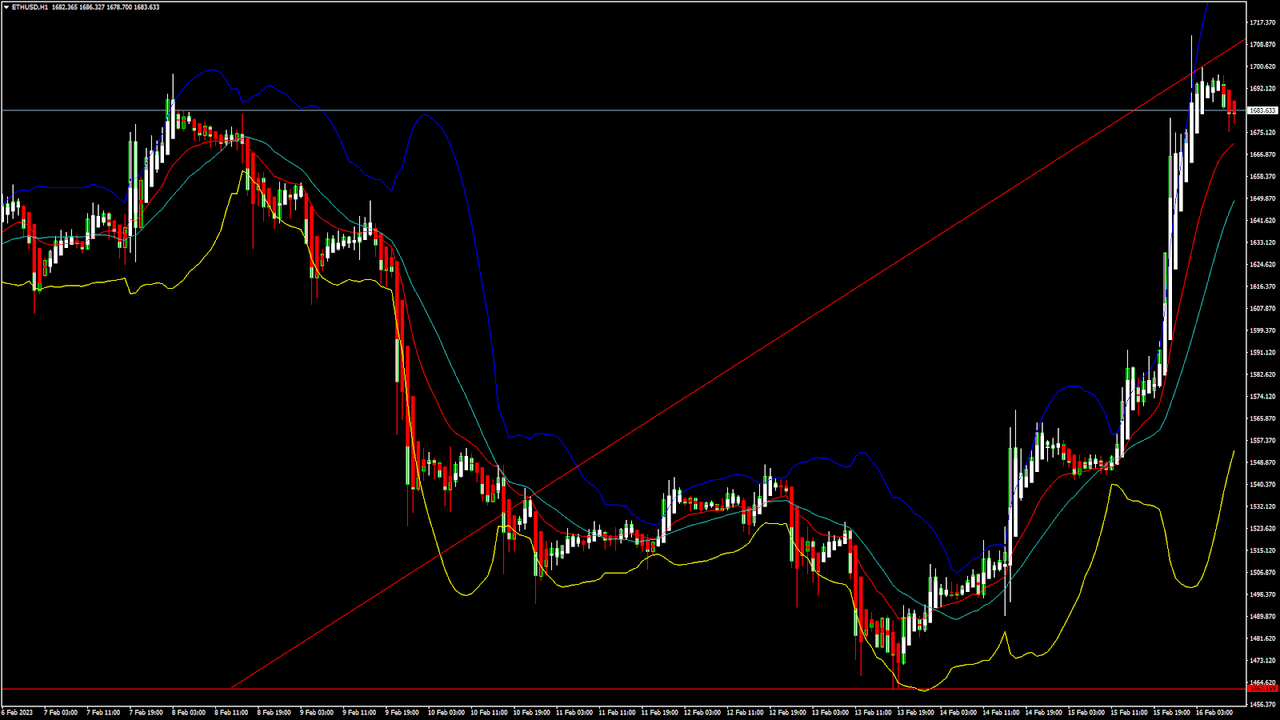

ETHUSD and LTCUSD Technical Analysis – 16th FEB, 2023

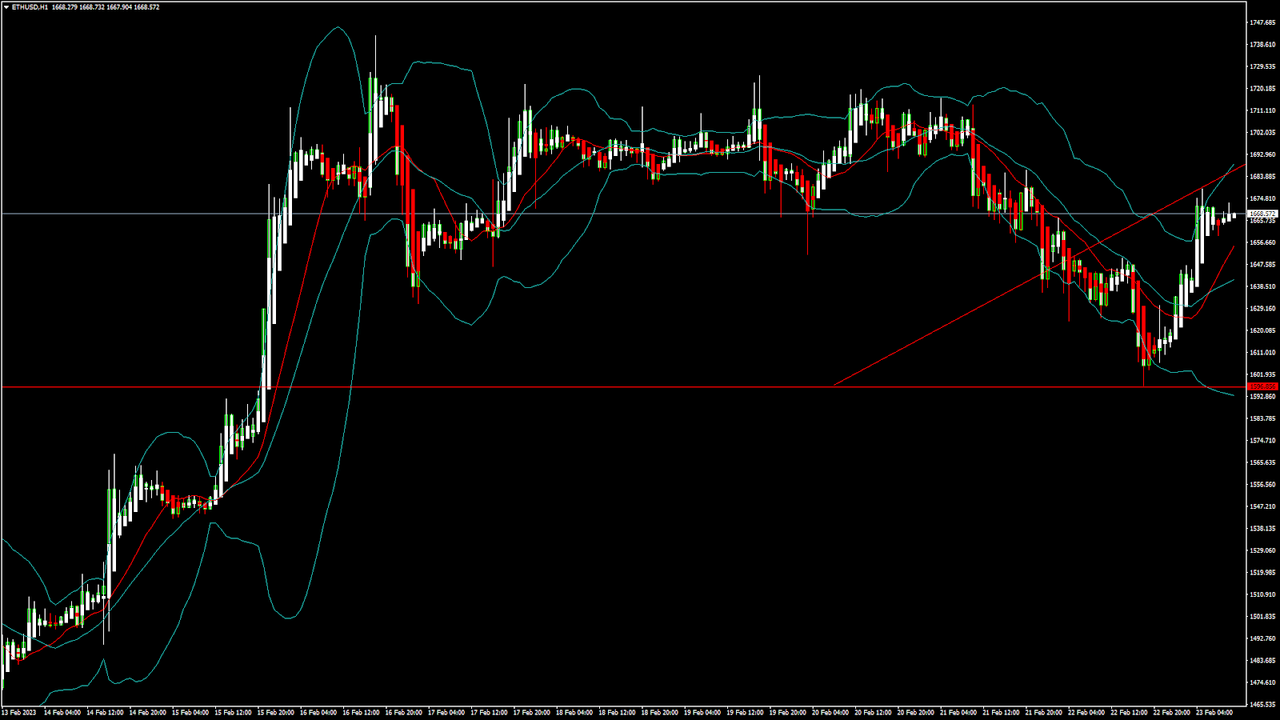

ETHUSD: Double Bottom Pattern Above $1462

Ethereum was unable to sustain its bearish momentum and after touching a low of $1462 on 13th Feb, the price started to correct upwards against the US dollar now ranging above the $1650 handle today in the Asian trading session.

We can see a continuous escalation in the price of Ethereum which is expected to push up its price above the $1700 handle.

The price of ETH has touched a new record high of 5 months.

We can clearly see a double bottom pattern above the $1462 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of 1681 and moving into a strongly bullish channel. The price of ETHUSD is now testing its classic resistance level of 1687 and Fibonacci resistance level of 1693 after which the path towards 1800 will get cleared.

We can see the formation of bullish engulfing lines in the weekly time frame.

The relative strength index is at 75.92 indicating a very strong demand for Ether and the continuation of the buying pressure in the markets.

The RSI is giving an overbought signal, which means that the price is expected to decline in the short-term range.

Most of the technical indicators are giving a STRONG BUY market signal.

Most of the moving averages are giving a STRONG BUY signal at the current market level of $1683.

ETH is now trading above both the 100 hourly simple and 100 hourly exponential moving averages.

- Ether: bullish reversal seen above the $1462 mark.

- The short-term range appears to be strongly bullish.

- ETH continues to remain above the $1650 level.

- The average true range is indicating LESS market volatility.

Ether: Bullish Reversal Seen Above $1462

ETHUSD has now resumed its bullish trend and we are now expecting a retest of the $1800 level soon after which the next visible targets are located at $1800 and $2000 levels.

We can see the formation of a bullish price crossover pattern with the adaptive moving average AMA20 in the weekly time frame.

We have also detected the formation of a white gravestone/inverted hammer pattern in the daily time frame conforming to the bullish reversal.

ETHUSD touched an intraday high of 1707 and an intraday low of 1664 in the Asian trading session today.

The Aroon indicator is giving a bullish trend in the daily time frame.

The key support levels to watch are $1657 at which the price crosses 9-day moving average stalls, and $1679 which is a 3-10 day MACD oscillator stalls.

ETH has increased by 8.76% with a price change of 135.58$ in the past 24hrs and has a trading volume of 12.329 billion USD.

We can see an increase of 34.47% in the total trading volume in the last 24 hrs which is due to the heavy buying seen at lower levels.

The Week Ahead

ETH has now moved into a breakout zone which is expected to continue this week and now we are heading towards the $1800 level.

At present the prices are moving in a super bullish zone above the $1650 levels.

We can see the formation of a bullish ascending channel from $1462 towards the $1713 level.

The immediate short-term outlook for Ether has turned strongly bullish, the medium-term outlook has turned bullish, and the long-term outlook for Ether is neutral under present market conditions.

The resistance zone is located at $1809 which is a 14-Day RSI at 70%, and at $1842 which is a pivot point 3rd level resistance.

Weekly outlook is projected at $1900 with a consolidation zone of $1850.

Technical Indicators:

The STOCH (9,6): is at 58.99 indicating a BUY.

The moving average convergence divergence (12,26): is at 32.22 indicating a BUY.

The Williams percent range: is at -20.25 indicating a BUY.

The rate of price change: is at 5.77 indicating a BUY.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks