Gold Price Faces Hurdles And Crude Oil Price Could Recover Steadily

Gold price declined from the $1,850 resistance zone. Crude oil price is attempting a recovery wave above the $75.50 resistance zone.

Important Takeaways for Gold and Oil

- Gold price started a strong decline below the $1,832 level against the US Dollar.

- A key bearish trend line is forming with resistance near $1,835 on the hourly chart of gold.

- Crude oil price started a fresh increase from the $73.75 support zone.

- There was a break above a major bearish trend line with resistance near $75.70 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

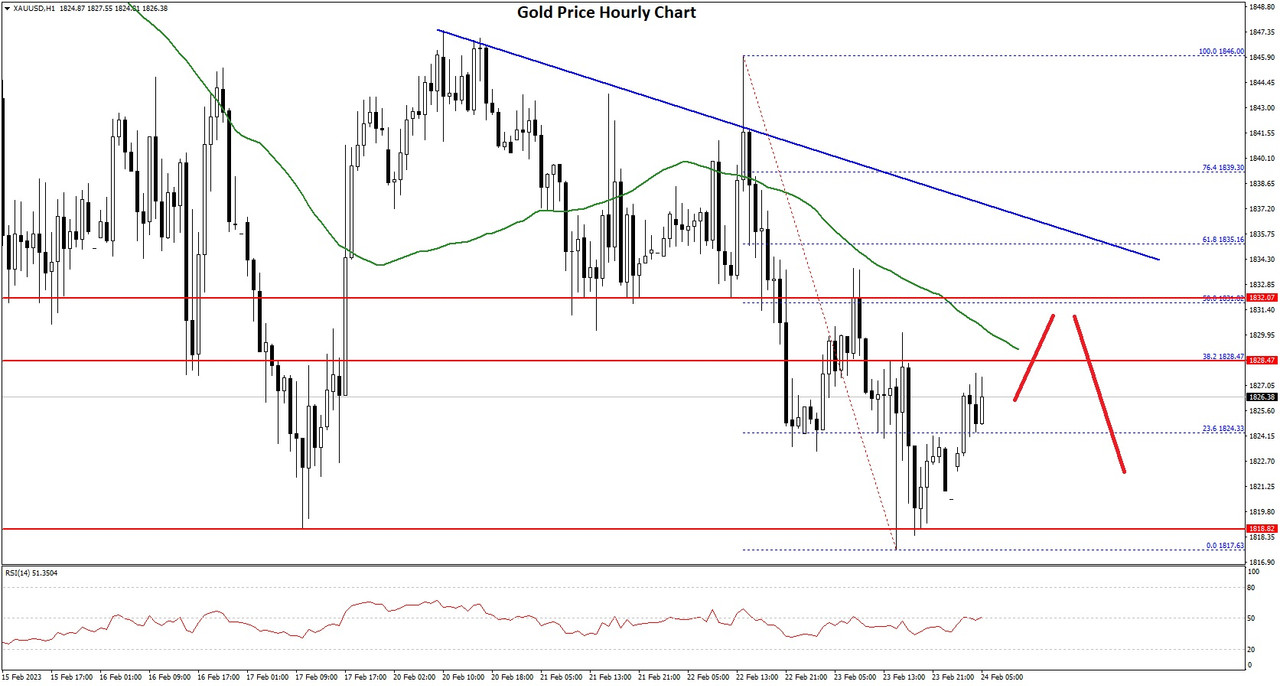

Gold price struggled to clear the $1,850 resistance against the US Dollar. The price started a strong decline and traded below the $1,832 support zone.

The bears even pushed the price below $1,825 and the 50 hourly simple moving average. The price traded below the $1,820 level. A low is formed near $1,817 on FXOpen and the price is now consolidating losses. On the upside, an immediate resistance is near the $1,828 level or the 50 hourly simple moving average.

Gold Price Hourly Chart

The stated level is near the 38.2% Fib retracement level of the downward move from the $1,846 swing high to $1,817 low. The next key hurdle is near the $1,832 level.

There is also a key bearish trend line is forming with resistance near $1,835 on the hourly chart of gold. The trend line is near the 50% Fib retracement level of the downward move from the $1,846 swing high to $1,817 low.

A clear upside break above the $1,835 resistance could send the price towards $1,850. If there is no upside break, the price might correct lower.

An immediate support on the downside is near the $1,820 level. The next major support is near the $1,812 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,800 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks