EURUSD Analysis: Market Reaction To The Fed's Decision

The Fed raised the rate yesterday by 0.25%, to 5.25%.

→ Now market participants expect a pause in the tightening policy. Moreover, the WSJ is hinting that the rate hike cycle may already be over.

→ According to Powell, it is important to raise the US debt ceiling, but not just raise it, but raise it on time (that is, not drag it out).

→ The Fed believes that the banking system is reliable and there is no cause for concern (by the way, PacWest bank shares fell 50% yesterday — bank management is considering selling it).

Although the decision was expected, it caused increased volatility:

→ US stock market indexes declined.

→ Gold jumped in price.

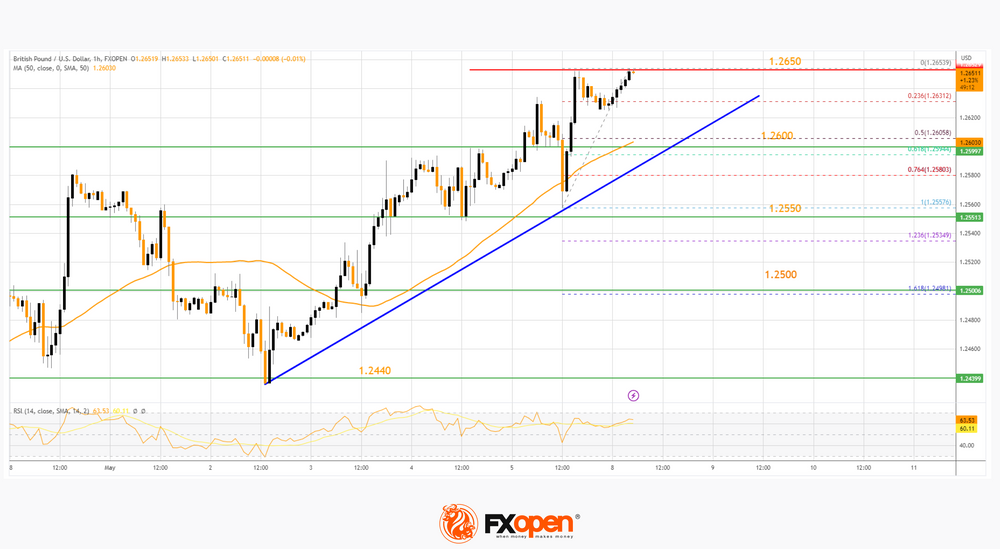

→ The US dollar index fell to dollar lows. Accordingly, the major currencies rose against the USD.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks