Watch FXOpen's September 5 - 9 Weekly Digest Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

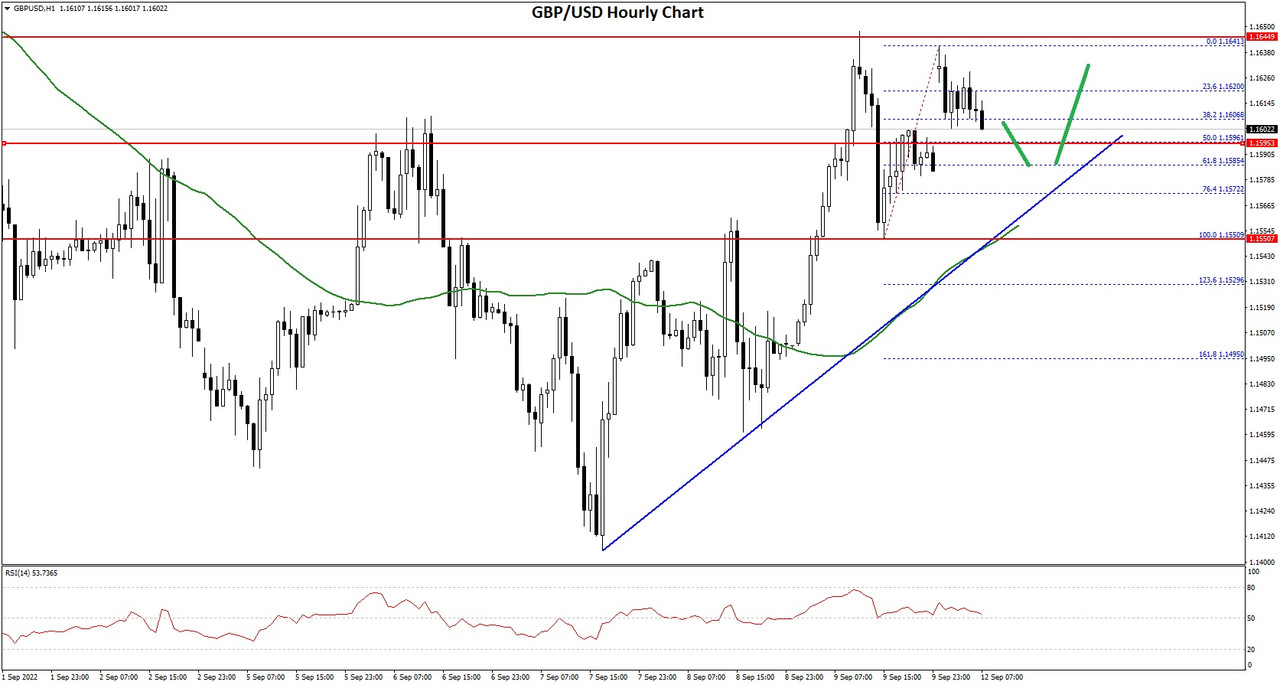

- British Pound at 20 year low as new Prime Minister takes office

- New extreme for the yen

- Has Apple's presentation affected the stock price?

- Stark reality of China's lockdowns: Oil and FTSE 100 down

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks