GBP/USD Could Accelerate Higher, EUR/GBP Remains At Risk

GBP/USD is facing resistance near 1.3850, but it might accelerate higher. EUR/GBP is facing an increase in selling pressure below 0.8550.

Important Takeaways for GBP/USD and EUR/GBP

- The British Pound is showing positive signs, but it is facing resistance near 1.3850.

- There is a key bullish trend line forming with support at 1.3810 on the hourly chart of GBP/USD.

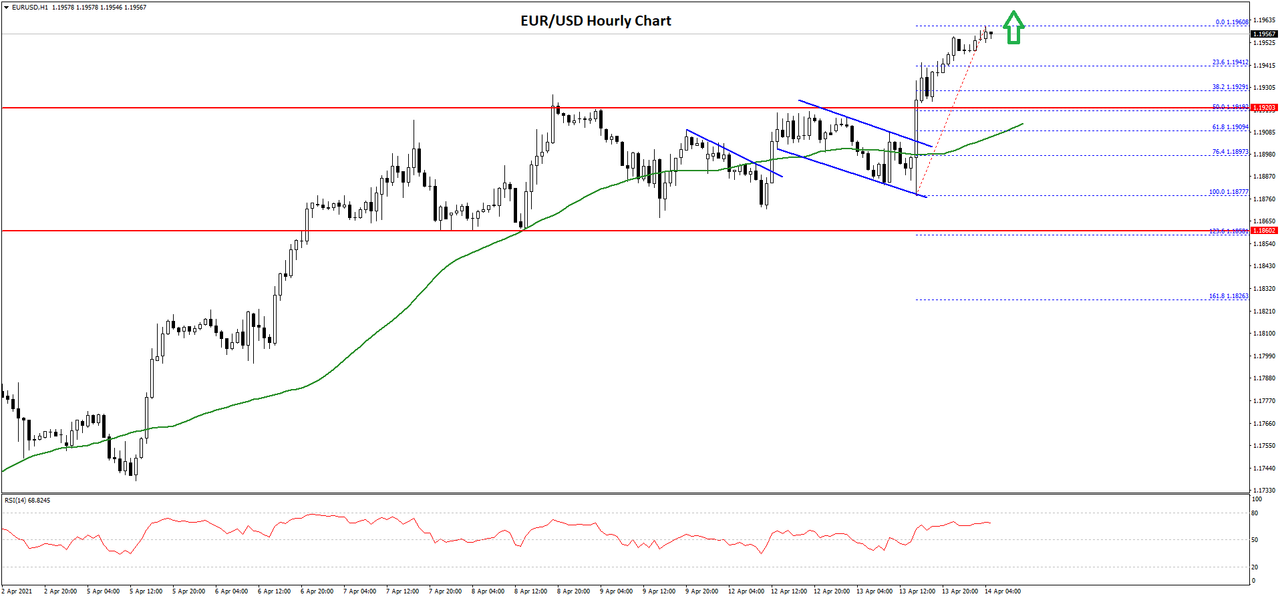

- EUR/GBP declined below the 0.8580 and 0.8550 support levels.

- There is a connecting bearish trend line forming with resistance near 0.8510 on the hourly chart.

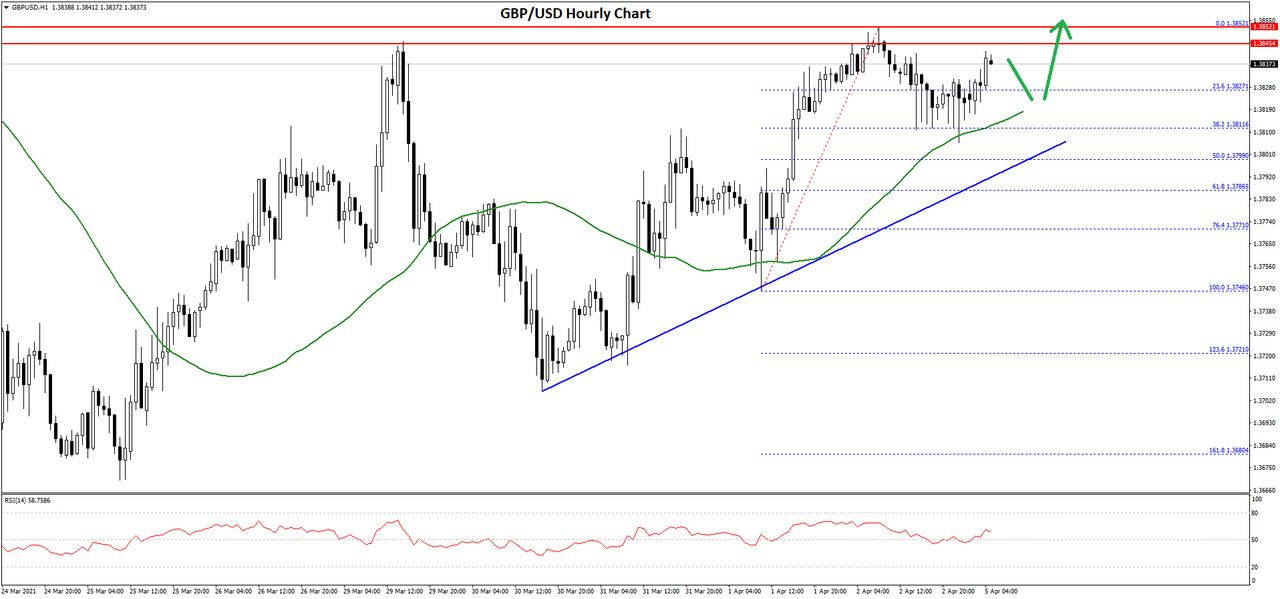

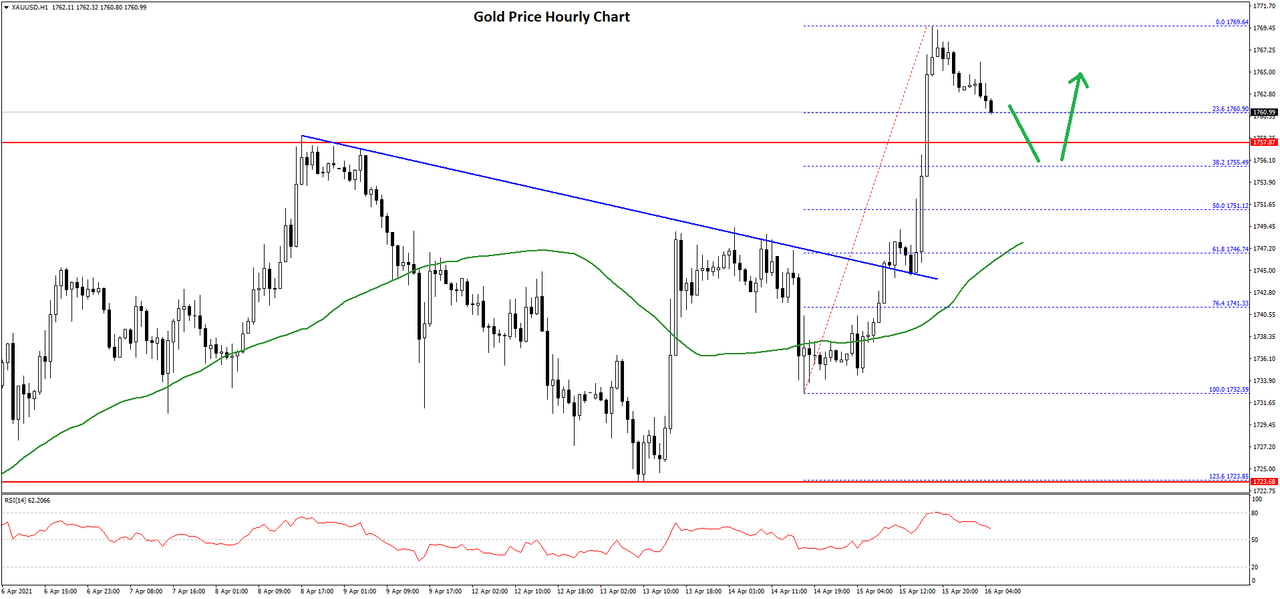

GBP/USD Technical Analysis

After forming a support base above 1.3720, the British Pound started a fresh increase against the US Dollar. The GBP/USD pair broke the 1.3780 and 1.3800 resistance levels to move into a positive zone.

There was also a close above the 1.3800 level and the 50 hourly simple moving average. The pair is now facing a strong resistance near the 1.3850 level. The recent high was formed near 1.3852 on FXOpen before there was a minor downside correction.

There was a break below the 1.3825 level. The pair even declined below the 23.6% Fib retracement level of the upward move from the 1.3746 swing low to 1.3852 high.

The pair is now holding the 1.3800 support zone and the 50 hourly simple moving average. There is also a key bullish trend line forming with support at 1.3810 on the hourly chart of GBP/USD. The trend line is close to the 50% Fib retracement level of the upward move from the 1.3746 swing low to 1.3852 high.

If there is a downside break below the trend line, the pair could decline towards the 1.3780 and 1.3770 support levels. Any more losses might lead the pair towards the key 1.3720 support.

On the upside, the pair is facing hurdles near the 1.3850 level. A clear upside break above the 1.3850 level could open the doors for a steady increase. In the stated case, GBP/USD could rise towards the 1.6000 level in the near term.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks