EUR/USD Approaches Breakout While EUR/JPY Takes A Hit

EUR/USD is consolidating below the 1.0650 resistance zone. EUR/JPY declined heavily below 143.00 and is currently attempting a recovery wave.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro started a downside correction from the 1.0735 resistance zone.

- There is a key contracting triangle forming with support near 1.0600 on the hourly chart.

- EUR/JPY started a strong decline and settled below the 142.50 support zone.

- There was a break below two bullish trend lines with support at 145.80 and 145.55 on the hourly chart.

EUR/USD Technical Analysis

The Euro formed a base above the 1.0550 zone and started a decent increase against the US Dollar. The EUR/USD pair was able to clear the 1.0650 and 1.0680 resistance levels.

There was a clear move above the 1.0700 level and the 50 hourly simple moving average. The pair even climbed above 1.0720 and traded as high as 1.0735 on FXOpen. Recently, there was a downside correction below the 1.0650 support zone.

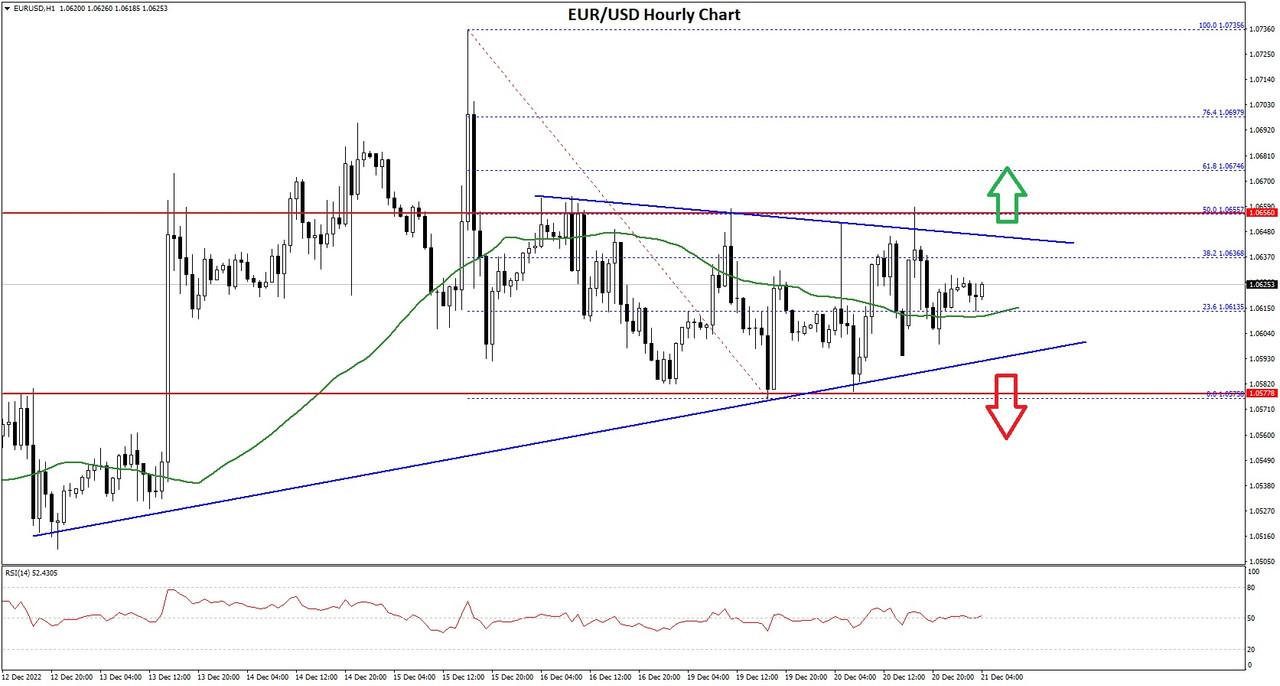

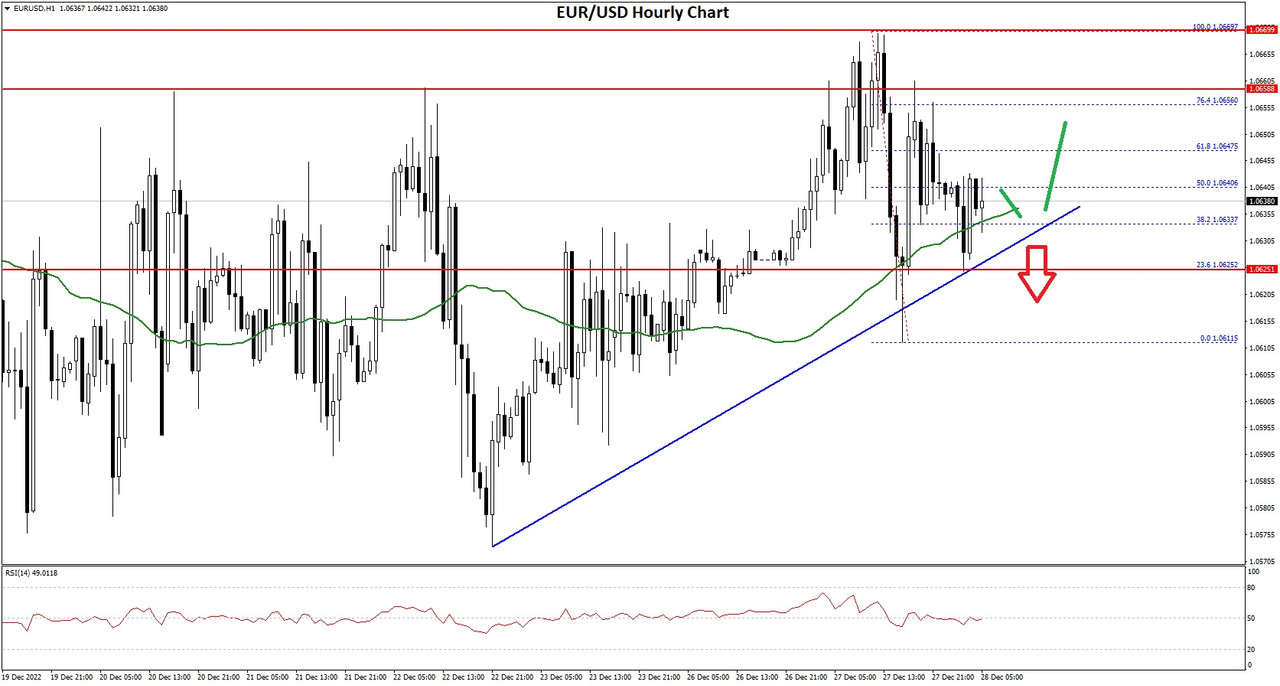

EUR/USD Hourly Chart

The pair even tested the 1.0580 level and started a consolidation phase. On the upside, an immediate resistance is near the 1.0635 level. It is near the 38.2% Fib retracement level of the downward move from the 1.0735 swing high to 1.0575 low.

The next major resistance is near the 1.0650 level. There is also a key contracting triangle forming with support near 1.0600 on the hourly chart.

The 50% Fib retracement level of the downward move from the 1.0735 swing high to 1.0575 low also sits near 1.0655. A clear move above the 1.0655 resistance might send the price towards 1.0700. If the bulls remain in action, the pair could visit the 1.0750 resistance zone in the near term.

On the downside, the pair might find support near the 1.0600 level. The next major support sits near the 1.0585 level, below which the pair could even test the 1.0520 support zone.

If there is a downside break below the 1.0520 support, the pair might accelerate lower in the coming sessions. In the stated case, it could even test 1.0425.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks