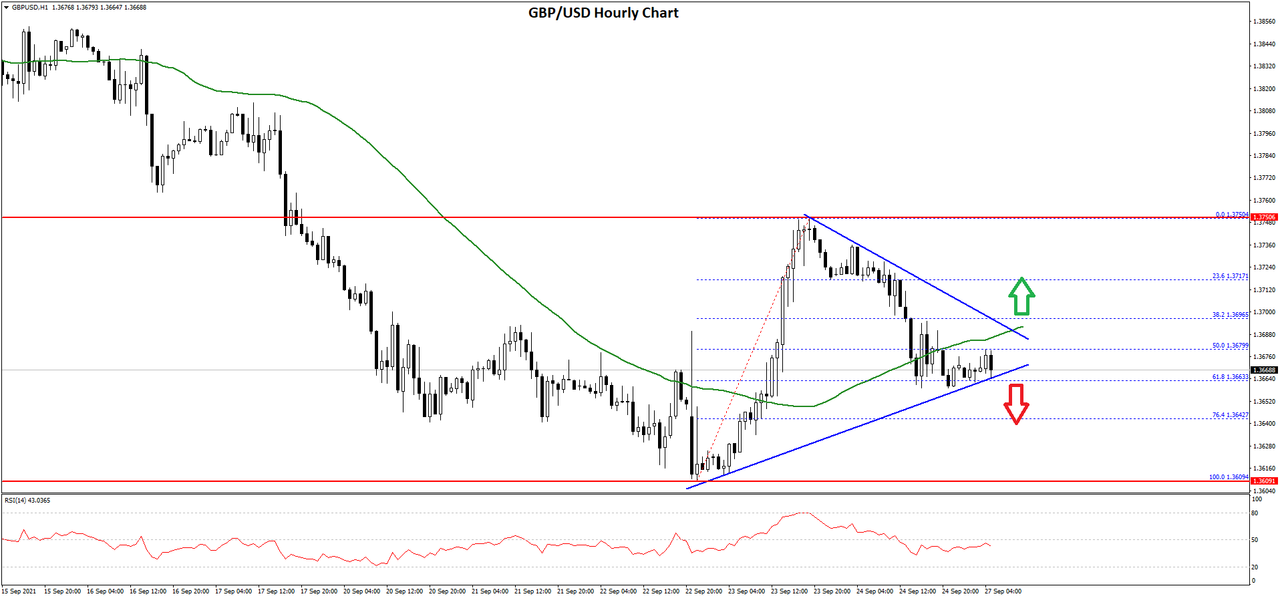

GBP/USD Technical Analysis

The British Pound started a major decline from well above 1.3800 against the US Dollar. The GBP/USD pair traded below the 1.3720 and 1.3700 support levels to enter a bearish zone.

The pair even broke the 1.3650 support and settled below the 50 hourly simple moving average. It traded as low as 1.3609 and recently started an upside correction. The pair climbed above the 1.3700 resistance, but the bears were active near 1.3750.

A high was formed near 1.3750 before the pair started a downside correction. There was a break below the 1.3700 support level. It traded below the 50% Fib retracement level of the upward move from the 1.3609 swing low to 1.3750 high.

It is now consolidating near the 1.3665 support level. It is close to the 61.8% Fib retracement level of the upward move from the 1.3609 swing low to 1.3750 high. There is also a key contracting triangle forming with resistance near 1.3685 on the hourly chart of GBP/USD.

If there is an upside break above the triangle resistance, the price could surpass 1.3720. The main resistance is near the 1.3750 zone. Therefore, a proper break above the 1.3750 resistance could open the doors for a steady increase. The next major resistance for the bulls could be 1.3800.

If not, the pair could break the 1.3665 and 1.3660 support levels to continue lower. The first key support is near the 1.3620 level. Any more losses could lead the pair towards the 1.3550 support zone.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks