GBP/USD and GBP/JPY At Risk of Downside Break

GBP/USD started a downside correction from the 1.2150 resistance. GBP/JPY is diving and there are chances of a move towards the 166.00 support.

Important Takeaways for GBP/USD and GBP/JPY

- The British Pound struggled to clear the 1.2150 resistance zone against the US Dollar.

- There is a key bullish trend line forming with support near 1.2040 on the hourly chart of GBP/USD.

- GBP/JPY started a fresh decline from the 169.00 resistance zone.

- There was a break below a major bullish trend line with support near 167.85 on the hourly chart.

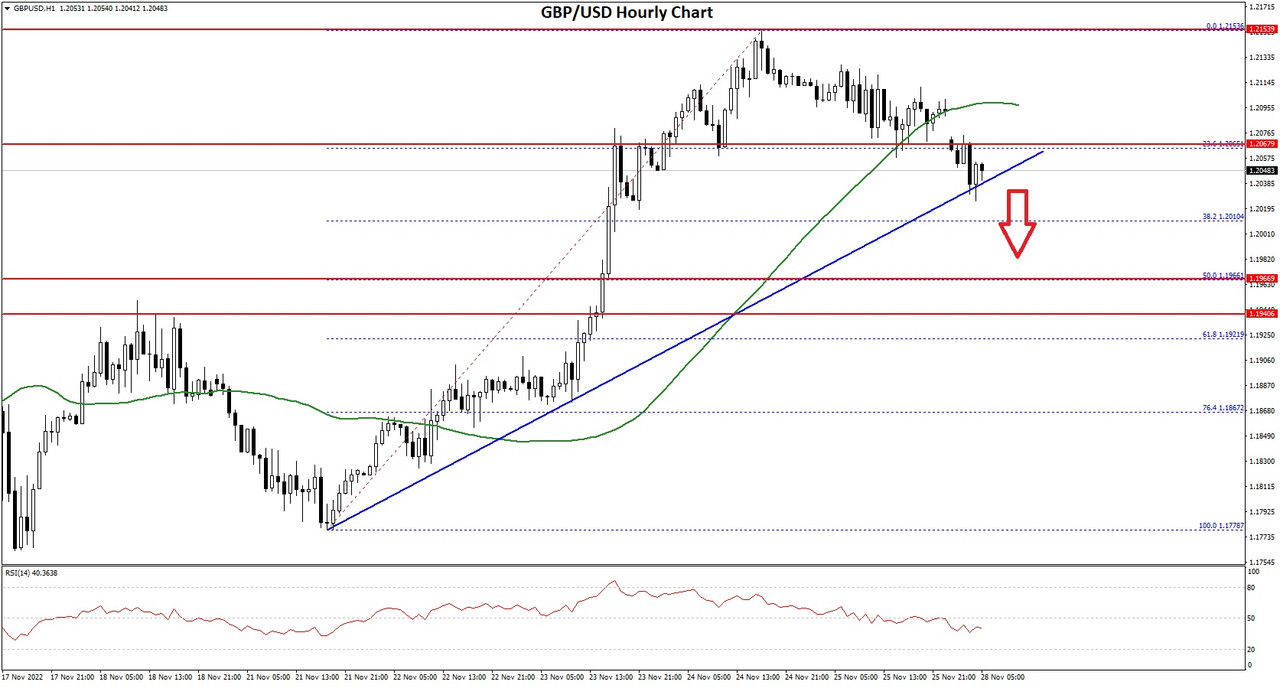

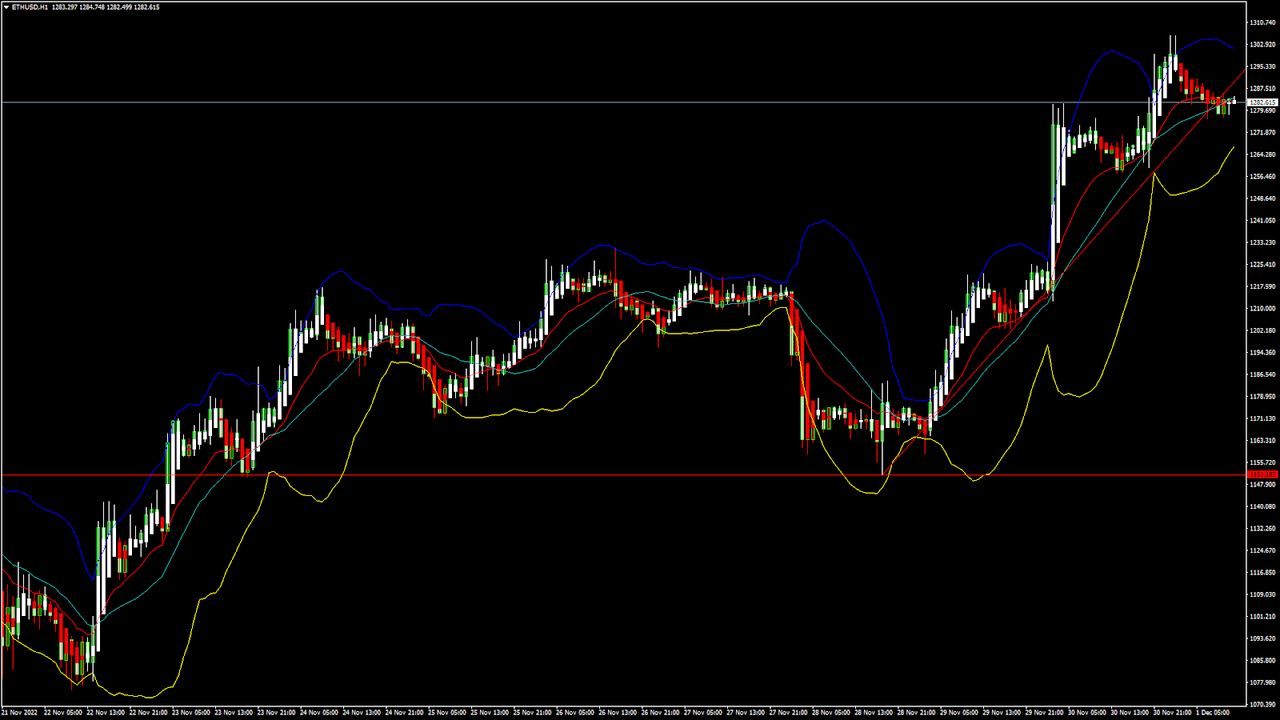

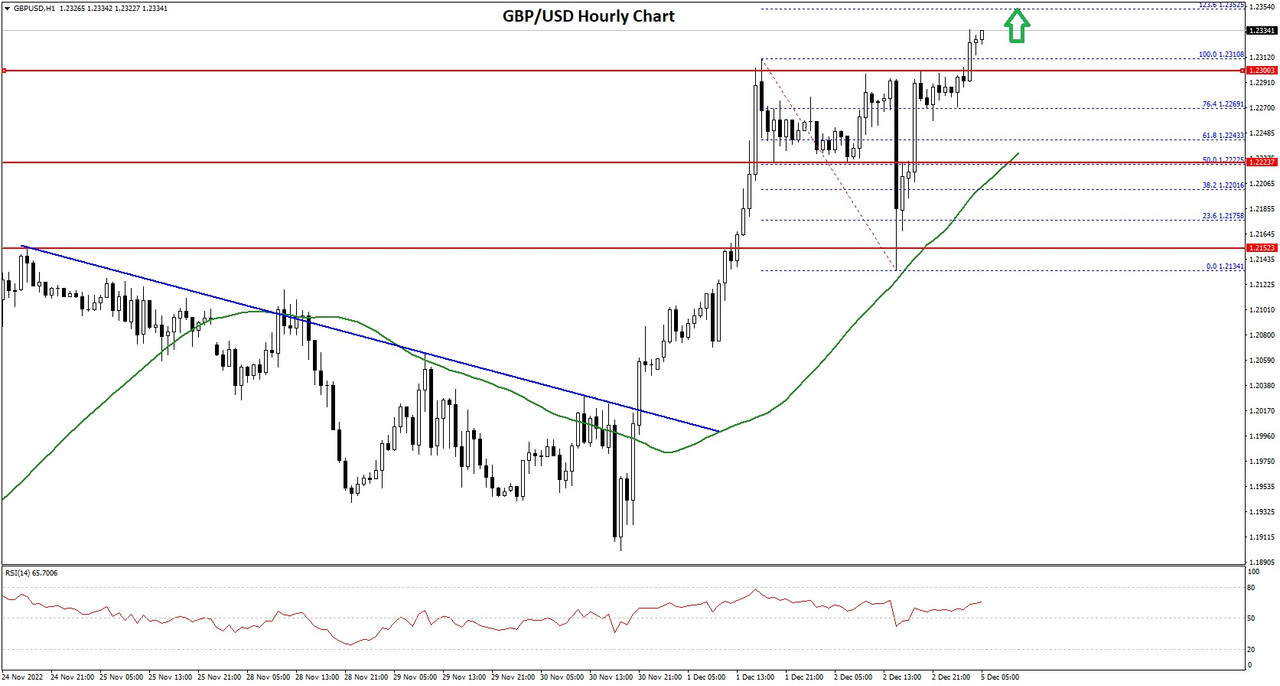

GBP/USD Technical Analysis

This past week, the British Pound found support near the 1.1800 zone against the US Dollar. The GBP/USD pair formed a base and started a steady recovery wave above the 1.2000 level.

There was a clear move above the 1.2050 resistance and the 50 hourly simple moving average. However, the pair struggled to clear the 1.2150 resistance zone. A high was formed near 1.2153 on FXOpen and the pair started a downside correction.

GBP/USD Hourly Chart

There was a move below the 1.2100 support and the 50 hourly simple moving average. The pair declined below the 23.6% Fib retracement level of the main increase from the 1.1778 swing low to 1.2153 high.

An immediate support is near the 1.2040. There is also a key bullish trend line forming with support near 1.2040 on the hourly chart of GBP/USD.

The next major support is near the 1.2000 level. If there is a break below the 1.2000 support, the pair could test the 1.1965 support or the 50% Fib retracement level of the main increase from the 1.1778 swing low to 1.2153 high. Any more losses might send GBP/USD towards 1.1880.

An immediate resistance on the upside is near the 1.2075 level. The next major resistance is near the 1.2120 level, above which the pair could start a steady increase towards 1.2150.

An upside break above 1.2150 might start a fresh increase towards 1.2250. Any more gains might call for a move towards 1.2320 or even 1.2400.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks